The S&P500 has gained almost 17% year to date, the Dow Jones is up 4% and the Nasdaq 100 has added a whopping 41%. Shares of the tech giants, which exited 2022 in a sorry state, have rallied so far this year. Apple and Microsoft are up 40% year to date, while Google-parent Alphabet is 50% higher and Amazon has added almost 60%.

US stock markets seem to have already priced in the pause and enthusiasm around the economy is high. This is reflected in Acuity’s Research Terminal dashboard.

The US is the world’s largest importer of goods, with over $3 trillion in imports in 2022. Any slowdown in the US economy has a trickle-down impact on its largest trading partners, namely China, EU, Mexico, Canada, Japan, India, and UK. Conversely, elevated interest rates in the US encourage investors to pull money away from emerging markets. A pause in rate hikes could rekindle interest in riskier equity markets, like Brazil, India and South Africa.

Forex Markets

Interest rate hikes supported the US dollar, taking it to two-decade highs in September 2022. Even after gaining more than 12% last year, the greenback has maintained an uptrend, albeit less steep, so far in 2023. While the greenback still has room for appreciation till yearend, it may begin weakening against most major currencies as 2024 progresses.

Inflation has proved stickier in the EU and UK. The European Central Bank and Bank of England are poised to continue their hawkish stance. The ECB hiked rates for the tenth straight month in September, taking its benchmark interest rate to 4%. The BoE seems steadfast in its battle against inflation too.

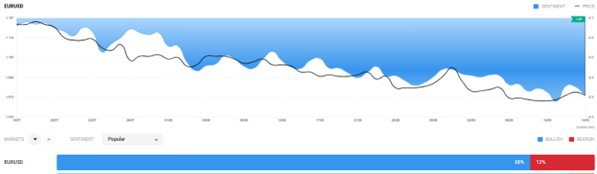

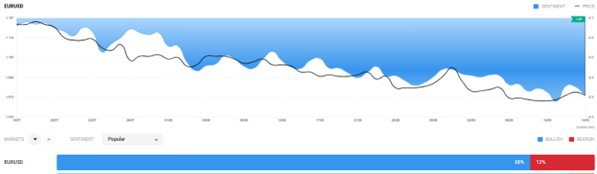

The Fed pausing rate hikes and the ECB and BoE continuing monetary tightening could see investors transferring funds from the US dollar to the euro and pound. Despite the EU’s stagnant growth outlook, the euro could reach parity with the US dollar again before the year ends. This can be seen on Acuity’s Sentiment widget.

Although the GBP/USD has appreciated so far in 2023, it could continue adding to its gains. The JPY/USD, which has declined by more than 10% this year, could recover some of its losses.

As the upward trajectory of the US dollar fades, investors may increasingly turn towards high beta currencies, like the South African rand, Brazilian real and the Turkish lira.