How Trump's Tax Bill May Impact Green Trading

The US House of Representatives passed President Trump’s “One Big Beautiful Bill” on May 22, 2025. The bill is now being debated in the Senate, where changes are likely to be proposed. The bill is largely seen as a blueprint for Donald Trump’s tax agenda, signalling a dramatic shift away from supporting renewable energy and sustainable initiatives.

Why it Matters

Trump’s proposed bill aims to largely dismantle clean energy incentives. This reversal could significantly slow the pace of the energy transition in the US with ripple effects across the global markets. It will hurt companies that invested in renewable energy, electric vehicles, and clean manufacturing due to the tax credits offered by the Inflation Reduction Act (IRA) passed by the Biden administration.

Incentives for solar and wind projects could be phased out as early as 2028 or earlier for new construction. Meanwhile, the withdrawal of incentives for cleaner cars could dampen consumer demand for EVs.

By the Numbers

A sudden withdrawal of policy support could:

- Drastically slow down clean energy deployment rates.

- Lead to the loss of over 50% of all new clean energy capacity, expected to be added to the grid over the next decade.

- Raise electricity bills for consumers.

- Lead to losses of about 300,000 jobs in the solar and energy storage sectors by 2028.

- Hurt the US GDP by more than $1 trillion by 2035.

- Increase America’s government deficit by $2.8 trillion over the next decade.

The Big Picture

The proposed tax bill, if enacted in its current form, presents a significant headwind for green investing. Therefore, renewable energy traders should brace for continued volatility. Plus, rising energy bills for American households and the adverse impact of fossil fuels on the climate could dampen market sentiment, hurting clean energy stocks.

What to Watch

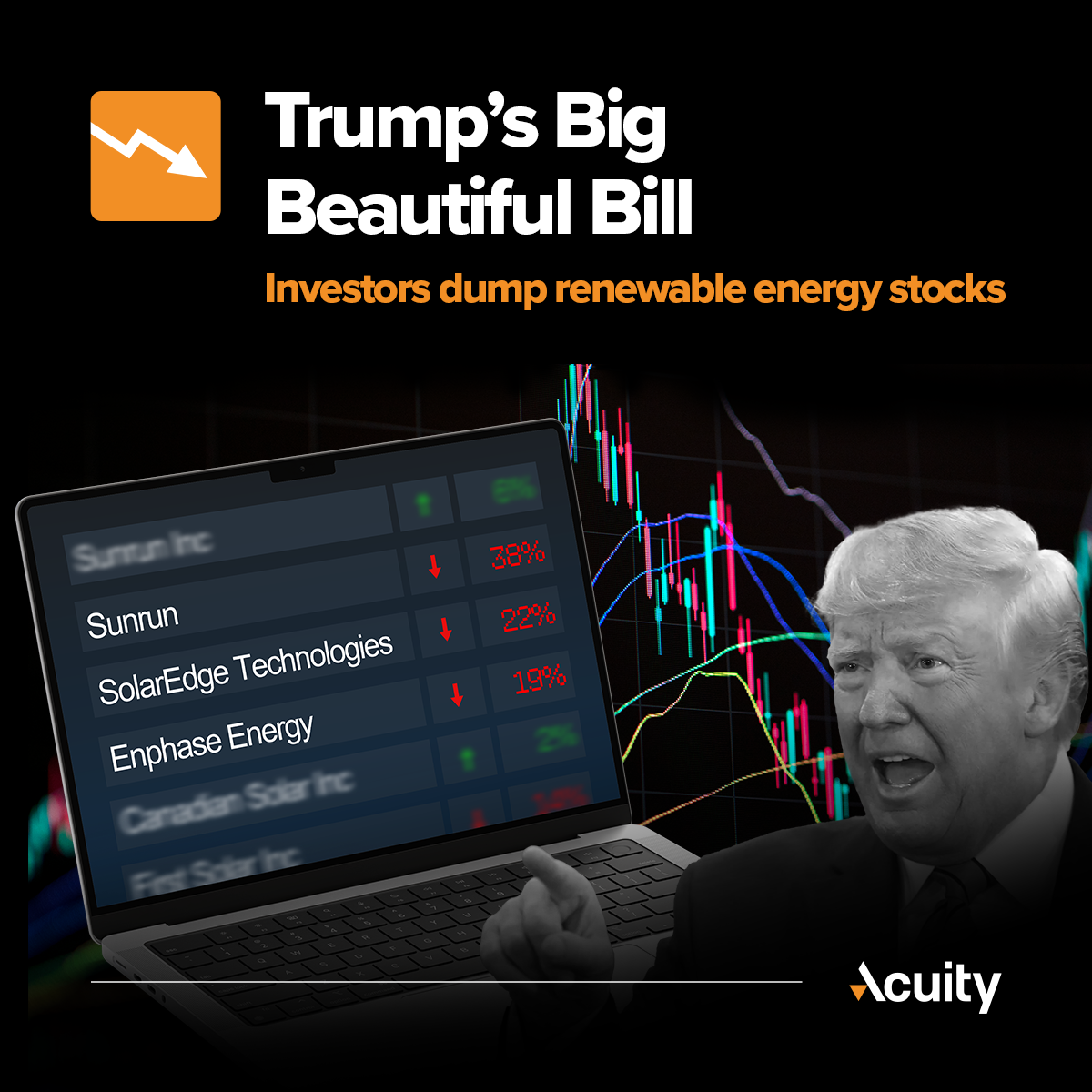

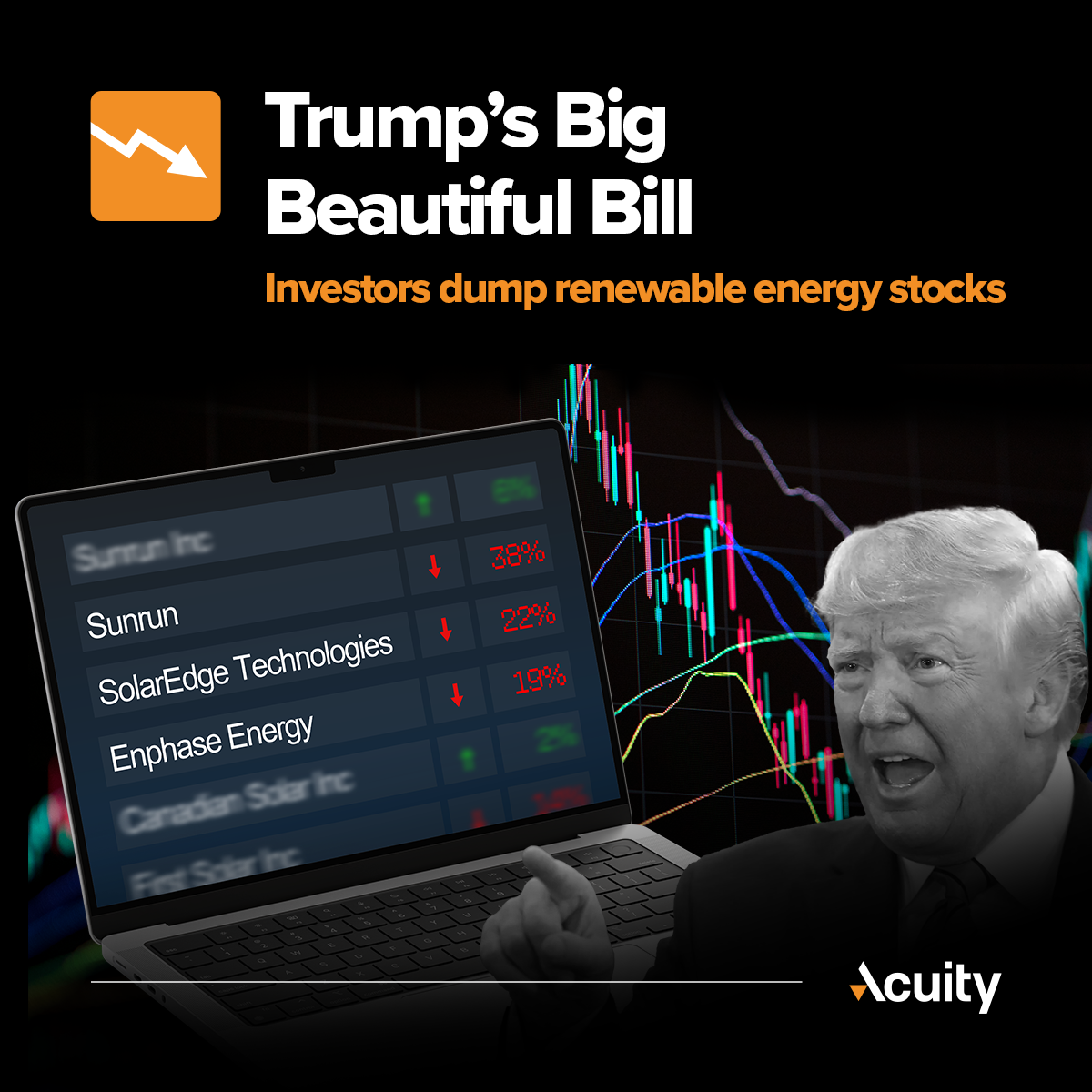

Renewable energy, EV and energy storage stocks are the worst hit.

- Sunrun fell over 38%, Enphase Energy declined 19%, NextEra Energy slipped 9% and First Solar was down 4% on May 22, after the House of Representatives passed the bill.

- SolarEdge Technologies tanked 22% and Enphase Energy’s stock plummeted 17%.

- Within a month of the bill being passed, Tesla had fallen 7.54%, Nio was down 14.85% and Rivian Automotive had declined 17.80%

The Bottom Line

Steep declines in clean energy stocks could present opportunities for green traders to buy the dip. However, at such times, it is important to carefully assess the long-term viability of companies based on their diversified revenue streams, technological advantages and adaptability to a less supportive policy environment.

Blog