Although the 2024 US election seems like a rematch of the 2020 one, the backdrop is very different, which means the markets could move very differently too.

Historically, the stock market has generated moderate gains in election years. For instance, the S&P 500 has posted an average 7% return during an election year since 1952. The average rises to 12.2% for years in which the incumbent president is running for re-election.

While a 7% return isn’t disheartening, it is significantly below the average of 16.8% the index gains in the year before the election year and the stock market’s average 10% annual return in a regular year. But the markets will also be impacted by which candidate ultimately wins. For now, President Biden has been trailing behind Donald Trump in the polls, which means we could well see a second term for Trump as President.

What Could Trump 2.0 Bring?

If Donald Trump is elected as the 47th president of the United States, it is likely to have a major impact on prominent macroeconomic factors, such as inflation, interest rates, and the USD. If all three were to rise, it would mean headwinds for the stock market. Trump is unlikely to repeat the tax breaks and fiscal expansion of his first term as president. Plus, there are concerns regarding the trade war with China escalating, following comments by Trump on his intention to increase tariffs on US imports, especially those from China.

In his rallies, Donald Trump has gone so far as to say that he could consider raising the tariff on Chinese goods up to a whopping 60% if he is re-elected. If he follows through on this, the US-China trade war will negatively impact global supply chains, and, consequently, the companies that rely on these supply chains. So, industries, such as technology, manufacturing, retail and consumer goods, and agriculture, which will be more affected by the trade war, are likely to see volatility in their stock prices.

On the other hand, raising tariffs could lead to a rebound in inflation by disrupting global trade. Some experts believe that these potential tariffs would adversely impact the US GDP by up to 1.5% while hurting corporate profits. America has demonstrated resilience against a backdrop of global uncertainty and rising interest rates. However, the nation is now witnessing inflation volatility due to its prolonged labour shortages and frequent supply shocks. Given this scenario, policies to drive demand, such as tax cuts, or those that hurt the supply chain, like tariff hikes, could rekindle inflation. This would then lead the Fed to push interest rates higher again.

Plus, if Trump wins, he will inherit a significant fiscal deficit that the Biden administration has been struggling with. Increasing spending and cutting taxes in this environment could be disastrous.

How Will All This Impact the Financial Markets?

If inflation rises and the Fed has to reconsider its monetary loosening, market sentiment will be hit. On the other hand, the US dollar will be strengthened, which would make exports more expensive, which is bad news for stock prices. The US dollar could also rally on the news of a Trump victory, given that the greenback was up around 5% after his surprise win in 2016. Acuity’s AssetIQ widget shows an ongoing bullish trend for the US dollar index, although market sentiment appears to be turning neutral. Keeping an eye on the index’s performance will be important in the run-up to the election.

Despite concerns regarding the impact of Trumponomics 2.0 on the stock market, there are unlikely to be any long-term effects. Plus, the ongoing AI bubble (if one can call it that) is likely to outweigh the macro concerns. AI-related stocks have been fuelling the stock market performance so far in 2024, which is apparent from the performance of the tech-heavy US 100 index, as seen on Acuity’s AssetIQ widget.

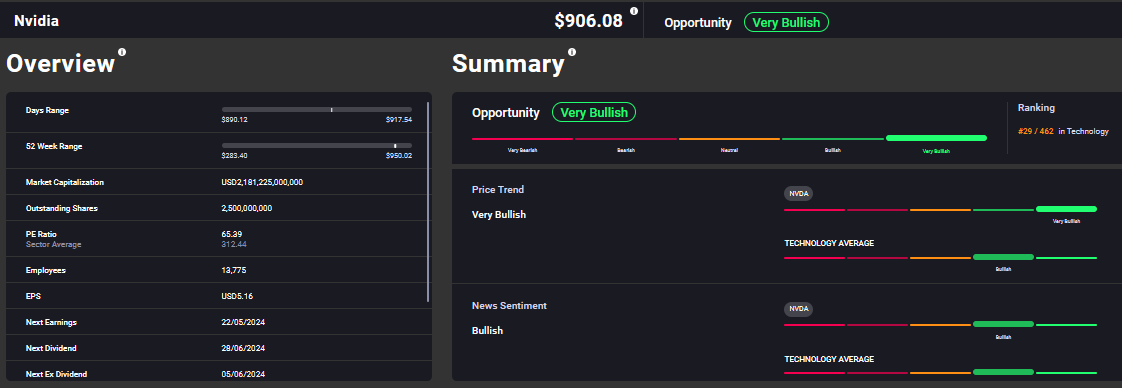

Among the AI stocks, Nvidia has been leading the charge, up a whopping 88% YTD, as of May 8, 2024. This bullish trend is likely to persist given that Acuity’s AssetIQ shows that market sentiment towards the stock continues to be positive.

Of course, there is another factor that could impact both the US dollar and the stock markets – Trump’s hardline stance on NATO. Any extreme statements regarding NATO members and the role of the US within the organisation by Trump could create uncertainties regarding America’s membership, which would have ripple effects on the financial markets.

Having said all that, the bottom line is that no one can consistently and successfully predict market performance or always get the timing right. This calls for a well-diversified portfolio across sectors and asset classes, along with a focus on breaking news, market updates and sentiment analysis.

Market Commentary