After global economic growth slowed from around 6.0% in 2021 to 3.2% in 2022, we welcomed the new year with hopes pinned on China. The economy had reopened and seemed ready for business. The Asian dragon was expected to roar back to life and power global growth in 2023.

China’s performance in the first quarter fanned hopes of a speedy recovery, with the economy expanding by a higher-than-expected 4.5%. By the second quarter, however, the Chinese economy began stuttering and faltering. Huge government debt, depressed consumer spending, sluggish overseas demand, property market crisis, and record-high youth unemployment prevented the Asian dragon from taking flight and breathing fire into the global economy

Why China Plays an Outsized Role in Global Recovery

China is the world’s second-largest economy. If it doesn’t live up to expectations, why can’t we simply shift our focus to the biggest or maybe the third-largest one? There are several reasons for China being in the spotlight.

China’s GDP is more than 4x that of Japan, which is at the #3 position. Understandably, China has a much greater global impact. While its economy is under pressure, not all is well with the other nations. Both US and Japan are facing strong economic headwinds. Japan’s economy grew by 2.7% in the first quarter of 2023, after two quarter of contraction. The US economy grew by 2% in the first quarter and is bordering on recession due to the Fed’s continued rate hikes. Despite the Chinese economy being in trouble, it grew by 4.5% in the first quarter and accelerated to 6.3% in the second quarter.

So, when China’s economy loses steam, it signals troubled times for the global economy.

Is China’s Economy Really Faltering?

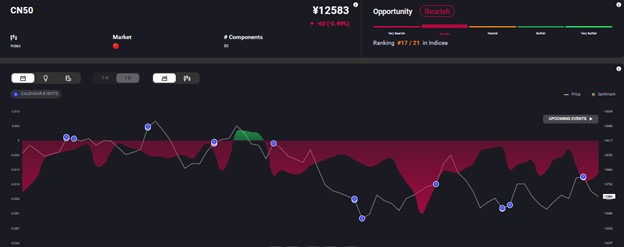

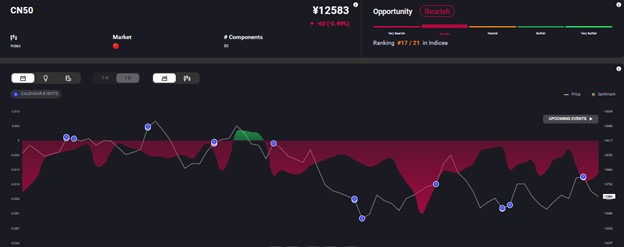

With accelerating growth, why is the economy seen as faltering? To begin with, China has generated this growth off a lower base, given its hugely delayed reopening. Other indicators show us the complete picture. The country’s retail sales growth slowed sharply to 3.1% in June, from 12.7% in the previous month. Exports, China’s main economic engine, contracted the most in three years, by 8.3% in June. The unemployment rate among the Chinese youth reached a record high of 21%. These figures signal slowing momentum in the world’s second-largest economy. This is also reflected in the overly bearish sentiment for China in Acuity’s AssetIQ widget.

China’s troubles would have been less critical if the global economy wasn’t already struggling with soaring inflation, a banking crisis, and the impacts of the Russia-Ukraine war.

Impact on the World

China is a manufacturing powerhouse, which means the global supply chain depends on it. While the US contributes 17% of the total global manufacturing output and Japan merely 8%, China accounts for almost 30%.

To understand the importance of China, let’s look at semiconductors. The world’s biggest companies today are focusing on artificial intelligence, which spans technologies like deep learning, machine learning, natural language generation, virtual agents, biometrics and robotic process automation. While AI was the single most powerful driver of US stock rallies in the second quarter of 2023, the future of this technology depends on semiconductor chips.

The US-China “chip war” has escalated with China curbing exports of germanium and gallium, which are used to manufacture semiconductors and electronics. China has the power to cripple the global economy with this move.

The global labour market is also impacted significantly by China’s job creation. The high unemployment rate in the red dragon renders any global economic growth too fragile to sustain. Sporadic growth in the global labour market impedes the employability of the youth, by reducing their on-the-job skill development and experience.

Let’s also not forget that China is a large consumer. Any slowdown in consumption in China will impact some of the largest companies, from Tesla to Starbucks. Metal exporters, including Australia, South Africa, Hong Kong, the US, Japan, and Indonesia, are particularly susceptible to a decline in demand from the world’s biggest consumer. The Australian dollar has been highly volatile due to China’s wavering prospects, as over 60% of Australian exports are consumed by the red dragon. South Korea and Taiwan are also feeling the heat, with a double-digit decline in their shipments of high-tech goods to China, in the first six months of 2023.

Where Do We Go from Here?

China’s double-digit growth era is most certainly over. Given the towering government debt, numerous structural challenges and the economy flirting with deflation, there are no great options to fix things quickly. While China’s faltering growth does impede the recovery of the global economy, all is not lost. The relatively thriving Asian economies of India, Singapore, Indonesia, Vietnam and the Philippines could come to the rescue. Also, the world waits on tenterhooks as China decides on fiscal stimulus for temporary relief to the economy.