The Party Pooper

Despite China making its way to the forefront of the global economic power structure, there is one thing that has investors concerned. The next “c” that impacts China is the Communist Party. To understand the implications, let’s look at the IPO saga of Ant Group, a spinoff from ecommerce giant Alibaba and having billionaire businessman Jack Ma as its largest shareholder. At an estimated $34.4 billion, Ant’s IPO would have been the world’s largest share sale, handsomely surpassing Saudi Aramco’s record IPO of $29.4 billion in December 2019.

In early November, regulators pulled the plug on Ant’s stock debut in Shanghai and Hong Kong. By doing so, the Communist Party conveyed in no uncertain terms that it was not intimidated by any private company or business tycoon. China had never really cared how its actions are viewed by other countries. Now, even more so, given its increasingly inward focus. Corporates just need to learn the rules of the game in China.

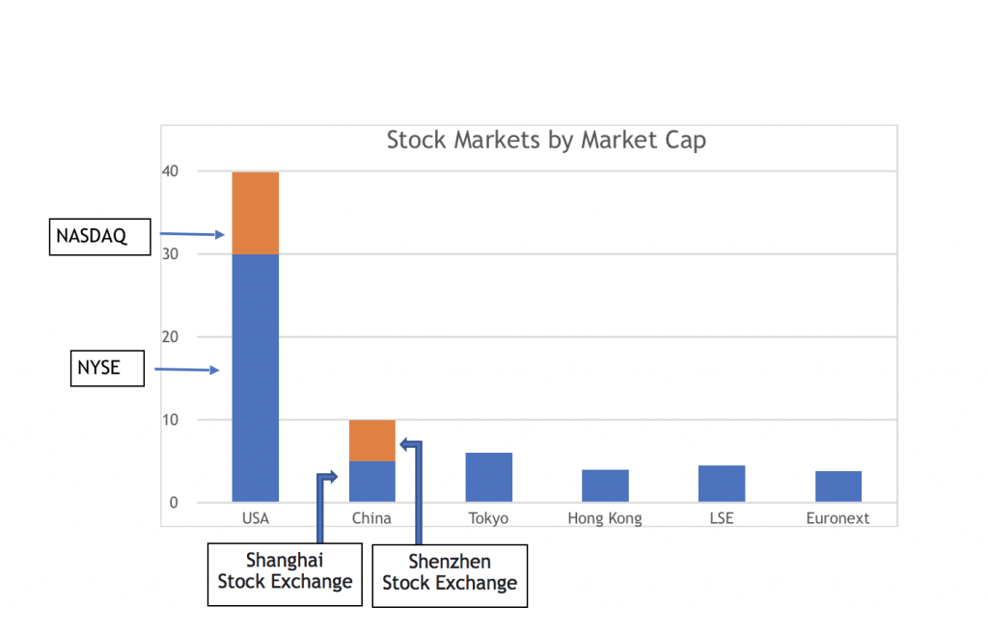

Despite the tragic fate of its IPO, Ant Group is a case in point. The company chose to IPO in China, rather than New York, which has so far been the preferred listing destination for Chinese tech firms. Chinese firms have abandoned US markets at a fast pace this year, amid intensified scrutiny. Such trends will continue to support China’s stock market, which is already the world’s second largest by market capitalisation. Sentiment for CSI 300, which replicates the performance of the top 300 stocks on the Shanghai and Shenzhen stock exchanges, is also hugely positive, according to the Acuity Trading Dashboard.

.png?width=531&height=304&name=Picture-1-1%20(4).png)