Still Aiming for the Skies

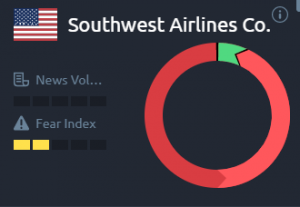

Most revenue lost was from international long-haul flights subject to pandemic restrictions. Companies such as Southwest Airlines, which cater to leisure, have a limited international route exposure as well as a low-cost structure. Due to these factors, the company could perform well as the economy gradually recovers. Any recovery will first come through the leisure travel segment, priming Southwest Airlines to collect profits. Southwest Airlines currently enjoys a higher margin than American Airlines, the largest airline globally. Southwest Airlines also ended 2020 with a significant cash buffer of $14.3 billion.

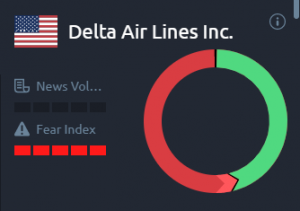

Meanwhile, Delta Air Lines has leaned into a health-focused message by appointing a Chief Health Officer and extending the ban of middle-seat seating. CEO Ed Bastian expects a return to profits by Q4 2022 due to pent up demand. It too had built a cash buffer of $16.7 billion as of December.

However, some companies have exited this pandemic with high levels of debt on their balance sheets. An example of this is American Airlines. The company has worked hard to reduce its persistent cash burn by shedding much of its international capacity, while also following cost-saving measures. While this company is likely to experience a more challenging 2021 than its competitors, its domestic business has done better than rivals and can be key to generating profits.

The sizeable cash buffers these airlines have built up and their capability to control cash burn are encouraging signs for 2021. It is unlikely that there will be any need of immediate financial assistance, in addition to what the government already provides. The next step for these companies is to estimate and time the recovery in demand. The industry does take a while to respond to a rise in demand, given the structure to deploy aircraft at signs of recovery. Spotting recovering and timing deployment correctly could be fundamental in securing recovery volumes as much as possible.

In the decade to the pandemic, America’s biggest airlines used 96% of their free cash flows for share buybacks. Given the newfound respect for cash flows, we believe airline companies will plough back these funds, rather than disbursing through share buybacks going forward.

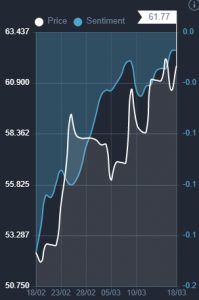

Overall, there is likely to be an industry recovery during the year. Sentiment for the leading airlines remains balanced, given the downturn in the industry and the imminent economic recovery. This can be seen from Acuity’s Trading Dashboard.