Governments and central banks supported them with attempts to reignite demand by announcing record fiscal and quantitative easing. In many ways, this was successful, with global growth bouncing back to 6.1% in 2021. However, the bounce back from covid-19 has caused a new foe for retailers and policymakers.

US inflation (CPI) hit 8.5% in March before easing slightly to 8.2% in April. These are levels not seen since the Great Inflation of 1965-82. In April, the UK posted 9% inflation, the highest rate since records began in 1989. The Eurozone economy is also under pressure, with inflation accelerating to 8.1%.

These economies, which were once struggling to sustain price growth, now finds themselves combatting inflation. With inflation hitting consumer disposable income and corporate profits, have stocks become un-investable? Let’s have a look.

The Big Selloff

Several US retail giants, including Walmart, Target and Best Buy, posted their worst quarterly earnings miss in around five years. These missed expectations stroked the already elevated inflation fears. Shares of leading retailers plummeted in response, with many of them attributed their dwindling margins to higher expenses due to supply chain disruptions and changing customer behaviour. So, how worried should we be?

While there are several reports on supply chain shortages, we need to keep in mind that there are three factors contributing to this. Firstly, many parts of the supply chain had downsized during the covid-19 era, with ships being scrapped, factories being closed, and mines being shut down. These will take some time to ramp up, but they will, as some of the biggest global players are investing in this space. Secondly, we witnessed a faster-than-anticipated recovery in demand in the advanced economies, especially the US. Although the steep rise in demand worsens the situation in the near term, it is good news for the longer term.

Commodity supply has also suffered from the Russian invasion of Ukraine. Over the past two years, the Bloomberg Commodity Index has doubled. Oil, another key input cost for most retailers, has increased more than 60% year to date. These are likely to reach a peak soon and begin to cool. The China covid scenario has already begun to ease.

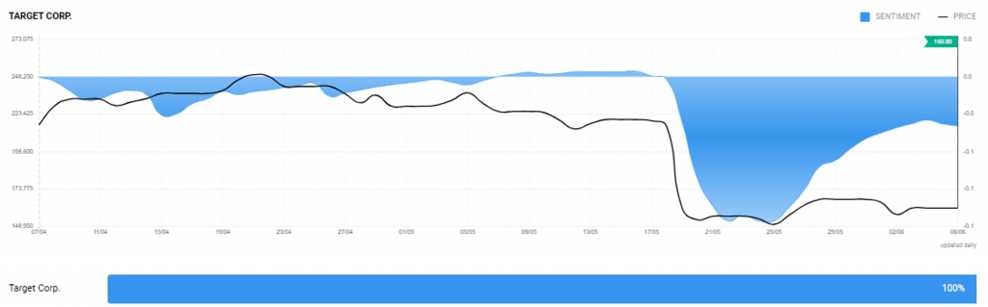

On the other hand, the big sell off in retail stocks presents opportunities. Walmart is down almost 14% and Costco 16% year to date. Market sentiment for Target, which has lost more than 30% this year, has turned positive, as can be seen on Acuity’s Sentiment Widget.