The global economy may not have shattered the gloomy predictions, but it has certainly proved the naysayers wrong. The past three years presented several horrors, including supply-chain disruptions in the aftermath of the pandemic, an energy crisis after the US imposed sanctions on Russia, a food crisis of unprecedented proportions, the doubled-edged sword of skyrocketing inflation and elevated interest rates, and China’s economy evading growth.

These shocks rocked the boat but didn’t sink it. Global GDP growth decelerated, from 6.0% in 2021 to 3.2% in 2022 and 2.7% in 2023. So far this year, the global economy has exhibited remarkable resilience, with steady growth. Inflation has been contained and has been easing almost as rapidly as it rose.

The Outlook Brightens

The IMF expects the global economy to grow by 3.2% this year. The median headline inflation is estimated to decelerate to 2.8% by end-2024 and continue easing to 2.4% by end-2025. With inflation being tamed, central banks around the world are gearing up to cut interest rates.

The ECB moved ahead of the US Federal Reserve to announce the first rate cut, down 25bps from a record high of 4%. Lower rates give a fillip to economic growth, making it more attractive for companies to borrow to expand their business and encouraging consumer spend and investments by homebuyers.

The Scars Run Deeper for UK

The UK’s economic performance since the pandemic was far worse than others. It was among the weakest in the G7 economies. Apart from the impact of the pandemic, UK’s economy was also battered by the decision to leave the European Union and political instability (remember Liz Truss resigning as Prime Minister only after 49 days?).

While other major economies managed to circumvent a recession, the UK recorded two consecutive quarters of contraction. The country slipped into recession in the second half of 2023, with GDP contracting by 0.1% in Q3 and by 0.3% in Q4, far worse than expected.

Yes, the recession was shallow, and the UK returned to growth in Q1 of 2024. But all is not well, despite what PM Rishi Sunak may say on his X post.

In a blow to Rishi Sunak’s hopes, the recovery from last year’s recession began to fade in April, when the economy flatlined. Why is growth stalling in the UK?

Why is Growth Evading the UK?

UK’s economic growth didn’t stagnate due to post-pandemic woes and the Russia-Ukraine war. Those just made it worse. Growth has been stagnant since the 2008-2009 financial crisis. The main culprit is the flatlining of productivity growth. When adjusted for inflation, wage growth, which is an indicator of productivity growth and the key determinant of standard of living, has been flat since the previous financial crisis.

The ripple effect of the US subprime crisis hit the UK hard, resulting in soaring debt. The government needed to cut down spending to bring the country’s budget deficit to manageable levels. Good strategy but overdone, with a pause on government investments in infrastructure, including mass transit, schools, and hospitals.

Business investments halted too, with the Brexit and resultant political instability. The short stint of Liz Truss clouds our memory of Theresa May’s government erecting trade barriers that impacted most industries. Navigating the Brexit restrictions dominated the mind-space, rather than innovation, market expansion, and talent development.

Britain’s performance has lagged that of most G7 nations for over 20 years. Meanwhile, the tax burden has become the highest in decades, resulting in the cost-of-living crisis.

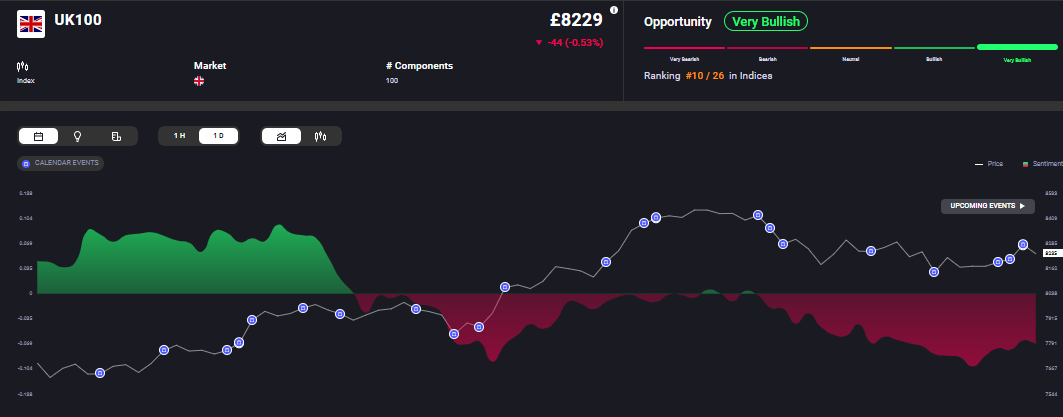

The one aspect of the economy that has exhibited resilience is the London stock market. The FTSE 100 has risen around 8% year to date and added 14% over the past year. Sentiment also remains bullish, as can be seen on Acuity’s AssetIQ widget.

Where Does Britain Go from Here?

The need for faster long-term economic growth is staring UK in the face. But the path to getting there remains elusive. How does the UK get out of its economic slump? Tax cuts and increasing government infrastructure investments could trigger growth.

There may be too much focus on the decline in manufacturing and construction. Unlike Germany, the UK has never been a manufacturing superpower. It must reclaim its leadership in services, especially legal and financial services.

Will the Elections Change Anything?

Since calling a general election for July 4, PM Rishi Sunak has been repeating that the worst is over. Maybe for the UK, but possibly not for the Conservatives. Polls indicate that the Conservatives could lose the elections after being in government for 14 years. If this were to happen, the victory for the Labour Party would be hollow, with people voting for them to punish the Conservatives rather than any excitement around their mandate.

The current government's fiscal plans continue to rely on further cuts in investments and public services to meet the promise of lowering debt. It’s what Einstein purportedly said about insanity – “Doing the same thing over and over again and expecting different results.”

The Labour Party’s mandate could achieve more in the current scenario. Investing in clean energy and skill development, from hiring teachers to building technical colleges, could take Britain a step further in its search for growth.

Acuity’s tech analyses an array of market insights to generate trading ideas and gauge market volatility. Other Acuity Trading products include NewsIQ, AnalysisIQ, AssetIQ, the Acuity Corporate Calendar, and AI-Driven Economic Calendar, which have earned Acuity Trading the title of ‘Best Specialist Data Provider’ at the Technical Analyst (TA) Awards, ‘#1 Sentiment Analysis Provider 2024' by Forex Brokers and many shortlisted nominations across the fintech industry. For more on the unparalleled edge that Acuity’s data-driven research provides, explore further resources and solutions at acuitytrading.com.

UK,

Economic Outlook,

Brexit