Large Language Models (LLMs) are bringing about a paradigm shift across industries.Every industry is experimenting with how this new application of AI can be best put to use to improve workflows and processes. The most apparent use of LLMs, Generative AI, is already proving its worth in improving customer experiences. Little wonder then that the global LLM market size, valued at $4.35 billion in 2023, is expected to witness a CAGR of 35.9% from 2024 to 2030 to reach $35.43 billion by the end of the forecast period.

One of the major drivers of this growth is expected to be the elimination of human intervention in training models. This will increase the efficiency of machine learning models by enabling autonomous learning and agile adaptation to changes without continuous manual oversight. The end result will be resource and time savings for businesses.

So, which sectors should investors keep an eye on to see the transformative power of LLMs?

The Healthcare Sector

This is a huge sector, encompassing everything from medical research to pharmacology and treatment delivery. However, this is also one sector that can benefit from the automation of time-consuming, repetitive tasks. Apart from reducing human error, it could also prove invaluable in using patient data to identify patterns and make predictions to improve patient care.

AI and LLMs are already being used with great success to aid physicians in diagnosing medical conditions. For example, VisualDx has been deployed in more than 2,300 hospitals as a support tool to assist in diagnostic decision-making. Viz.ai, on the other hand, can detect the risk of neurological disorders, such as left ventricular dysfunction, with 93% accuracy.

Virtual patient care will also undoubtedly benefit from AI monitoring remote patients and alerting the concerned physician if behavioural changes are detected. LLMs are assisting in precision medicine, using patient data such as diagnosis, demographics, disease profiles, etc. Drug discovery and development are also benefiting from the ability of LLMs to mine massive biomedical datasets to identify new applications of existing drugs.

Whether the financial markets have factored in this potential is hard to say. Healthcare stocks have been volatile in recent times, underperforming the S&P 500 so far in 2024. Eli Lilly has been the largest gainer, rising almost 42% in the 6 months to April 2024, while the otherwise popular Johnson & Johnson has declined almost 3% during the same period. Acuity’s AssetIQ widget shows that market sentiment on LLY continues to be bullish, while JNJ is witnessing bearish sentiment.

Banking and Financial Services

The finance sector is using large language models to not just improve customer experience but also strengthen security. Generative AI, powered by LLMs, is turning banking into a self-service sector, helping customers as the first contact to resolve issues, and freeing human agents to add greater value. Offering financial advice and investment recommendations based on the analysis of individual customer profiles, such as the wealth segment they fall in, life stage, etc., is leading to personalisation like never before.

Not only are LLMs making banking much more convenient, but they are also supporting investors in discovering market opportunities that can help achieve their financial goals. They are recommending the most relevant resources, tools, and asset classes, providing 24/7 support.

On the other hand, LLMs are increasing employee efficiency and productivity in this sector too. Employees no longer have to spend time and effort trying to locate relevant information to better serve customers. Plus, AI and its various applications are driving innovation in finance, which, in turn, is likely to help fulfill the vision of financial inclusion.

Banking stocks seem to have recovered well after the tumultuous start to 2023. The largest finance stocks have been performing well in the six months to April 2024, with Bank of America gaining close to 42% and JPMorgan coming in a close second with an increase of almost 37%. Acuity’s AssetIQ, however, reveals that market sentiment is more bullish on JPMorgan, which could indicate that this is one banking stock to keep an eye on.

Retail and Commerce

This sector that has seen a seismic transformation following the pandemic. Adopting the latest technologies has been one of the primary ways for the retail sector to emerge even stronger than before. Customers are already used to personalised recommendations of products, content, deals and special offers. Alexa is helping with voice-enabled shopping, and LLM-powered chatbots are answering complicated product-related questions to drive purchase decisions. These chatbots might even be doing better than human sales representatives in cross-selling and upselling.

Home décor and fashion are finding uses for AI and its associated technologies to create 2D and 3D previews of products to aid customer decision-making. Multiple variations of the products can be displayed to help customers make an informed choice without the retailer needing to undertake expensive photoshoots of each variant.

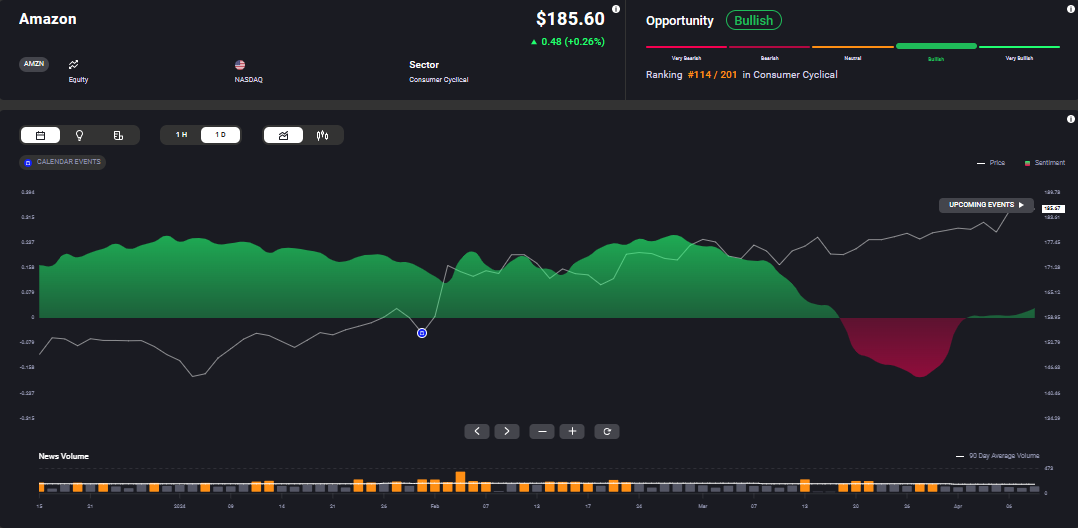

People are loving the way AI and LLMs have changed the retail sector. This is visible in the performance stocks like Amazon, which has risen almost 43% in the six months to April 2024, while Costco and Home Depot are up around ~23%. But investors are currently more bullish on Home Depot than Amazon, according to Acuity’s AssetIQ.

Will the continuing evolution of AI prove positive for industries and their stocks? Keeping a close eye on breaking news events and company announcements, while using Acuity's AI-powered analytics tools, can help identify viable market opportunities.

Data Science,

Technology