Moody’s has reaffirmed its “negative” outlook on China’s sovereign credit rating. The credit ratings firm had lowered China’s rating from “stable” to “negative” in December 2023. Although domestic fiscal risks have receded, Moody’s maintained its A1 rating, explaining that “the drivers of (China’s) negative outlook have changed.” Fitch had cut its sovereign credit rating on China to A in April 2025, citing rapidly rising debt and deteriorating public finances.

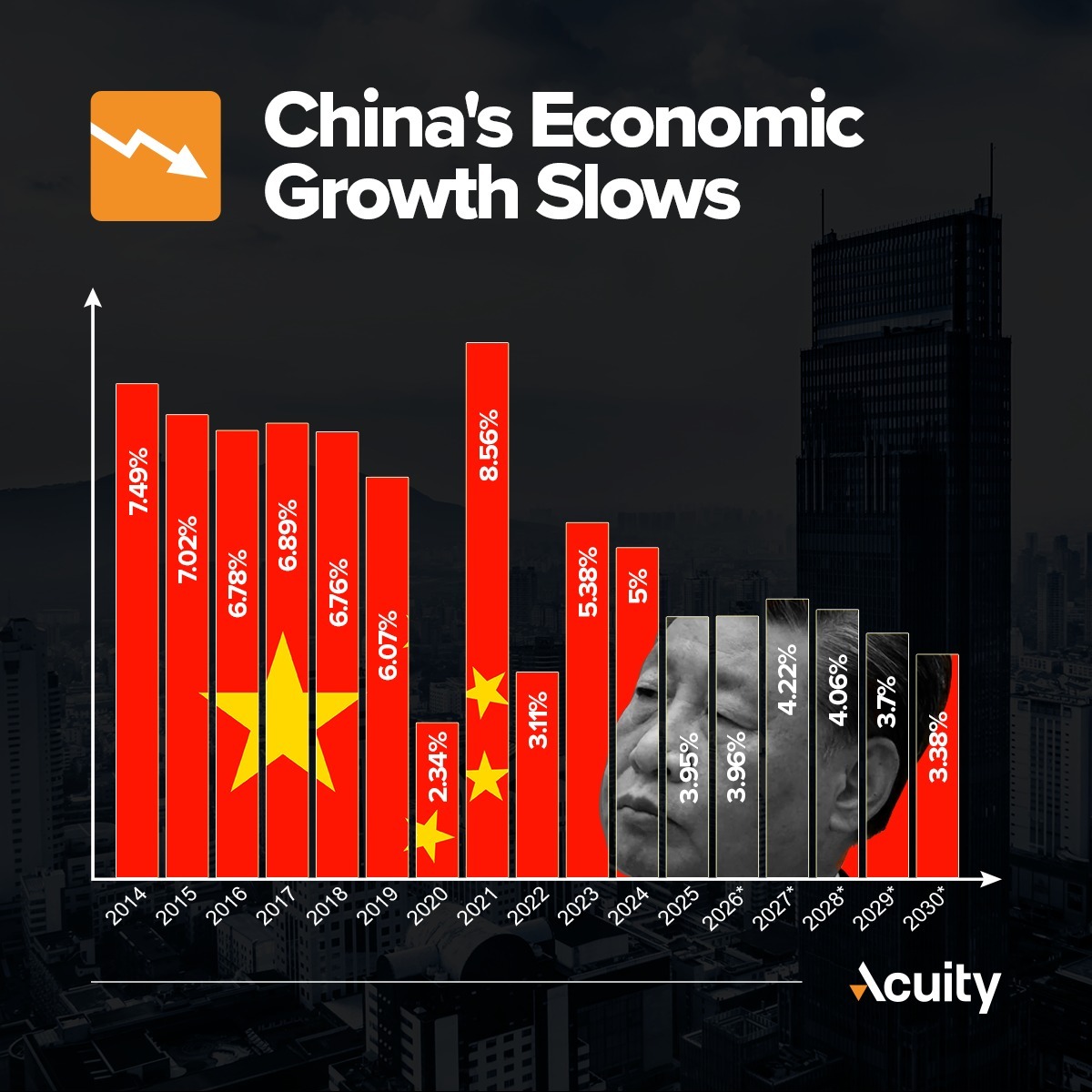

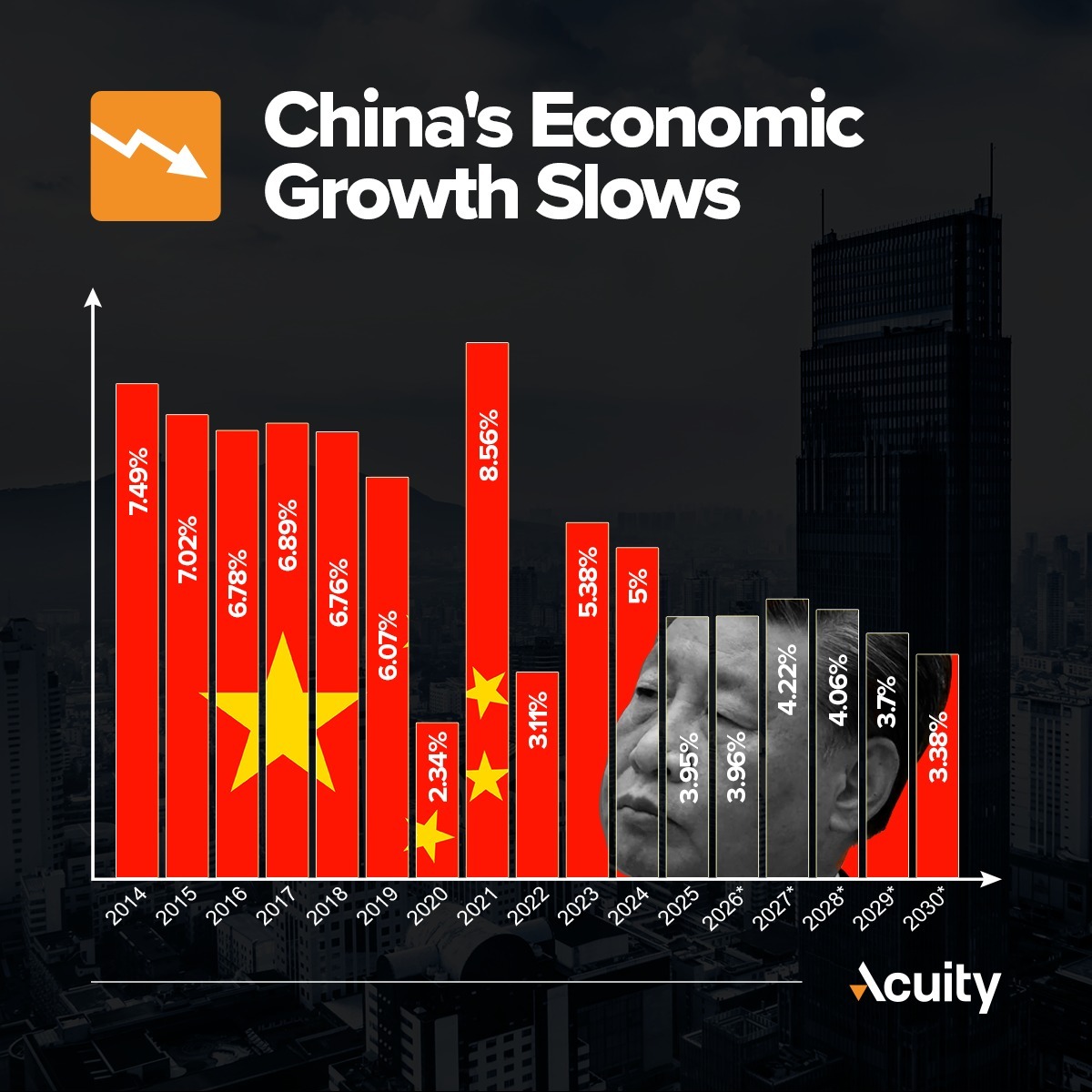

Slowdown in China’s Economic Growth

China had been the world’s fastest growing economy, with an average annual GDP growth rate of 10% from 1978 to 2010. The country’s GDP growth slowed steadily since, reaching 6% in 2019. China’s economic growth slowed from 5.38% in 2023 to 5% in 2024.

Is China’s Economy in Trouble?

The Chinese economy faces several challenges, including:

- Slowing consumer spending

- A struggling real estate market

- Deflationary pressures

- Geopolitical uncertainties, including trade tensions with the US

- An aging population and shrinking labour force

- High debt levels, which pose significant long-term risks

- Overcapacity in various industries, leading to price deflation and pressure on businesses

- Structural issues within the economy, including lack of innovation and reliance on government investment.

Why Does This Matter?

A “negative” outlook from Moody’s can potentially erode investor confidence and lead to volatility in the Chinese financial markets. A negative outlook suggests a higher probability of a future downgrade, which can make investors nervous. This, in turn, can lead to a sell-off in Chinese assets.

It could also impact the Chinese yuan, as investors might sell the currency to avoid exposure to the risk of a downgrade. Given China’s role in the global economy, a downturn or increased volatility in its financial markets could have a ripple effect worldwide.

What to Watch

Acuity’s AssetQ widget reveals a bullish market sentiment towards the China 50 index but a bearish sentiment towards the HK50. For informed decision-making, traders should keep an eye on key economic data from China:

- GDP growth

- Industrial production

- Retail sales

- Inflation (CPI and PPI)

- Trade data (Exports and Imports)

- Foreign investment flows

- Property market trends

- Yuan exchange rate

The Bottom Line

The OECD expects China’s economic growth to slow to 4.7% in 2025, while weakening further to 4.3% in 2026. The country might require additional stimulus injections to meet the government’s growth target of 5% for 2025. Traders should keep an eye on the PBoC's monetary policy announcements and government policy changes.

Market Commentary