Rising fossil fuel prices have majorly hit the German economy. Europe’s largest economy is focusing on reducing its dependence on fuel imports by supporting wind energy. Driven by recent policy changes, the nation is well on its way to adding wind capacity and making the economy energy independent.

Why it Matters

The expansion of wind energy capacity is expected to attract significant private investment, creating jobs and stimulating economic growth.

Wind energy has also emerged as a major driver of economic growth in Germany, employing around 135,000 people. The wind energy sector is also a significant exporter, contributing to Germany’s overall economic competitiveness.

By the Numbers

- 4GW – New wind energy capacity added by Germany in Q1 2025.

- 1+ GW 1,000+MW – New wind energy installations in Q1 2025.

- 40% – Year-on-year rRise in new onshore wind energy installation in Q1 2025.

- 8GW – Average wind capacity to be added annually from 2025 to 2030.

- €500 billion – Expenditure target on wind energy-related infrastructure.

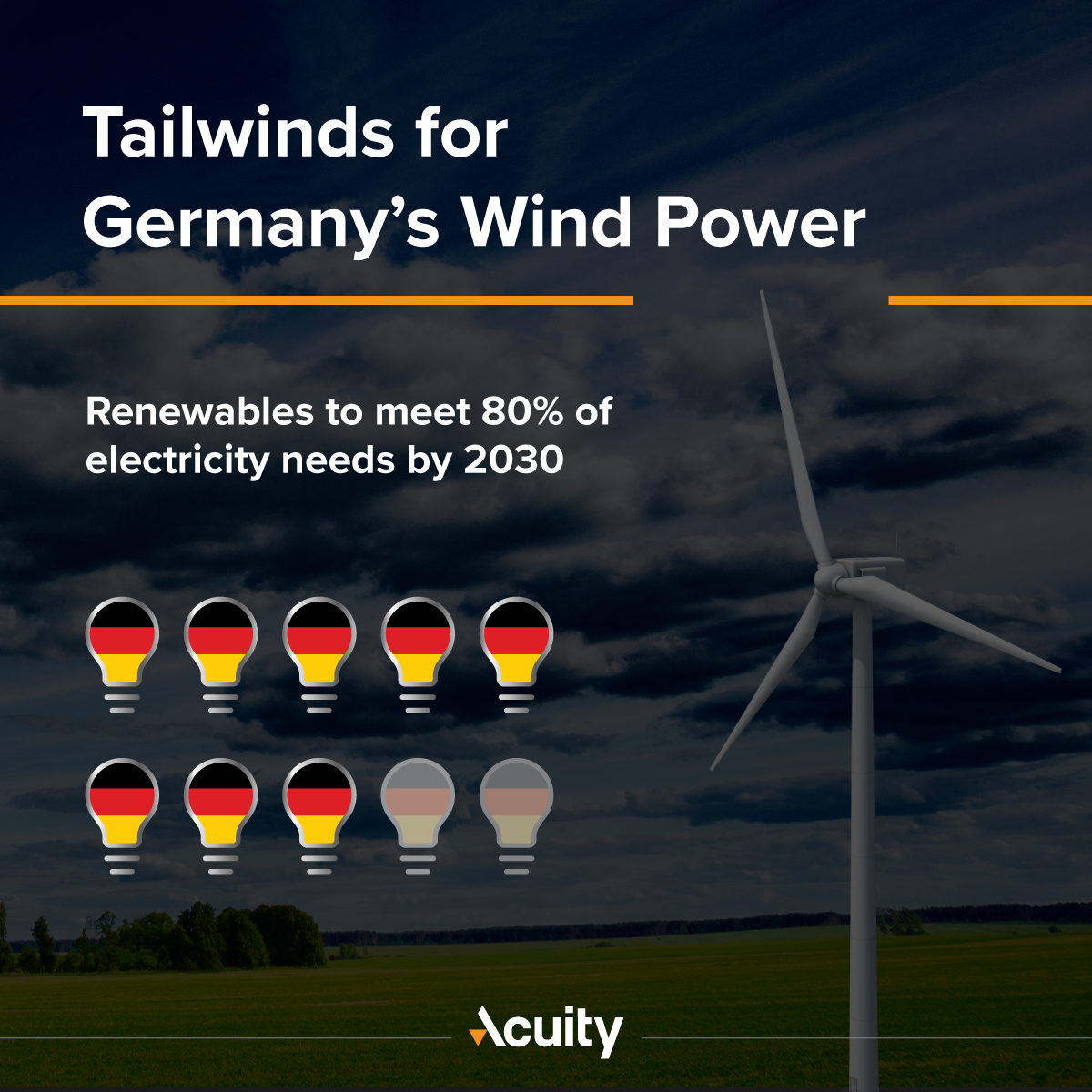

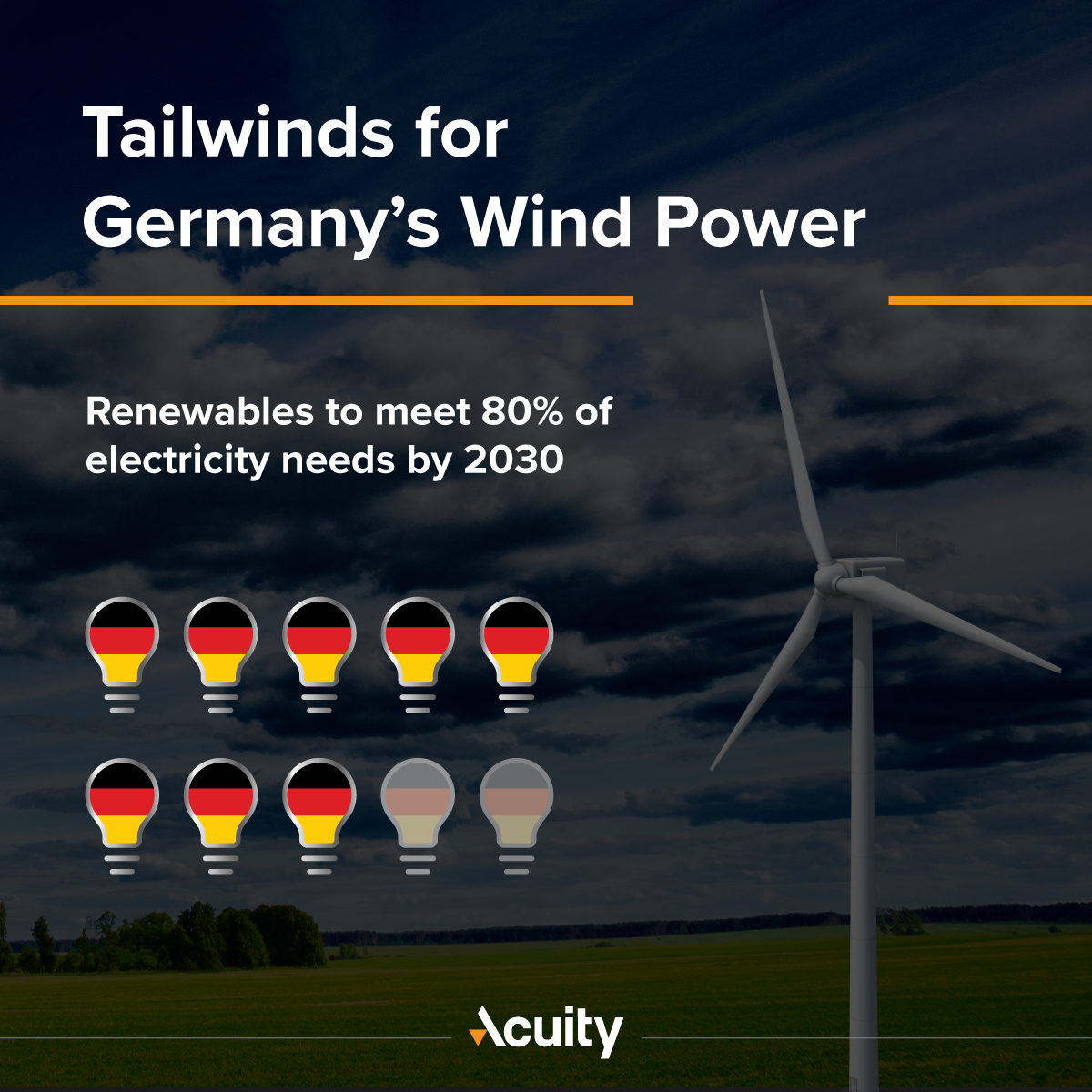

- ~60% - Of energy needs in Germany were fulfilled by the renewables market by early 2024.

- 145 GW – Wind capacity goal for 203025.

The Big Picture

Germany is actively expanding both onshore and offshore wind energy capacity, which will contribute to the country’s climate goals, energy independence, and economic growth. Wind energy is expected to:

- Reduce wholesale electricity prices by displacing expensive conventional power plants.

- Attract significant private investment, particularly in the offshore wind supply chain and grid infrastructure.

- The European Investment Bank (EIB) had activated a €5 billion initiative to support wind-energy equipment manufacturers in Europe in 2024.

What to Watch

- Renewables stock moves due to developments in the German wind energy sector

- Acuity’s AssetIQ widget shows bullish sentiment on German wind energy stocks, including RWE AG, Nordex SE and E.ON.

The Bottom Line

Wind energy is expected to bolster the German economy and boost the performance of stocks in the sector in 2025.

Blog