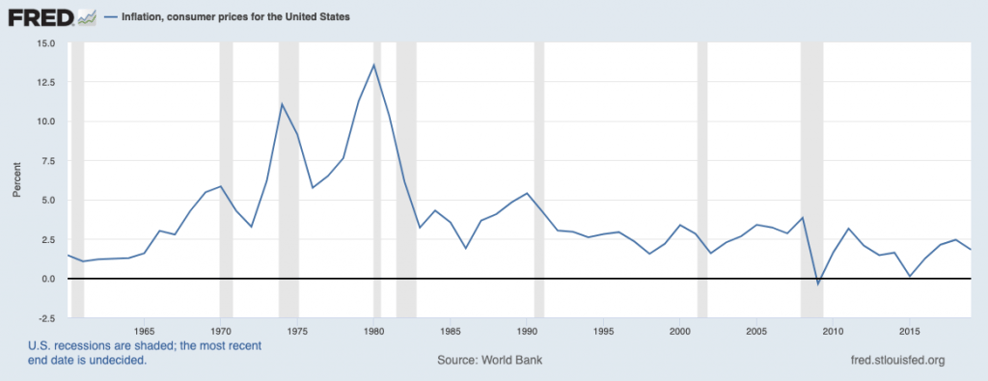

The US economy is now clawing its way out of a recession. The IMF projects 5.1% growth for 2021. That’s all very well, except that much of this recovery is being led by unprecedented fiscal and monetary support, targeted at increasing economic output and reigniting a dormant service sector. Through its Average Inflation Targeting Framework, the Federal Reserve has targeted an average inflation level of 2% up to 2022. However, the clear and present danger is the record level of money supply boosting consumer spending and taking price levels higher. The resultant inflation is feared to spike beyond the 2% target, causing a runaway effect and a return to the Great Inflation. So, are these fears justified – is double-digit inflation looming large again?

What Does Inflation Do?

Inflation has a bad reputation that is culturally entrenched. Much of this is primarily due to the role it played in the 1970s. However, inflation is not always bad. It is often a natural result of a growing economy. Due to economic prosperity, demand can rise in excess of what the economy can produce at full employment, which leads to an increase in prices. This phenomenon is widely referred to as demand-pull inflation, as it temporarily causes the economy to create more output than it would have at full employment.

Demand-pull inflation has a nefarious twin – cost-pull inflation. This is when rising costs of material and/or labour causes supply to shrink. Economic output contracts, while demand remains high. Supply shortages cause price levels to rise. In the 1970s, these supply shortages were caused by high employment and a labour force demanding higher wages. Since cost-push inflation can cause output to contract lower than full employment, it can damage the economy and trigger a recession.

Harbingers of Inflation

Whichever form inflation comes in, it erodes the purchasing power of money over time. For holders of Treasury instruments, an inflationary environment means their future fixed payoff at maturity can buy fewer things. So, when inflation rises, money flows out of Treasury instruments to inflationary hedges, such as commodities. When money flows out of Treasury instruments, their price falls, and their yields rise (since you get the same payoff for a lower price). For this reason, spikes in Treasury yields are often seen as the financial market expecting higher inflation. In late February 2021, yields on 10-year and 30-year Treasuries spiked, signalling that the market expected inflation ahead.

A Rerun of the 70s Show?

No doubt, inflation will return in 2021. Large sections of America’s sizeable service sector are reopening with massive stimulus payments and the rollout of covid-19 vaccines allowing Americans to return to restaurants, entertainment events, and travel. As the economy springs back to life, demand will rise further with a return to business spending. In addition to rising Treasury yields, commodity prices have been rising, indicating both an increase in demand and inflationary hedging. In early March, Fed Chairman Powell’s comments added fuel to market concerns of a potential increase in inflation, pushing yields higher. But will inflation go to the 70s levels?

Let’s say stimulus activity performs better than it says on the package and manages to reduce unemployment below the 5% mark. This will put an upward pressure on wages, much like what happened in the 70s. The resultant increase in production cost will constrain aggregate supply. During the pandemic, banks have taken advantage of low-interest rates to rapidly expand their balance sheets. As these liabilities come due, banks may draw on their Fed deposits to cover the outflow, increasing monetary supply and inflation.

To control inflation, the Fed would need to lower interest rates. However, its benchmark rates are already at all-time lows, threatening to go into negative territory. With inflationary pressures and the central bank’s hands tied, there is fear of inflation rising past the Feds target. For the markets, this would mean a loss of the Fed’s credibility to stick to the targets it has committed to, which in turn would trigger more inflationary trades, such as buying commodities. And this takes cost-push inflation even higher. A vicious cycle that may result in runaway inflation.

What Would Inflation Do to Asset Prices?

Inflation increases the price of commodities, such as oil and precious metals. In fact, these assets have traditionally been considered inflation hedges. Equity and indices usually come under pressure, as risk-free Treasury yields rise. The pressure, along with prospects of an economic recovery, could cause significant volatility in the stock market. While the US dollar will be battered by a rise in inflation, the asset class that was missing in the 70s saga – cryptocurrencies – may enjoy increased interest from traders and investors.

So, why does the Acuity Trading Dashboard show negative sentiment for commodities like oil and precious metals?

.png?width=276&height=196&name=Picture-1-1%20(1).png)

.png?width=276&height=196&name=Picture-2-1%20(1).png)