The Sweet M&M Plan

Then came the pandemic, further battering an already fracturing economy. The threat of economic calamity spurred solidarity. Germany relinquished its stance of opposing burden sharing and vouched for fiscal unity. Leaders of the EU powerhouses – German Chancellor Angela Merkel and French President Emmanuel Macron – came together in May to propose creating a one-off €500 billion recovery fund. The Macron-Merkel plan proposed financing the fund with shared EU borrowing and disbursals in the form of grants.

Next Generation EU

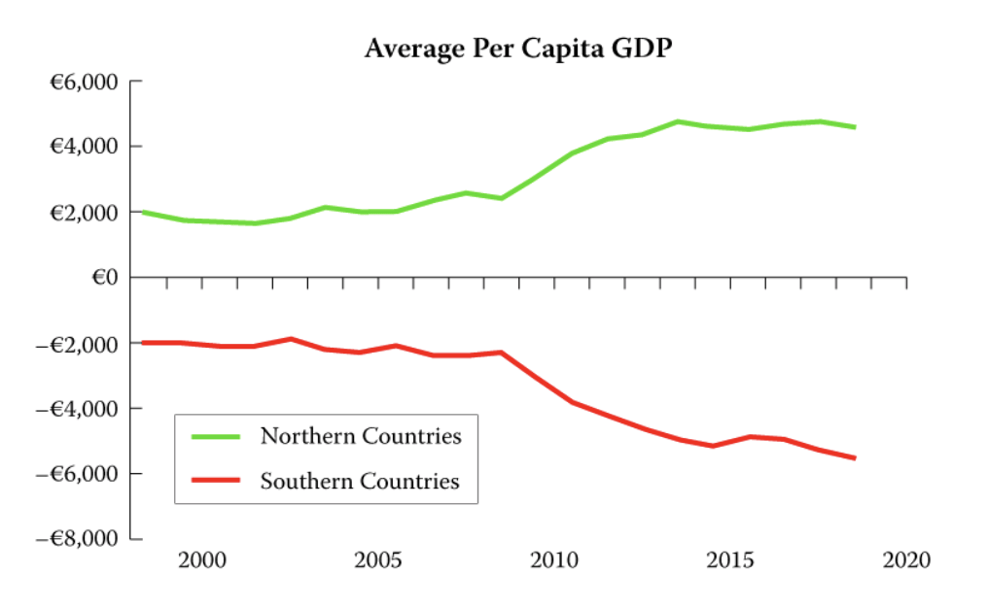

The Macron-Merkel plan was later restructured and named “Next Generation EU.” Unveiled in July, Next Generation EU expanded the package to €750 billion. Under this agreement, the European Commission will raise money in capital markets and sanction €390 billion as grants and €360 billion as loans to countries like Italy and Spain, which were the most severely affected by the pandemic. The European Commission’s borrowings will be repaid through the joint EU budget, thereby becoming the collective financial responsibility of all EU members, although the funds will be used mainly by the Southern nations.

The existing debt of individual nations will not be included in the fiscal union being formed. Nonetheless, this marks a giant step towards fiscal unity among EU members. What’s even more promising is that the initiative for increased economic unity was spearheaded by Germany, a country that had long resisted this approach to borrowing.

The Next Generation EU, together with the EU’s budget for 2021-2027, totals a fund of €1.85 trillion, making it the largest stimulus package for the region. Moreover, the recovery plan is not merely for short-term damage control. Rather, it is an investment for the EU’s long-term future.