Around 77% of people globally expressed their desire to live more sustainably, showed a study by South Cross University. Another survey by Yale indicated that 70% of people are concerned about global warming. Despite all the hype about Green Energy, the markets reveal our seemingly insatiable thirst for oil.

The global economy has managed to shake off the pandemic shackles, resulting in growing demand for crude oil markets. Demand growth averaged 5.5 million barrels per day (bpd) in 2021, pushing WTI to become the best performing non-crypto asset class. Crude continued to rally as we entered the new year, hitting 7-year highs in January. While some investors braced for a sharp downturn, oil exhibited great resilience. Crude breached the important $90 per barrel resistance level, only to climb past $92 by February 4.

The record run had very few detractors. Money managers had a long position volume of almost 340,000 in WTI crude, eclipsing their short positions of around 27,000, in January. Market volatility threatened to spike early in the year, but quickly returned to medium-term averages. Oil serves both as an investment vehicle and an input cost for almost every commercial good and its price is critical to a wide range of investments. So, how concerned should investors be about market exuberance and a potential correction ahead?

We’ll Take It Lock, Stock, and Barrel

The global economy needs oil to keep its wheels greased. In its January 2022 meeting, the OPEC+ raised its demand forecast by 260,000 bpd, citing stronger demand from the advanced economies despite the spread of the Omicron variant. In the US, for example, November 2021 saw traffic reaching the highest in a decade, 12% more than in November 2020, when there were restrictions to curb the Delta variant. Although Omicron cases rose, restrictions were significantly less harsh, dampening the virus’s impact on oil demand. Developing nations also exhibited demand resilience, with rising traffic and factory activity in Asia.

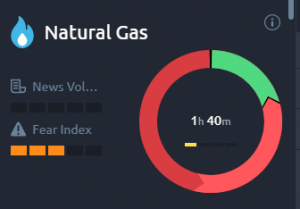

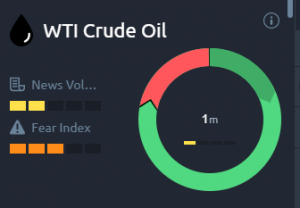

Demand for crude as a substitute for natural gas has also recently grown. Natural gas contract prices have not only surged, but also remained incredibly volatile. The IEA estimated this trend towards crude as a substitute to have created the demand for 100,000 bpd in December. This is also reflected in the largely positive sentiment for oil and the overly negative one for natural gas on Acuity’s Trading Dashboard.

The demand strength is also evident in the market’s forward curve. Brent crude backwardation, the difference between front-month contract and 6-month due contract, climbed to its steepest since 2013.

The IEA also revised its total demand forecast for 2022 to a whopping 99.7 million bpd, which is 200,000 bpd higher than the pre-pandemic levels in 2019. The OPEC’s Joint Technical Committee (JTC) is more optimistic, predicting oil demand to grow by 4.2 million bpd this year.

Risks to Demand

The risk to demand comes from potential economic growth slowdowns. After all, the IMF has reduced its economic growth estimate for 2022 by 0.5% to 4.4%. However, it still sees upward pressures on commodity prices. There is also a tail-risk to growth from potentially more disruptive covid variants, while vaccination rates in developing countries remain low.

The Squeaking Wheel

OPEC+ and US shale producers were forced to shut down oil production when markets turned negative in 2020. It’s been over a year and production hasn’t resumed to the levels needed to meet demand. A decade of under-investment casts a long shadow on oil supply. According to Rystad Energy estimates, average annual investment contracted from $100 million in 2010-2015 to $50 million in 2016-2020. This trend of tight-fisted investment continued in the post-pandemic period. The IEA estimates a 26% decline in global oil and gas investments in 2021, compared to the pre-pandemic levels. Investments will need to remain subdued for another decade to meet the Paris Agreement goals.

Production in the US, the world’s largest oil producer, has been sticky. Last decade’s shale boom made the US the top crude supplier and triggered the price war with Saudi producers. This hit the bottom line of shale producers, requiring them to embrace financial discipline and avoid risky exploration. Against this backdrop, only 8 of the top 20 produce more than their pre-pandemic levels. Super majors like Exxon have publicly announced plans to go carbon neutral, due mainly to shareholder pressure.

Although Exxon and Chevron do plan significant output increases at key drilling sites like the Permian Basin in 2022, these will offset declining outputs from other oil fields globally. Oil fields in Alaska remain underdeveloped, with six big US banks pledging to not finance Arctic drilling due to environmental concerns. Privately held companies are now battling inflationary input prices with relatively smaller economies of scale.

Among OPEC+ member nations too, supply has been hard to increase. The cartel has managed to increase production by merely 6.4 million bpd, versus the 9.7 bpd it had cut in 2020. The nations are faced with force majeure events and dwindling spare capacity. The cartel’s members fell 48% short of their January production target. On the other hand, Saudi Arabia, which is the group’s largest producer, has refused to produce beyond its quota. The second-largest producer, Russia has failed to meet its quota and is expected to miss its May target of pre-pandemic production levels.

Taking Stock of the Situation

While oil producers are struggling to increase supply, the world’s crude stockpiles are contracting. The OPEC’s JTC estimates that crude inventories in developed nations were 85 million below average, as of November 2021. In January, stockpiles in Oklahoma fell to their lowest seasonal levels in 5 years. Goldman Sachs estimates that by summer this year, oil inventories in advanced economies would have fallen to the lowest in 20 years.

A Buddle of Energy

While there are some risks to demand from interest rate hikes and a slowdown in China, these are unlikely to have a meaningful impact on oil prices. On the other hand, oil markets appear ill-equipped to handle any upward demand shocks due to sticky supply and low inventories. While some may short oil in view of the recent rally, a steep decline in oil prices is unlikely. Goldman Sachs and Morgan Stanley retain their forecasts of oil hitting $100 in 2022.

Commodities