The Battle for Chips

The underlying hostility between the world’s two leading superpowers came to the surface in 2018. The US-China trade war led to tariffs on about $550 billion worth of Chinese goods and $185 billion worth of US goods. The trade and diplomatic war between Washington and Beijing has now evolved into an odyssey of technological dominance.

China’s growing interest in AI has made the US extremely nervous about the People’s Liberation Army (PLA) becoming more powerful than the US military. Despite China’s significant progress in certain AI applications, the Asian dragon has not yet been able to produce advanced semiconductor chips that power these technologies and relies heavily on imports.

To curb China’s rising dominance in AI and quantum computing, the Biden administration took a leaf out of the Trump playbook and imposed sweeping export controls on semiconductors and related products in October last year. US suppliers now need to obtain a licence from the government before exporting chips to China. By May this year, the US had got Taiwan, Japan, and the Netherlands on board to block exports to China, both chipmaking materials and advanced semiconductor manufacturing equipment.

The Biden administration had obviously not thought this through. China retaliated to the chip bans by restricting the export of gallium and germanium, two metals that are essential for manufacturing semiconductors. The red dragon is by far the largest supplier of both metals, producing 94% of the world’s gallium and 83% of germanium. A chokehold on these can inflict a great deal of pain for the tech industry.

Caught in the Crossfire

Semiconductor manufacturers are already facing headwinds from the chip war. The two leading chipmakers, Micron Technology, Nvidia and Advanced Micro Devices (AMD) generate 16%, 20% and 30% of their respective revenues from China. Intel and Qualcomm have manufacturing facilities in the country and are concerned about the impact of the US-China faceoff.

It’s not just US chipmakers that are directly impacted by the restrictions. Dutch semiconductor equipment maker ASML and UK chip design firm ARM find themselves in the crosshairs. South Korean Samsung Electronics and SK Hynix are feeling the heat too. While Samsung has two giant production facilities for NAND and DRAM semiconductors in China, SK Hynix’s facility in the country produces over 40% of its DRAM chips.

China-based Alibaba, Baidu, Tencent and Huawei are already struggling to source advanced chips to operate their AI workloads. Much to their dismay, the US tech behemoths, including Microsoft, Apple, Amazon, Google and IBM, are realizing that it’s not their AI prowess, but the availability of semiconductor chips, that could determine the returns on their massive investments.

The Way Forward

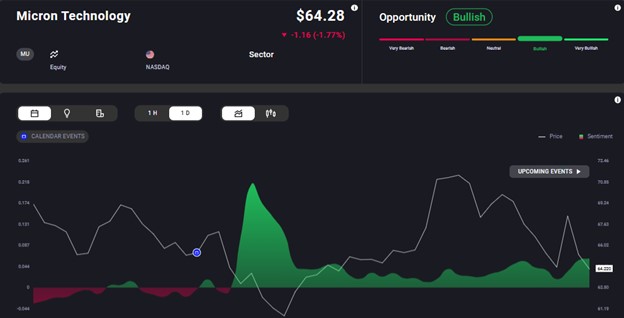

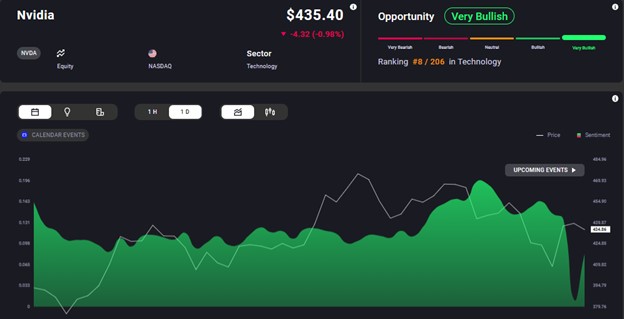

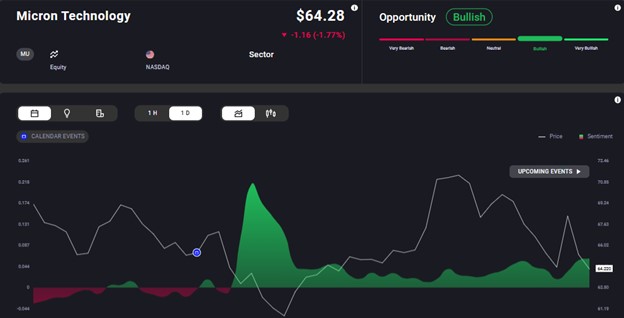

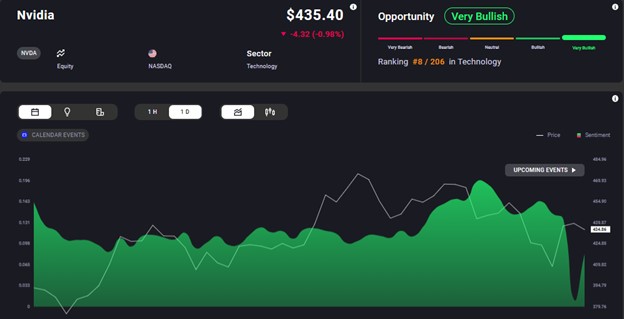

Fortunately, there are several ways forward to prevent tech companies from becoming collateral damage in the US-China trade war. To begin with, the demand for chips remains buoyant, with explosive growth in generative AI. That’s the reason the sentiment for chipmakers continues to be positive despite the loss of demand from China. This is reflected in Acuity’s AssetIQ widget.

Moreover, the companies investing in AI belong to the trillion-dollar club, which has significant financial flexibility and political clout to overcoming hurdles.

Companies will also consider shifting their chip production facilities out of China to avoid long-term supply disruptions. China’s ban on gallium and germanium could push US allies to rethink their curbs on the red dragon. Conversely, the ban could incentivise other counties to produce these materials, with China’s low-cost product out of the way.

The complex semiconductor value chain has no single, self-sufficient member, which makes inter-dependence beneficial for collective growth. The US-China chip war has seen companies focus on de-risking their over-dependence on any one company or country.