AssetIQ

In-depth asset-by-asset analysis, providing a laser-focused understanding of the factors influencing market performance.

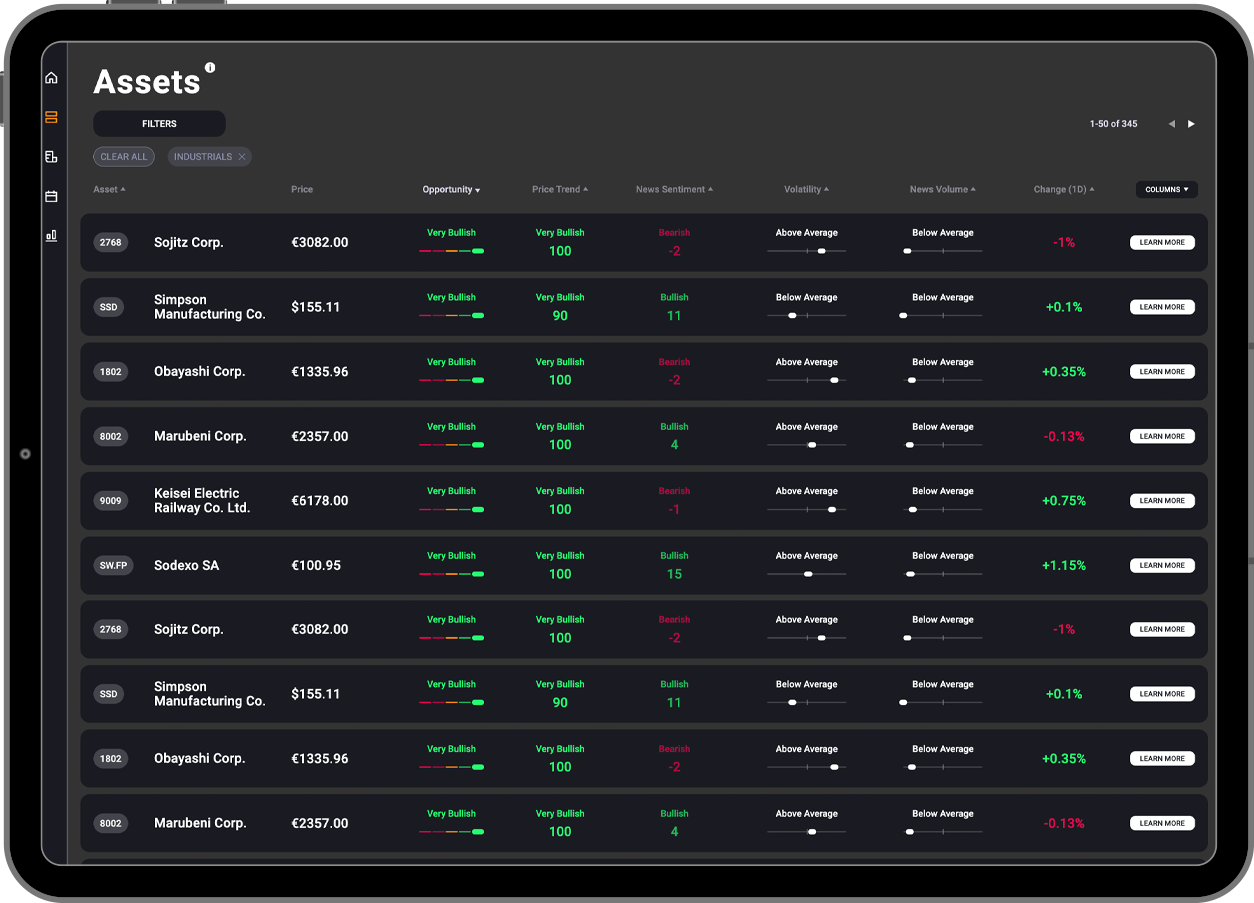

Opportunity Scoring and Monitoring

We apply forensic, AI analysis across an extensive range of traditional and alternative data sources to identify trading opportunities on an asset-by-asset basis. See how these benchmark against other assets for more informed decision-making.

Play video

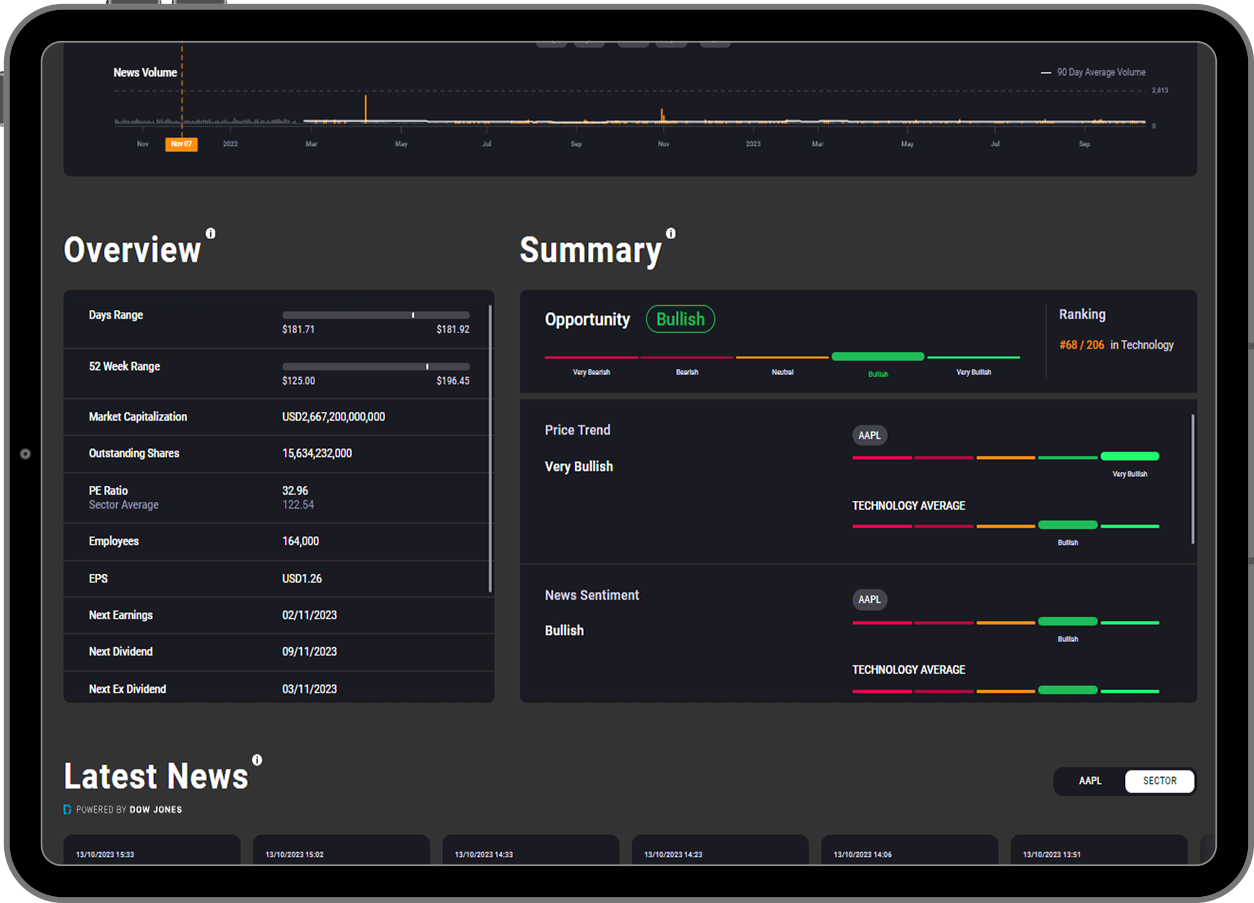

Opportunity score

We analyse traditional and alternative data sets on each asset to generate a unified opportunity score, helping traders avoid confusion from conflicting market signals and provide clear actionable insight.

Opportunity Ranking

We rank opportunities against similar assets in their market and sector across multiple market indicators, providing traders with additional context to help select the best opportunities available.

Market moving events

Interactive charts and with multiple overlays displaying market-moving events, encompassing macro-economic and corporate events, financial market news, and news sentiment alerts.

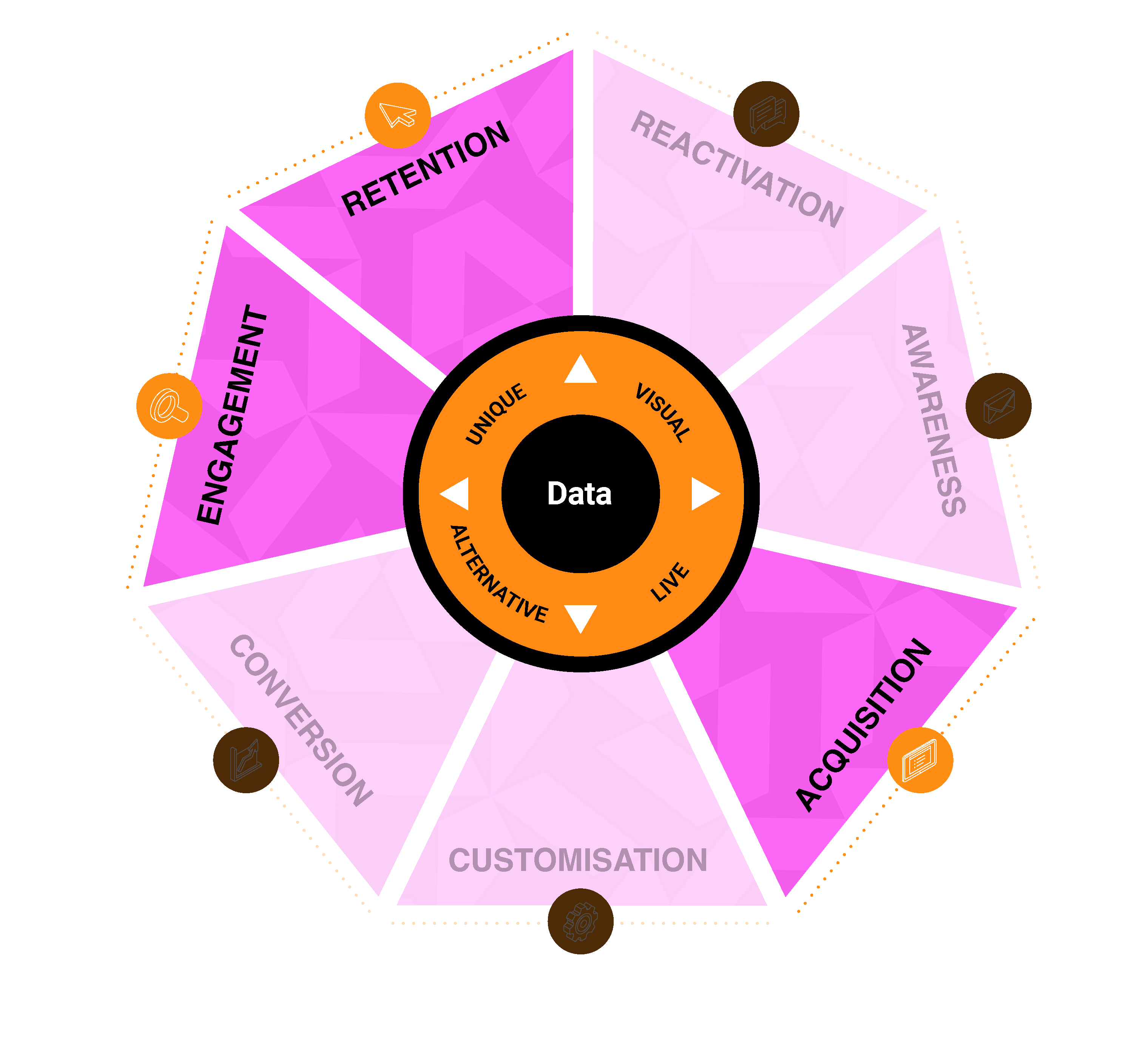

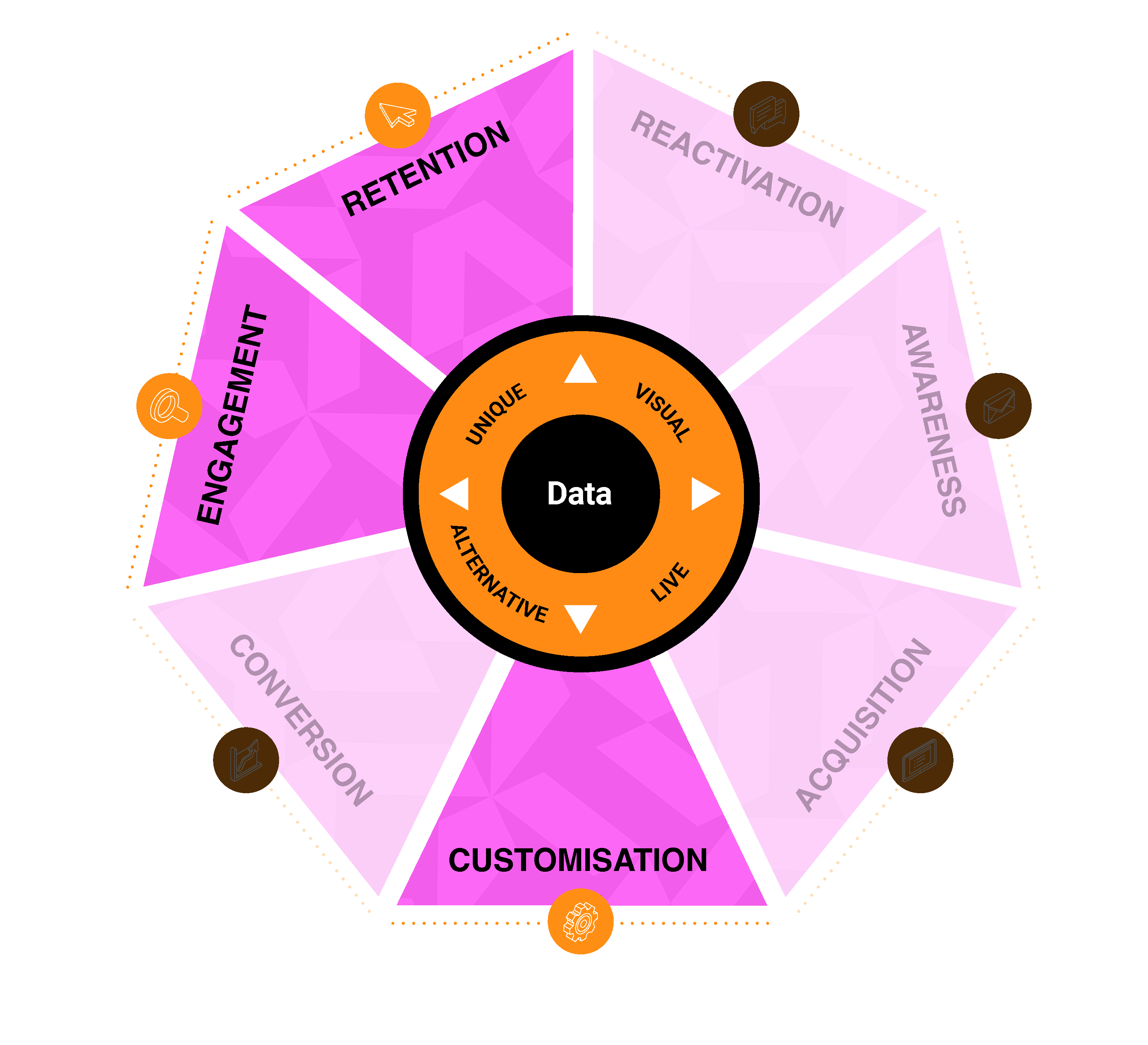

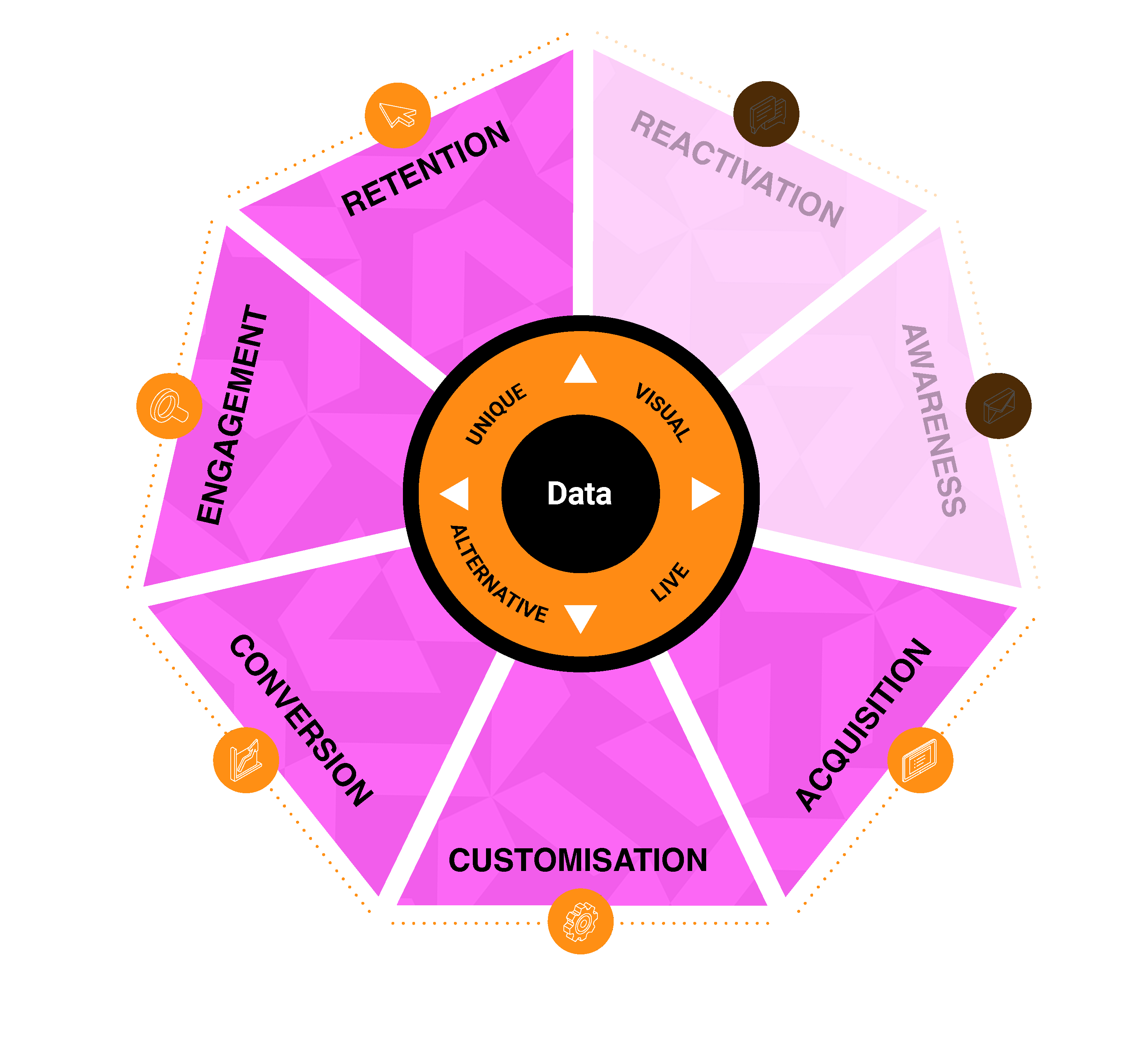

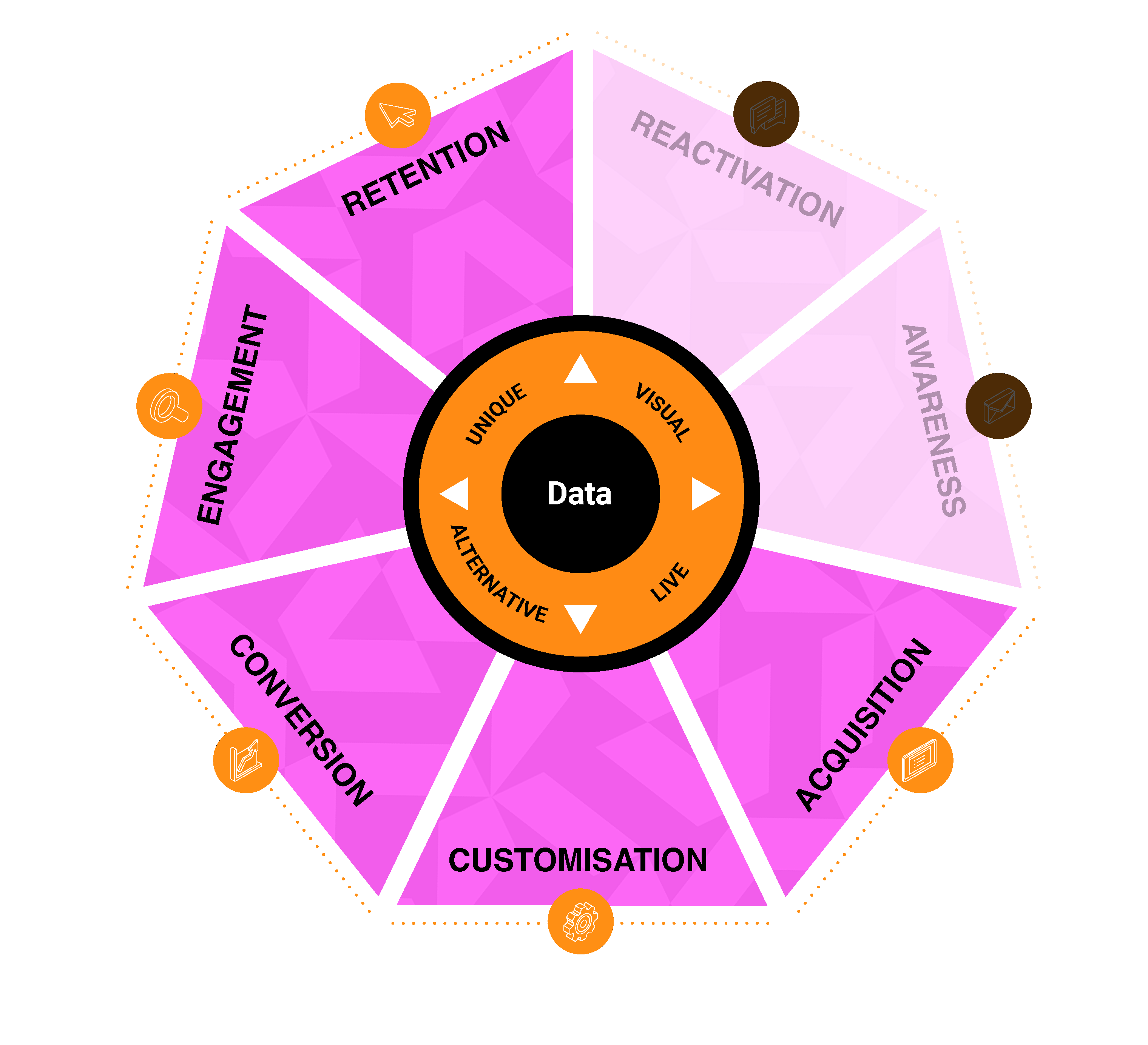

Seamless and Rapid Integration

Effortless and speedy integration through multiple channels including web, email, MetaTrader (Mt4/5), cTrader, Telegram, Hubspot plus many more.

Benefits for Brokers

Attracts a broad client base

Stimulates trading activity

Educates Traders

Simplifies decision-making

Personalised content offering

Our clients

Case studies

Valutrades & Acuity: Turning Actionable Insights into Market Trades

“We've achieved over 4,000 leads in the first year...”

Graeme Watkins, CEO, Valutrades

Get sharper investment data with Acuity

FAQs

Here are some of our most frequently asked questions. Contact us if you have a specific question that you would like us to answer.

How many assets are covered?

We currently provide coverage on around 3,500 assets, Everything from FX, Indices, Commodities, Cryptocurrencies and Equities.

How is your opportunity score generated?

Can I map the assets with the products we offer?

Can AssetIQ use my own market data?