The Organisation of Petroleum Exporting Countries (OPEC) plays a key role in determining oil prices worldwide by actively overseeing oil production among its member countries. OPEC sets production targets for its members to balance oil supply, given that its member countries account for 40% of the oil produced globally and 60% of the total traded petroleum. Historically, oil prices tend to rise when OPEC cuts its production targets.

What is OPEC’s Spare Capacity and Why Does it Matter?

Spare production capacity is defined as the amount of production that can be brought online within 30 days and maintained for at least 90 days. Among the OPEC members, Saudi Arabia has the highest spare capacity, usually maintaining it at more than 1.5–2 million barrels per day (bpd). Saudi Arabia has held an average of 70% of OPEC’s spare capacity since 2001. The International Energy Agency (IEA) estimates OPEC’s total spare capacity at 5.1 million bpd.

OPEC member countries use their spare capacity to maintain global oil supply levels. This is why OPEC’s decisions have a huge influence on oil prices. When OPEC's spare capacity is low, oil prices tend to rise to include a higher risk premium. The organisation often withholds crude oil production when prices fall or demand is low. OPEC has repeatedly extended its “temporary” production cuts in response to price or demand declines.

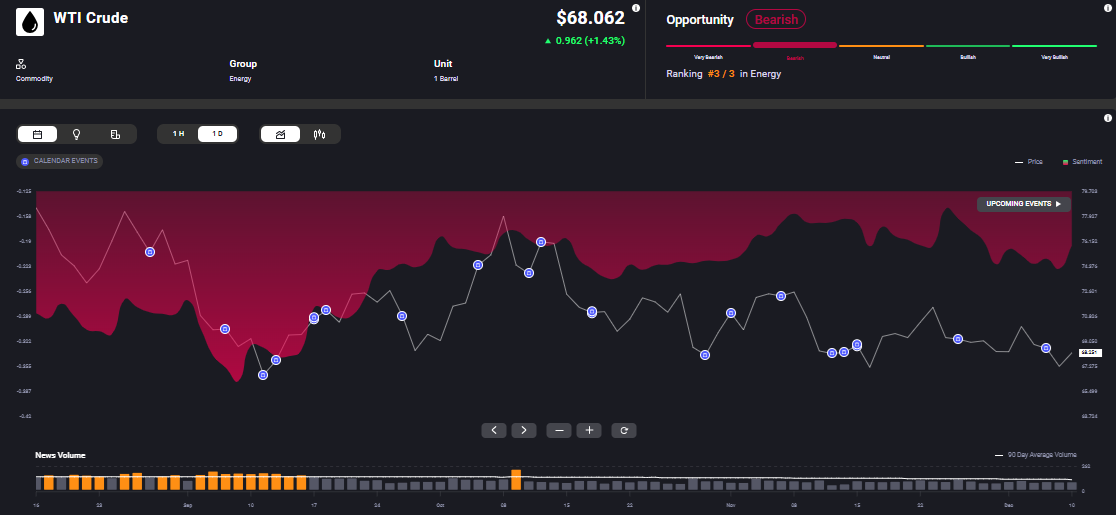

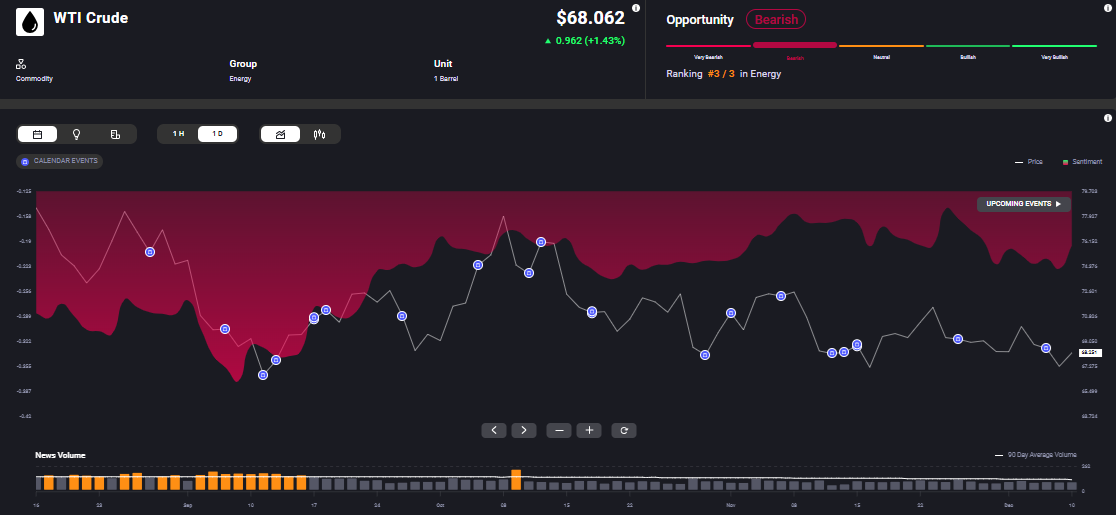

For instance, on December 5, 2024, OPEC+ pushed the start of its oil output hike back by three months to April 2025 while extending the complete relaxation of its cuts to the end of 2026 against the backdrop of weak demand and high production levels among non-member countries. This led Brent crude to trade near $72 a barrel, after hitting a 2024 low of below $69 in September. Brent crude price has been bearish, having declined 5.35% YTD. Acuity’s AssetIQ widget indicates that this bearish sentiment is likely to persist.

Oil Price Outlook for 2025

A large spare capacity acts as a buffer against price spikes by allowing OPEC to quickly increase production if a supply shock occurs, potentially keeping prices relatively stable. If OPEC chooses to tap into its large spare capacity, it could lead to a market oversupply, putting downward pressure on oil prices.

Although OPEC has extended its production cuts twice already in 2024, if global oil demand weakens significantly in 2025, it could still lead to a market glut. The extent to which OPEC utilises its spare capacity will depend on factors like geopolitical tensions, individual member country interests and market conditions.

If OPEC uses its spare capacity to counter supply disruptions or moderate price increases, it could help stabilise the oil market. However, if OPEC members disagree on production levels or rapidly change their output strategies, it could lead to increased price volatility. On the other hand, a large OPEC spare capacity could put pressure on non-OPEC producers to adjust their production levels to remain competitive.

Oil is unlikely to be in short supply in 2025, while ample spare capacity will prevent major price shocks. Plus, optimism regarding a rise in demand from China rose following the Asian nation announcing that it intends to keep its monetary policy “moderately loose” in 2025 and potentially implement a bolder stimulus package. WTI rose 1.7% to cross the $68 mark after the announcement.

However, this gain wasn’t sufficient to take oil prices out of the range it had been trading in since mid-October. This continued bearish sentiment is reflected by Acuity’s AssetIQ widget.

The global oil market is likely to continue to deal with various competing factors in 2025, such as the geopolitical tensions in the Middle East and a potential increase in oil production by non-OPEC nations like Guayana, Brazil, Argentina and Canada.

There are fears of a market glut if demand remains lacklustre, and added to that is the Trump administration’s chant of "Drill, baby, drill." There’s also a risk of oversupply due to the push for renewables by numerous nations worldwide to achieve the Net Zero target.

It will be interesting to see how OPEC handles these production hikes in the Western Hemisphere while taking care of the interests of its own members. We will also need to keep an eye on how China's monetary policy and stimulus package impact oil demand. The key now is to ensure that traders have access to the latest market news and sentiment for informed decisions.