Reading Between the Lines

Yes, rate hikes can dampen economic activity. However, there are two important things to consider related to the ECB’s move. First, the bloc’s central bank remains more accommodative than its advanced economy counterparts. Although, on the face of it, the 50bps rate hike was higher than expected, it simply brings the central bank’s key rate back to 0 from negative territory. On the other hand, the UK and US have hiked their rates over the past few months to 1.5% and 1.75%, respectively.

Second, although there is growing concern around inflation in Europe, the issues are not intrinsic to the region (unlike the other advanced economies). Much of Europe’s inflation is imported, coming in from across the Atlantic. The Russia-Ukraine war has added fuel to the fire. Gas prices have been a significant contributor, rising over 100% since the invasion of Ukraine in February 2022. Since the issues are external, the EU can take action to shield itself. For instance, the bloc has made attempts to alleviate its dependence on Moscow, signing new gas deals with the US and Azerbaijan and asking EU member nations to reduce consumption by 15%.

A Focus on Defensive Assets

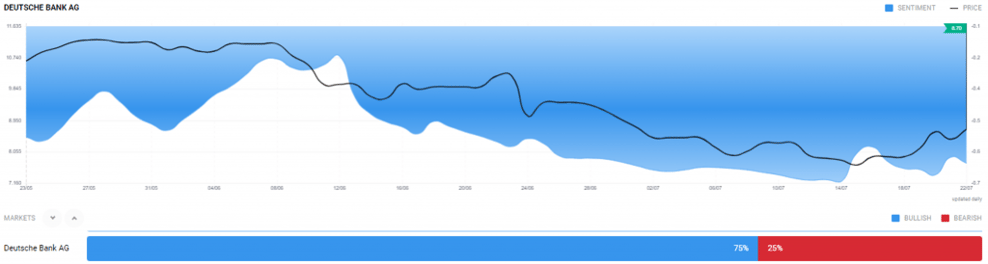

Short-term fixed income yields are the most sensitive to policy changes. An increase in rates makes bonds less valuable, leading to a sell-off and a corresponding increase in yields. German Bund yields rose despite downward pressure from a sharp fall in US treasury yields. The 2-y German Bund increased 22% from 0.61% to 0.75% on the back of the rate-hike announcement. Bond yields are likely to keep rising, with markets anticipating further rate hikes by the ECB. Corporate bonds are likely to see a strong rise in yields too.

Rake in the Cash

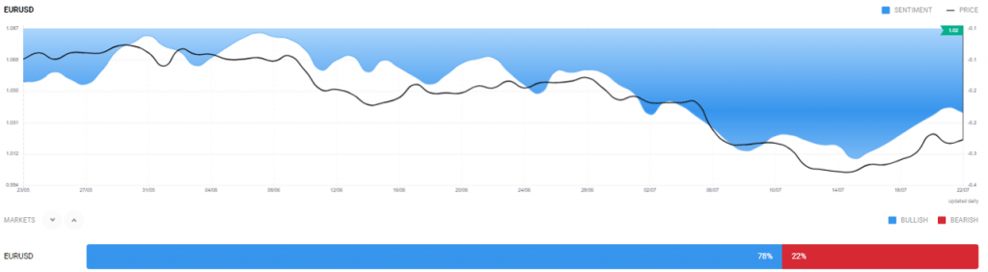

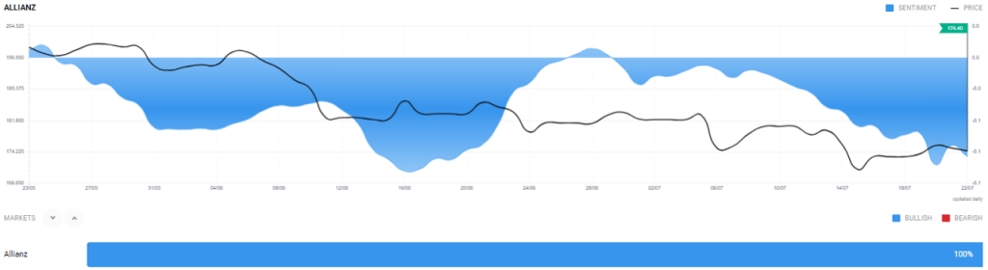

Cash is a defensive asset that is directly impacted by interest rates. The euro has experienced a turbulent year so far, reaching parity with the US dollar, as it hit 20-year lows in July. This fall was as much driven by inflation as by the Fed’s aggressive rate hikes. The ECB’s alignment with other major banks to raise rates could trigger demand for the euro. If the rate hike succeeds in easing inflation, even slightly, the euro could soon pare all its losses. The sentiment for the euro has already turned overwhelmingly positive, as can be seen on Acuity’s Sentiment Widget.