At its peak in November 2021, the entire crypto universe was valued at $3 trillion. Since then, however, the crypto market has had a few strained months. As of June 2022, the market capitalisation of cryptos has fallen to $1.3 trillion. Yet many investors, from Reddit forums to trading desks on Wall Street, continue to believe. Can cryptos once again thrive during a recession?

The Next Recession

Advanced economies, like Europe and the US, are experiencing supply shortages that have pushed inflation to the highest levels since the Great Inflation of the 1970s and 80s. Inflation increases prices and makes customers less likely to shell out for high-margin discretionary items. Since April, the US consumer confidence index has been steadily declining, signifying the reluctance to purchase non-essentials.

Central banks globally are raising rates to stave off inflation, but the resultant decline in demand is a bearish indicator for the world economy.

Bear signals also emanate from the Russian invasion of Ukraine and China’s zero covid-19 policy, which may have global ramifications that have not yet fully materialised. Goldman Sachs gives a 35% probability of a US recession over the next 24 months. Deutsche Bank analysts are even more bearish and predict a US recession in 2023.

Why Cryptos May Thrive Even If the Global Economy Stutters

Source of Value of Assets

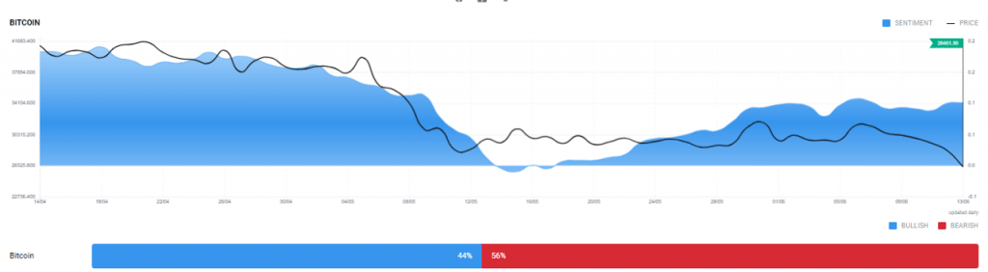

In assessing the importance of cryptos as a portfolio asset during a recession, it is essential to see their sources of value. With economic signs turning bearish and central banks hiking rates, many speculators lowered their risk tolerance and cashed out their crypto bets. The treatment of Bitcoin as a risk vehicle, rather than a safe-haven option, is exhibited by its high positive correlation with major equity indices. However, cryptocurrencies have utility outside of being a speculative vehicle.

The most common utility is to facilitate transactions. With commercial activity being severely inhibited by a recession, their utility in this area is reduced On the flip side, cryptos that are supply capped can perform well as inflation-proof assets, if the current high supply-side inflation persists during a recession.

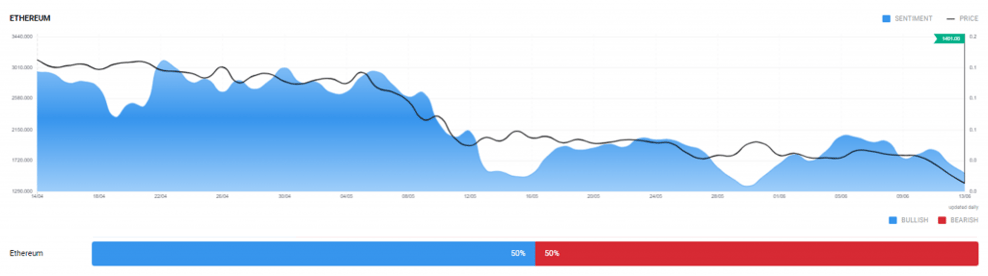

While the Bitcoin network is limited to acting as an exchange for bitcoin, other networks have found functionalities that would be useful during a recession. There are cryptos that facilitate financial activity through transparent algorithms called smart contracts, thereby eliminating the need for intermediaries and high transaction fees. During a recession, less disposable cash is available to pay for the myriad of intermediaries that investors and borrowers have to deal with in traditional markets, increasing the utility of these coins. Ethereum (ETH) is possibly the most popular altcoin because it supports smart contracts.