The second quarter of 2023 was brimming with positive surprises. Of the companies listed on the S&P 500, almost 79% reported earnings higher than the consensus estimates. Yet, it’s not a quarter that we cheered or got excited about. To begin with, market expectations were exceptionally low, with experts predicting upbeat earnings only in the fourth quarter. Also, it was a paradoxical performance, with companies reporting the lowest revenue beats since the worst of the pandemic in 2020. In fact, inflation-adjusted revenue growth was negative for the second quarter.

Nonetheless, investors seemed thrilled even with these middling overall results, which sent both the S&P 500 and Nasdaq 100 on an upward trajectory through most of July. With time for a deeper retrospect, investors gave up their optimism, sending both indices on a marked downtrend in August.

Even amid a broadly sluggish quarter, there were some companies that did shine. Here’s a look at some of the outperformers of the second quarter.

Tech Takes the Lead, Again

While the US-China chip war has cast dark clouds on the AI aspirations of industry majors, tech stocks have climbed almost 30% year to date.

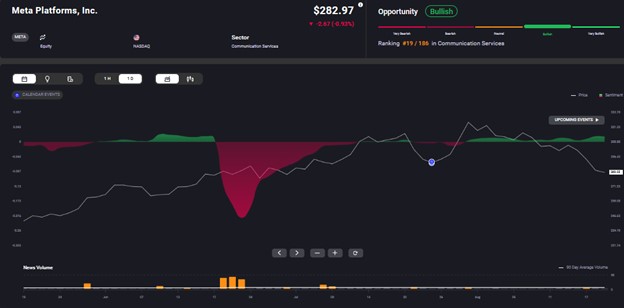

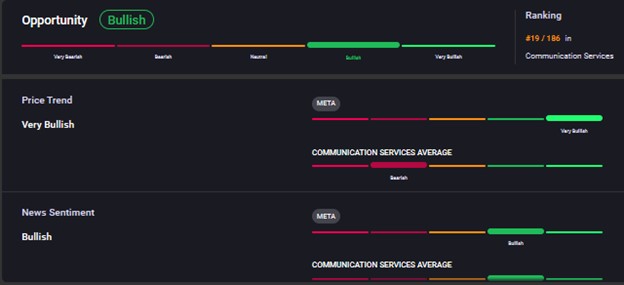

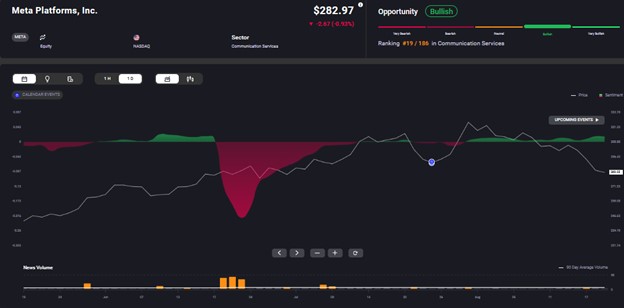

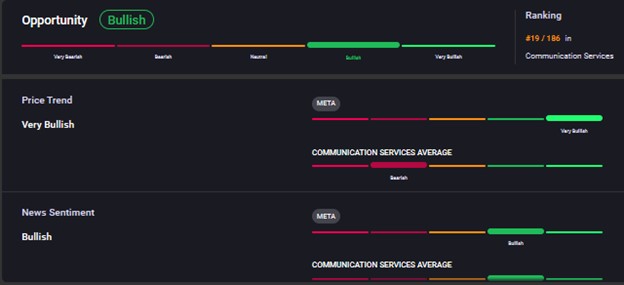

Meta Platforms not only reported double-digit revenue growth for the first time in five quarters, but also projected a higher-than-expected range for the third quarter. Last year had been particularly gloomy, with Meta’s ad targeting capabilities being hit by Apple’s iOS privacy changes. Investors rewarded the Facebook parent by sending its stock 5.5% higher, the third biggest earnings-reaction-day rally in its history.

Meta Platforms continues to focus on improving the operational efficiency of all its platforms, especially its AR/VR-based Metaverse. Investors eagerly await more updates from Llama 2 and Quest 3 as well as new AI products in Meta’s pipeline. That’s the reason sentiment remains bullish, as reflected by Acuity’s AssetIQ widget, despite the stock’s steep rally so far this year.

Against a volatile quarter for networking companies, Cisco Systems exhibited its ability to ride out the storm. This was achieved on the back of its more diversified customer base, large portion of recurring revenues and stronghold in the enterprise segment. Cisco’s announcement of orders worth $500 million for its AI Ethernet fabrics and the piloting of 800G for AI training fabrics grabbed investor attention.

Applied Materials and Roblox were among the other companies that delivered robust results.

Consumer Discretionary Standouts

After a full year of inflation-driven declines in consumer discretionary spending, retailers breathed a sigh of relief with increased footfall from June.

Amazon achieved accelerating market share gains in North American retail. With expanding scale, the company’s bottom-line benefited from lower unit costs. The company reported blowout earnings for the latest quarter, in the wake of its cost-cutting efforts that included the largest layoff in its history. Management’s guidance pointed to sustained retail sales growth in the third quarter.

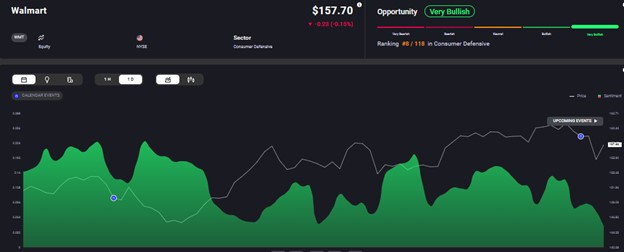

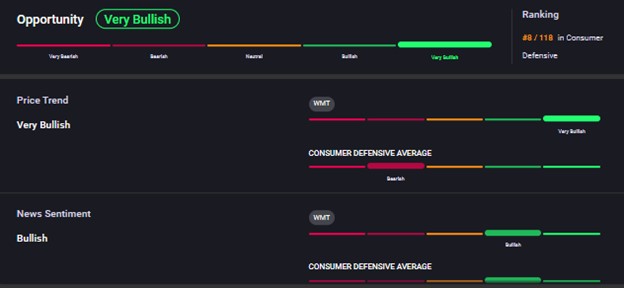

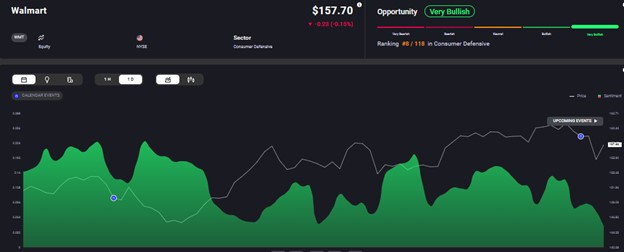

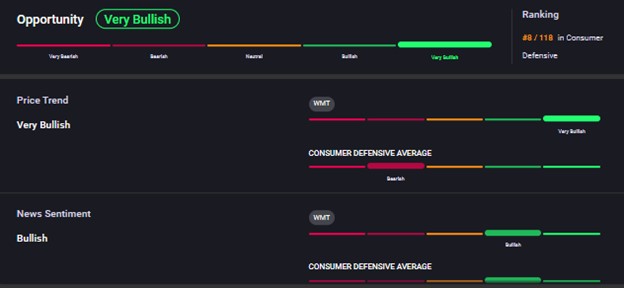

All eyes were on Walmart as it delivered a strong set of quarterly results on the back of broad-based market share gains and strong momentum in its key growth initiatives. Management raised their 2023 guidance and the retail giant looked well-positioned to continue gaining market share, especially with the automation of its supply chain.

Starbucks and Yum Brands were the other two companies in the segment that delivered outstanding results.

Healthcare Didn’t Get Left Behind

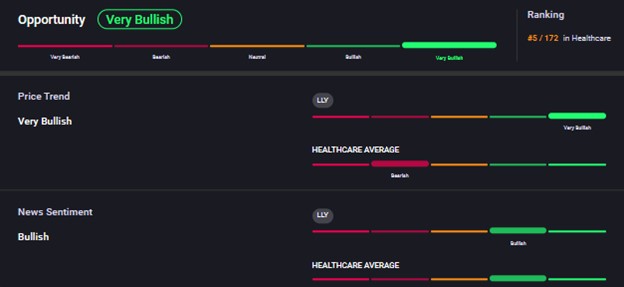

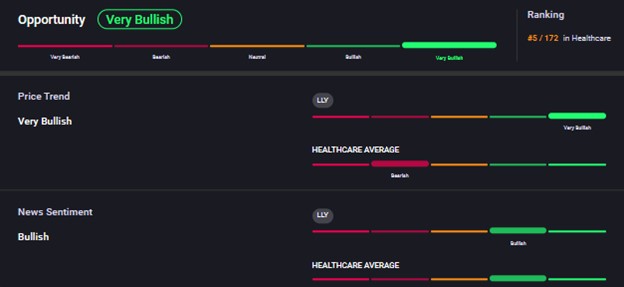

The healthcare sector constituted more than 50% of the S&P 500 companies that reported earnings and revenue growth. Elevated demand for new diabetes drug Mounjaro drove Eli Lilly to report one of its most profitable quarters. Eli Lilly became the world’s most valuable healthcare firm, overtaking UnitedHealth, after adding $64 billion to its market cap following the earnings.

The company’s global revenue grew by 28% year-on-year, despite the negative impact of currency exchange rates. Although earnings per share surged 85%, driven by an array of blockbuster drugs, the FDA approval of the company’s chronic weight management injection drove the stock rally.

Pent-up International Travel Demand

Royal Caribbean Cruises reported what is known as an “earnings triple play.” The cruise giant reported an earnings beat, a sales beat and raised its guidance. This also marked the fifth straight quarter of more than 7% stock gains on earnings-reaction-day. The stock has rallied more than 100% in 2023. The hopes are high its luxury liner – Icon of the Seas – scheduled for launch in January 2024. The vessel is expected to be 5 times the size of the Titanic.

Rivals Carnival and Norwegian Cruise Line also reported epic revenue growth of 100% and 86%, respectively.

Biggest Losers of the Second Quarter

While several companies reported upbeat results, some of the investor darlings shockingly underperformed. Apple reported declining revenues for the quarter and issued a cautious guidance. Although its stock took a hammering after the earnings release, it has added around 40% year to date. Tesla was another disappointment. While the company did beat the low revenue and earnings estimates, its margins contracted due to price cuts. To add to worries, the EV maker announced the launch of cheaper versions of its high-end S and X models. Qualcomm and Target also reported underwhelming results.

As the dust settles on the second-quarter reporting season, we’re looking ahead to the next one. While inflation concerns remain, the US market is proving resilient. Investors may remain cautious, however, about emerging recessionary pressures due to the delayed impact of interest rate hikes.