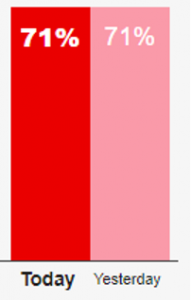

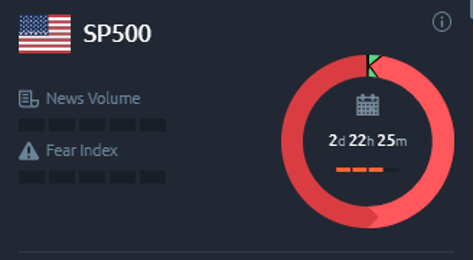

Despite the significant downside risk, their stock prices remain elevated. And sentiment for the tech giants continues to be overwhelmingly positive, as reflected in the Acuity Trading Dashboard. But look at how high the fear index is!

One explanation of positivity amid fear could be the hope of these companies declaring onetime dividends, returning cash to shareholders before the higher tax rate is levied. Once this happens, there could be rampant profit-taking among tech investors.

So, who will be the main beneficiaries of a Democratic sweep? The heavily regulated sectors come to mind – utilities, pharma, and staples. The more cyclical industries may also benefit, including automakers, financial services, and maybe even real estate. Infrastructure and clean energy stocks may also receive a fillip from a Biden victory.

Many experts believe a Biden win will put an end to the US-China trade war. Well, tensions may ease to some extent, with Biden adopting a more tactical approach. But tensions between the world’s two largest economies is part of the “new normal” too! US companies with high exposure to China may continue to feel the heat. In fact, although China is recovering faster than other countries (with its economy recording not just growth but accelerating growth!), we’d be weary of US-listed China stocks.

Speaking of China, the yuan has certainly priced in a Biden victory! Meanwhile, the US dollar has declined again its major rivals and could continue to be under pressure. That’s probably because the US government will be more likely to announce its stimulus package after the hullabaloo over the elections comes to an end.

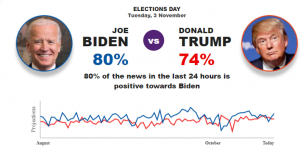

.png?width=936&height=570&name=Picture-1%20(4).png)

.png?width=936&height=282&name=Picture-4%20(2).png)

.png?width=490&height=260&name=Picture-6%20(1).png)