The Bitter Breakups

Brexit is unarguably the most impactful policy decision for the UK in the new millennium. London, that served as Europe’s largest share trading centre, has now been overtaken by Amsterdam. Productivity in the UK has suffered a blow from the increased trade barriers with the EU and the failure to establish non-EU trading partners to offset the tighter trade stance with the EU.

Negotiations with Washington have been difficult since the Biden administration has other things to worry about. UK’s target of reaching an agreement with India in November was also missed.

The UK was forced to turn a cold shoulder to China, its fourth-largest trading partner. The Cameron administration had tried to pursue easy trade policies to increase its influence with the Asian Dragon. However, the Sunak one didn’t have that luxury. Any soft power gained was not ostensible during the Chinese government’s crackdown on protestors campaigning for the expansion of democratic values and an end of the draconian zero-covid policies. These developments fuelled the already simmering fire after the Beijing’s sanctioning of seven British MPs.

The UK found itself in the sanction-imposing taskforce comprising the G7 allies, which has collectively blocked or frozen more than $30 billion in Russian assets. UK’s relationship with Russia has always been fragile due to the lack of common goals or values. With China counting Russia as its most influential informal ally, Britain finds itself on the other side of two significant military threats to its sphere of influence, both in Europe and in Asia.

Sitting in a Gloomy Corner

Approaching the end of 2022, the UK economy is straggling. In the G7 nations, which includes the UK, US, Japan, Germany, France, Italy and Canada, average GDP growth is estimated at 2.5% in 2022. Among these nations, only the UK has posted a contraction, of about 0.4%. The country also lags the cumulative 3.7% growth among the OECD nations. The UK’s independent Office of Budget Responsibility (OBR) forecasts the country to contract by 1.4% in 2023, the single largest decline since the OBR started recording. The OBR also expects the current economic trends to result in Real Household Disposable Incomes falling to their lowest since 2013-2014. For the first time since 2003, the UK is on the brink of dropping out of the list of 7 largest trading partners of the US, being surpassed by Vietnam.

Returning to the Dating Scene

With its economic momentum looking rather languid, the UK desperately needs some friends. Britain could consider “friend sourcing,” shifting its supply chains and building trade relations with developing economies that can take over, at least in components, China’s role as the factory to the world. Vietnam, for example, has a Free Trade Agreement with both the EU and the UK. The FTA with the UK has helped boost trade between the countries to nearly $6 billion.

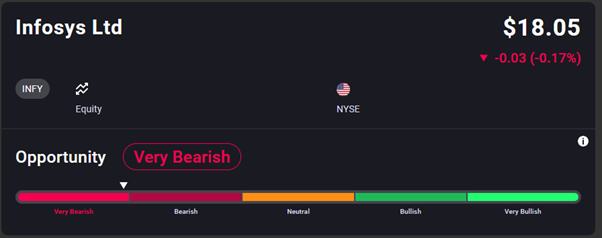

Although trade between the UK and India trade has grown significantly over the past couple of decades, India’s trade with the rest of the world has grown 3X faster. As a result, the UK has fallen from being India’s second-largest trade partner to the current 17th rank. Trade talks with India continue, and the potential agreement aims to double bilateral trade to $100 billion by 2030. This could spell significant growth opportunities for Indian companies for the remainder of the decade. Investor sentiment for such companies is already turning positive, as can be seen on Acuity’s AssetIQ widget.