The Next Generation of Trading Tools

Traditional trading tools have served traders extremely well. But as computation capacities have improved, AI-based trading indicators and signals are now available for better and faster decision making. With technologies such as artificial intelligence and machine learning, huge quantities of data can be processed to provide more accurate trading signals.

AI and natural language processing also help turn massive amounts of unstructured information into actionable information. They can detect even the most subtle changes and patterns, which are not visible to the naked eye.

Also, with AI and NLP, it has also become possible to identify multi-hop relationships to make connections between assets and other data sets. Large data sets, despite the number of connections, can be analysed at lightning-fast speeds. On the other hand, earlier, analysing a large number of relationships (hops) was extremely time and resource intensive. In fact, analysing relationships beyond 3 hops wasn’t possible with traditional methods.

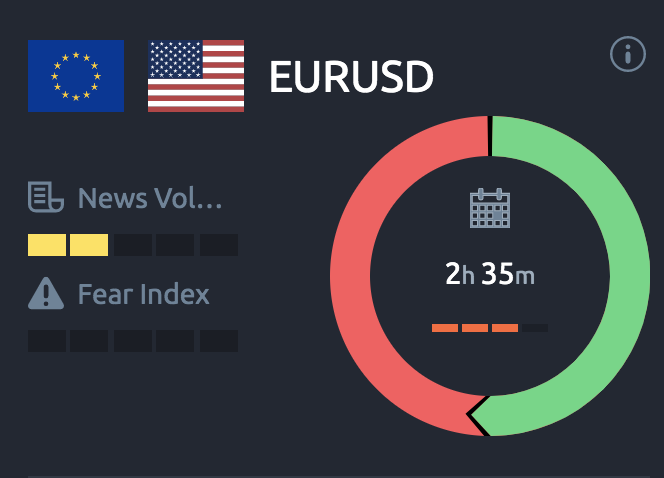

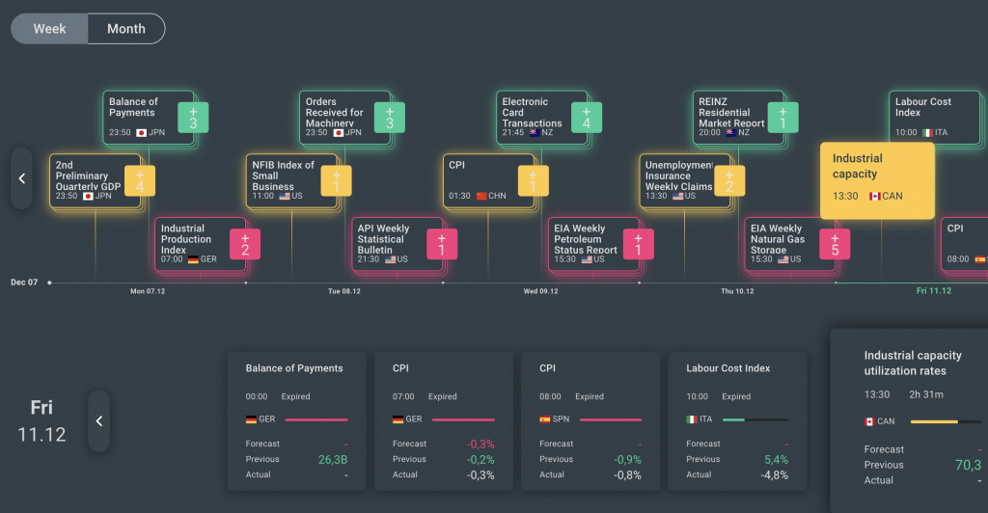

These AI-based signals can tell traders about when to buy or sell an asset, the target price, stop loss price and entry price. Technologies such as AI and NLP use price action, currency evaluation, news/social media analysis, and technical analysis to provide actionable insights to traders. For example, using NLP and AI, large volume of news is processed, and sentiment is extracted from it. This transforms unstructured news text into structured data sets. It helps tame, or manage, what has been termed ‘infobesity’.

Which Trading Tool Should You Use?

The answer is not to use just a single leading or lagging indicator, but a combination of tools. The concept of “traffic light signals” can be incredibly beneficial for this. With this, if a trader has access to multiple tools, they can use each one individually to form an opinion. When used together, a much stronger opinion can be formed.

Depending on whether a tool is providing a favourable signal or not, a trader could treat them like a traffic signal, assigning each indicator a different colour, from green to red. So, if one indicator is ‘green’ and so are the others, this would be a strong signal. On the other hand, if there is just one ‘green’ signal, the trader might prefer to continue their research till they find a stronger signal.

Conclusion

Today, traders can access a wide variety of trading tools to enhance trading decisions. So, why not take full advantage of them? Independently, trading tools are great. But when used together they can be much more powerful. So, traders could use leading trading tools, such as news sentiment, along with lagging technical indicators, such as MACD and Bollinger Bands. This would help them take advantage of market opportunities and weed out false signals.