Making Microsoft, Google and Apple Great (Again)

Meanwhile, Microsoft and Alphabet reported their Q3 earnings well ahead of expectations, which sent the stock soaring. So much so that the rise in these two stocks helped the Nasdaq rise, while the S&P 500 and Dow Jones Industrial Average declined. This was Microsoft’s 11th consecutive quarter of reporting better-than-expected earnings.

Apple, like Amazon, faced supply change issues and inflation concerns. In addition, the privacy changes made by the company meant that advertising would be restricted on Apple. Despite all this, the tech giant surpassed consensus expectations, demonstrating its resilience to economic uncertainties.

Microsoft, on the other hand, saw its market cap rising to $2.47 trillion on November 1, overtaking Apple’s $2.46 trillion to become the most valuable company in the world. The two companies have been vying for the crown for quite some time now, with MSFT capturing the prize in 2010, 2018 and 2020 as well. Alphabet isn’t too far behind either, just shy of the $2 trillion mark as of November 8. Amazon, at $1.79 trillion might be last in the race for now but not that far behind.

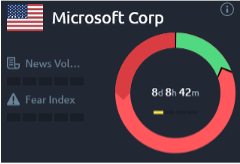

But if you look at market sentiment, it’s a very different story. Alphabet is the clear winner with a surprisingly positive sentiment, as can be seen on the Acuity Trading Dashboard. What is even more surprising is the declining positive sentiment towards Microsoft, soon after it overtook Apple in valuation.

.png?width=234&height=166&name=Picture_4-1%20(1).png)