The Coronavirus Effect: Devil & Deep Blue Sea

In 2021, most of the biggest companies flourished, with coronavirus-related uncertainty abating. People felt increasingly confident of getting back to office, eating out and traveling, supporting reopening stocks. For the second quarter that year, Coca Cola reported 42% revenue growth, Restaurant Brands International posted 37% growth in net sales, Airbnb’s EBITDA skyrocketed 227%, Walt Disney reported strong financials, Gap crushed Wall Street expectations and more.

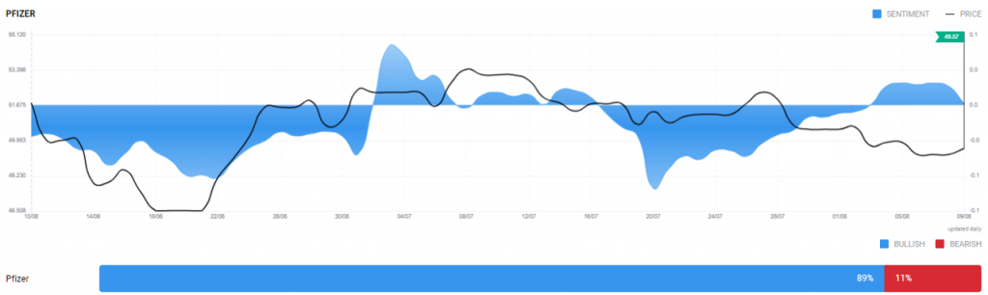

The vaccination drive continued around the world, while people returned to elective treatment as well. This supported pharma stocks. Pharma giant Pfizer reported 98% revenue growth. Logistics companies supporting the vaccination drive also benefited.

This year, the story reversed. On the one hand, pent-up demand had mostly been satisfied. The spread of covid-19 in China and the country’s zero infections policy resulted in lockdowns, aggravating global supply chain issues. On the other hand, people had received their third and even fourth jabs. The demand for vaccinations fell, hurting pharma and related logistics companies.

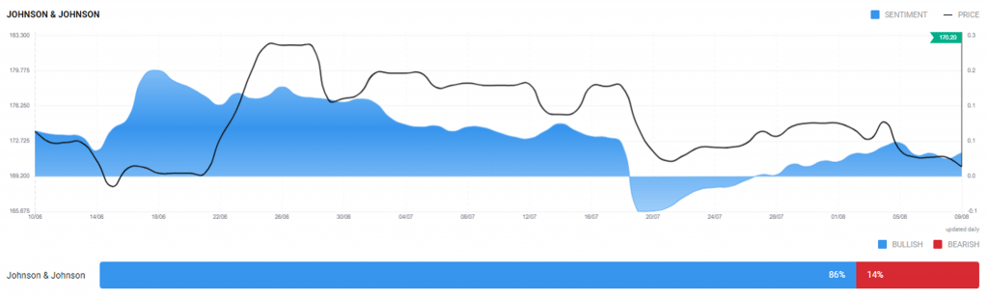

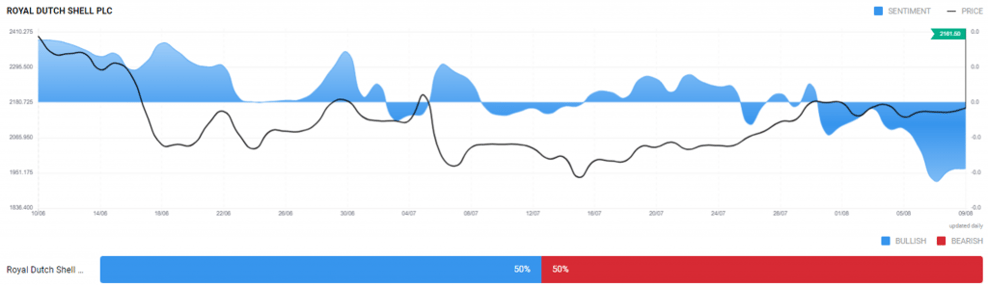

These are, however, transient factors, which will get equalised as we progress into the back half of the year. Investors seem to understand this and the sentiment for large pharm stocks remains overly positive, as reflected by Acuity’s Sentiment Widget.