Even when the US is not involved in a trade, the exchange of currency involves the greenback. All commodities (ranging from oil to coffee) and metals (like gold and silver) are quoted in the US dollar in the global financial markets. Due to these reasons, around 50% of the roughly $2.04 trillion worth of dollars in circulation was held by foreign entities (in circulation outside the US), according to the Federal Reserve’s estimate released in the first quarter of 2021.

So, why did the greenback become the world’s most prominent currency, why is its power flailing now and what could this mean for the global economy?

All Hail the Power of the USD

The US emerged as the leading superpower after World War II. At this time, the country controlled around 75% of the world’s gold supply and the US dollar become the only currency to be backed by the yellow metal. Meanwhile, with depleted gold reserves, other nations were unable to follow the gold standard and 44 countries came together to sign the Bretton Woods Agreement, pegging their currencies to the US dollar. The agreement, inked in 1944, made the US dollar the new gold.

Although the Bretton Woods system failed, the US dollar didn’t lose its power. By the 1970s, the US no longer had enough gold to back all the dollars issued and the gold convertibility for the greenback was ended by President Richard Nixon. Several economists predicted the end of the dollar dominance following this move. But that didn’t happen. In fact, the US dollar gained momentum as the world’s currency for trading and as a store of value. The strength of the US economy supported the greenback’s position as the global currency.

How the US Dollar’s Demise May Impact Us

Countries recognise that the dollar dominance puts the US in a position of power, giving it an “exorbitant privilege,” a term that was coined in the 1960s by France’s then Finance Minister Valéry Giscard d’Estaing to bring this issue to the limelight.

Fundamentally Mismatched

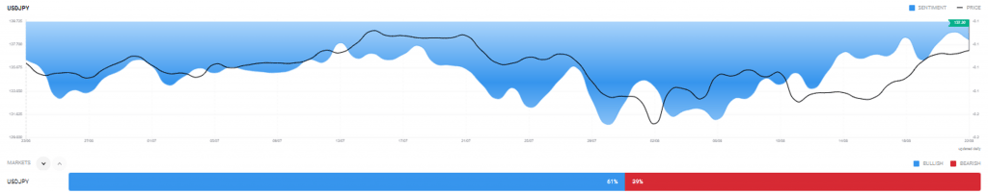

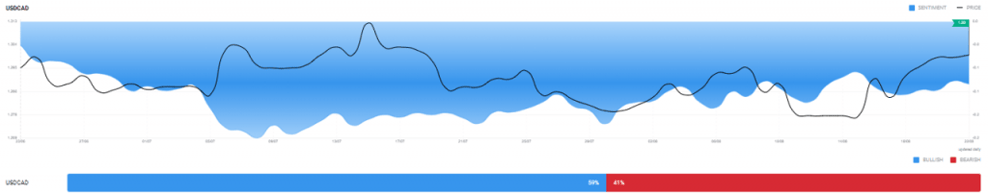

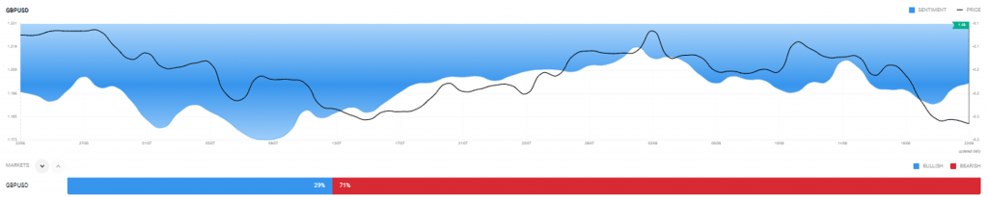

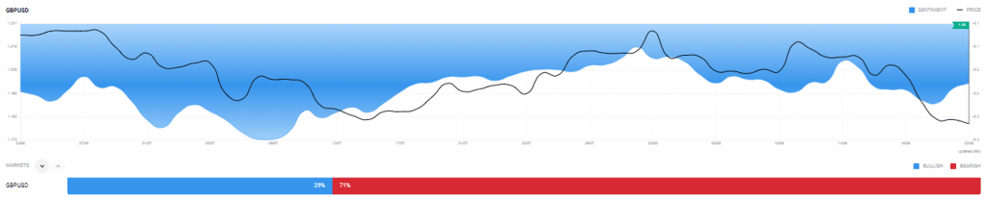

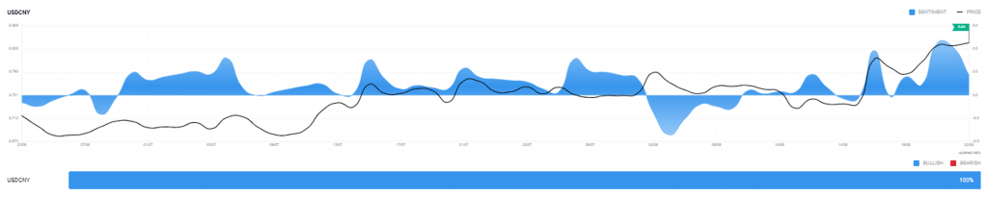

Although the greenback has held its position as the king of currencies, the US economy’s global output has shrunk over the past couple of decades. America’s economic growth is projected to slow. S&P Global forecasts a slowdown to 2.4% in 2022 and 1.6% in 2023, while the OECD projects a deceleration to 2.5% in 2022 and 1.2% in 2023. Despite this, the sentiment for the US dollar is largely positive, as reflected by Acuity’s Sentiment Widget.