The Buffet Indicator, the ratio of total US stock valuation to GDP, shows similar results. The indicator is 2 standard deviations above the mean and represents a tail event, comparable only to the Dotcom Boom in recent history.

Markets appear overvalued as per these indicators. Equilibrium would mean either price reversal or economic recovery. Wall Street’s bullishness is hinged on a low friction vaccine rollout, promoting a speedy economic recovery.

Buy the Rumour, Sell the News

Buy the Rumour, Sell the News is a Wall Street adage for trading strategies. It is especially popular with retail investors, especially day traders. It suggests buying good rumour stocks and selling when bad news hits.

A strong trend in 2020 has been the continuous influx of retail investors into financial markets. For many day traders, it is an alternate income source facilitated by free time in lockdown. Retail investors have led the current volatility. Lizz Ann Sonders, Chief Investment Strategist at Charles Schwab, told Forbes that the “extremes of speculative fervour have defined the mini peaks and troughs in the market this year”.

Low yields have made stocks the best game in town for return seekers, which supports price levels. However, significant negative news about the vaccine rollout may send retail investors scurrying. The resulting fall in prices could cause an exodus towards capital preservation rather than returns. Another double-digit fall in returns may make even the most aggressive institutional investor apprehensive.

So what are the possible news stories that could cause a bear market? What should we look out for in 2021 to know when to sell or short?

Where’s the Gloom?

Mutation

The final trading week before Christmas brought news of a mutated strain of covid-19 in the UK. The CDC has stressed that this variant is not necessarily more infectious, and pharma majors have expressed confidence that their vaccines will be efficacious against this variant. The markets remained bullish, but the mutation shows that an easy recovery may be too much to hope for.

Anti-Vaxx

This has been a fringe movement for much of history. However, recent events have made vaccination an extremely polarising political issue. Dr Fauci, an advocate of mask-wearing and vaccination on the White House’s coronavirus taskforce, now travels with a security detail, due to threats on his life from extremist critics. NBC News reported, “The anti-vaxx movement in the US is strong, and multiple studies have shown large swaths of the population are reluctant to get vaccinated.” There is a strong possibility of extremism delaying adoption and economic recovery.

Allergic Reactions

The FDA is currently investigating five cases of allergic reactions. They stressed that mitigation strategies were in place to treat severe allergic reactions, but this could serve as fodder for the Anti-Vaxx movement.

Trial Limitations

Pfizer’s and Moderna’s trials focused on the vaccine’s efficacy on the disease rather than the virus. However, it is unclear if vaccinated individuals can still carry and spread the virus. Complacency may cause vaccinated individuals to abandon current preventive protocols and spread the virus, elongating the route to economic recovery.

Logistics

The US is on course to miss its original goal of having 20 million vaccinated people by the end of 2020. While the government has coordinated extensively with logistics companies and airlines, there are hurdles in storage and movement. The Pfizer vaccine, for example, has to be stored at -70 degree Celsius. FedEx and UPS are expanding their fleet but struggling to keep up with demand. These are the first signs of logistical bottlenecks in the system, and if more do appear, investors are likely to be spooked.

Inexperience

Inexperience may be an issue for Moderna’s vaccine. The vaccine is the first product from the company to receive regulatory approval, and there is a risk that scalability may not be as smooth as Wall Street expects.

Meanwhile, most outlooks forecast a robust structural economic recovery only in the second half of 2021. If a recovery does not take place in the first half and the corporate earnings releases fall short of expectations, market shocks may follow.

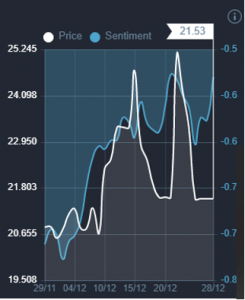

Market sentiment is overwhelmingly optimitic right now, as shown by the Acuity Trading dashboard.

.png?width=943&height=438&name=Picture-1%20(3).png)

.png?width=943&height=470&name=Picture-2%20(1).png)

.png?width=300&height=209&name=Picture-6-300x209%20(1).png)