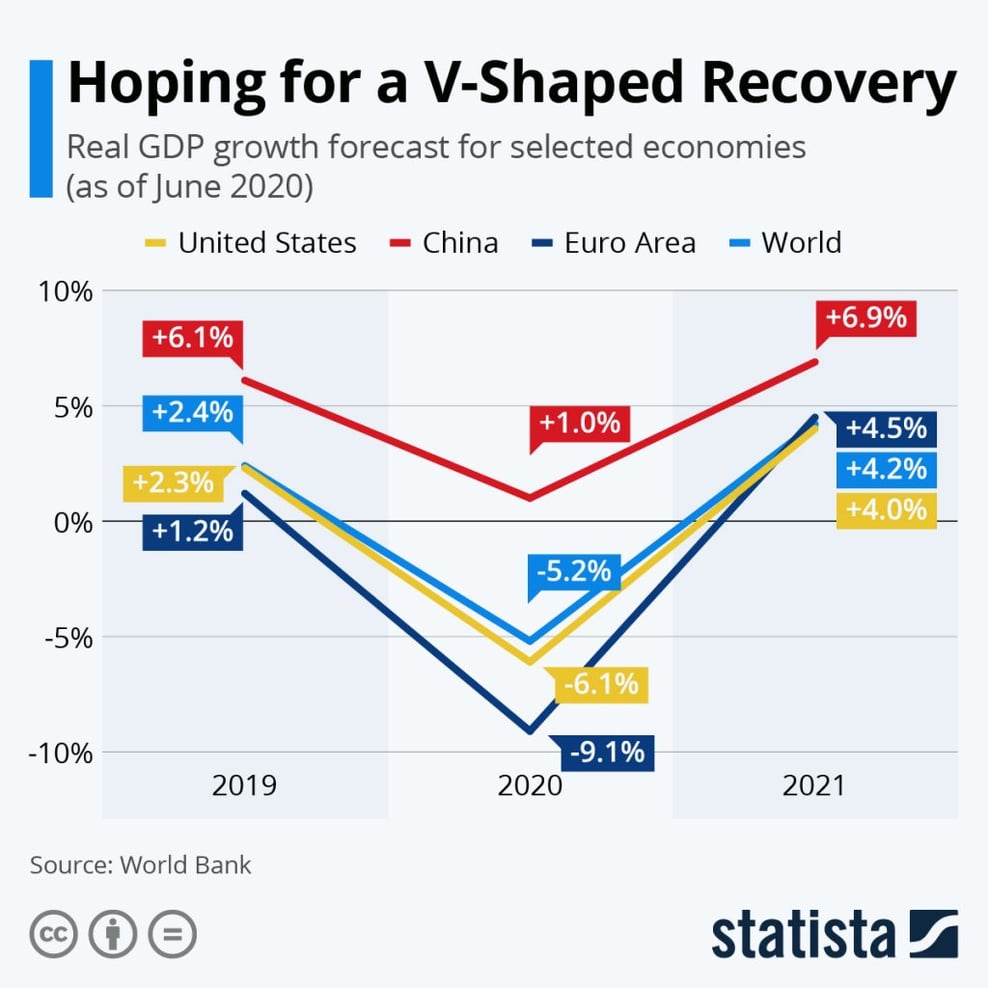

Economic Outlook

December 21, 2020

By Acuity Trading

More news

Moody’s Has ‘Negative’ Rating for China. Why is Its Economy in Trouble?

Moody’s has reaffirmed its “negative” outlook on China’s sovereign credit rating. The credit ratings firm had lowered China’s rating from “stable” to...

Is Xi Jinping Shifting his Stance Towards Chinese Tech Companies?

On February 17, 2025, China’s President Xi Jinping called a meeting of prominent tech leaders in the country, including Alibaba’s co-founder, Jack...