The UK’s GDP grew 0.6% from April to June 2024, driven by the strong growth in the British services sector, following an increase of 0.7% in the first three months of the year. In comparison, the Euro Area and EU’s GDP grew 0.3% in the second quarter, following a 0.3% rise in Q1 2024. The IMF now expects the UK’s GDP to grow 0.7% in 2024, up from its previous prediction of 0.5%. The IMF also forecasts GDP growth of 8.8% by the end of 2029, compared to the beginning of 2024.

Inflation in the UK has also been tracking below the EU's inflation rate, with the CPI coming in at 2.2% for the year to July. Although this figure is above the 2% reported for June, it is well below the 6.8% recorded in July 2023. The EU, on the other hand, reported its inflation rate at 2.8% for the year to July, compared to 6.1% for the same period last year.

The IMF expects the UK economy to grow faster during the remainder of 2024 than Germany, France and Italy.

Drivers of the UK Economy

The British Chambers of Commerce (BCC) has raised its growth outlook to 1.1% for 2024, up from its previous 0.8% projection. With the decline in inflation, real incomes are improving in the UK, which is promoting consumer spending. This, along with the rapid growth of the services sector is driving economic growth for the nation. Government and business investments are also expected to drive the economy in 2024 and into 2025.

The new Labour government is working to establish the country as an attractive and politically stable destination for business investment. The resultant public spending on infrastructure and a focus on planning reform could give the economy a much-needed shot in the arm with the government initiating major projects.

EY expects business investment in the UK to grow by 1% in 2024, up from its previous expectation of 0.6%, followed by more significant growth of 3% in 2025. While real household incomes are likely to continue to rise considerably, driven by lower income, the slowdown in wage growth is expected to persist.

Interest rate cuts by the Bank of England (BoE) will further boost the economy and market sentiment. The central bank cut rates for the first time in four years from 5.25% to 5% in August 2024. Going forward, the BoE is likely to take a more cautious approach to cutting rates and deliver the rate cuts in a series of smaller reductions.

However, ongoing global conflicts, the impending US presidential election and trade tensions are likely to fuel a climate of hesitation for both businesses and investors for the remainder of 2024. This is already apparent from the performance of the FTSE 100. After climbing more than 7% year-to-date by the beginning of September, the sentiment for the UK100 has turned bearish, according to Acuity's AssetIQ widget.

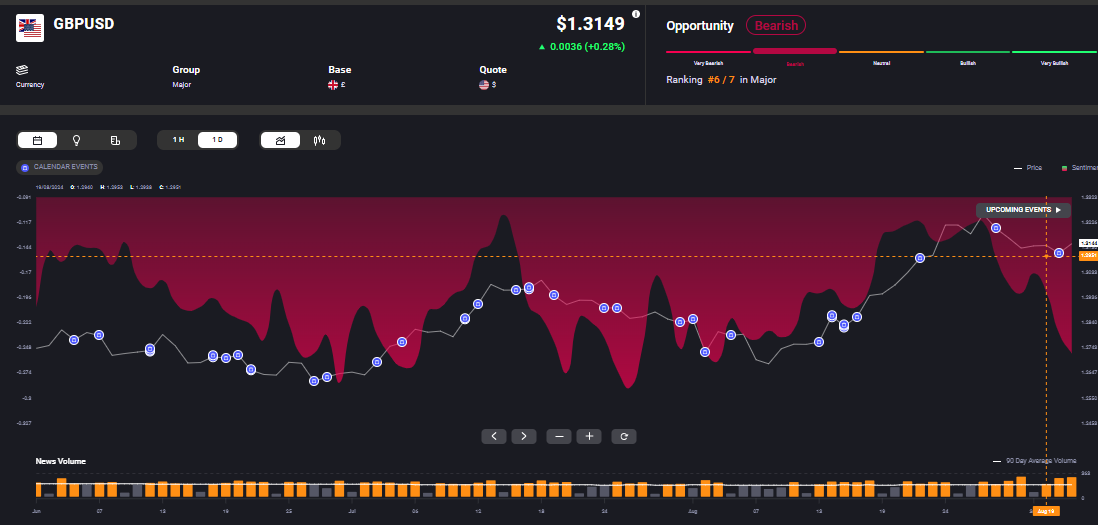

Market sentiment on the GBP/USD is also bearish, despite moderate gains from the beginning of the year to September.

The State of the EU Economy

Following 5 years of stagnation, the Eurozone economy returned to growth in Q1 of 2024, primarily driven by higher exports. With core inflation at 2.6%, YoY economic growth of 0.8% and an unemployment rate of 6.5%, as of July 2024, the EU’s growth rate is well below that of the UK. However, with the ECB cutting interest rates by 25 basis points in June and another cut likely in September, the eurozone is expected to see higher growth going forward. The EU economy is also supported by lower energy prices.

At the same time, the deteriorating relations with China, divergence of the ECB’s monetary policies from those of the US Federal Reserve, political uncertainties in the EU and the persisting global tensions are likely to weigh on investor and business confidence. All these factors could also lead Eurozone’s economy to continue to grow at a slower pace than the UK.

Against this backdrop, the market opportunity on the EU 50 remains bearish, according to Acuity’s AssetIQ tool. This can also be seen in the performance of the STOXX 50, which was down almost 3% in the first week of September, following over 7% YTD growth till the end of August.

So, while recovery is on the cards for both the EU and the UK, growth is likely to be steady rather than spectacular. These are times where staying informed of the latest economic releases, geopolitical developments and market sentiment are crucial. Tools that allow real-time analysis with access to relevant news, based on each investor's chosen assets can be invaluable in supporting informed decision-making.