Fed Enters Uncharted Territory

By 2022, the US economy was sizzling hot. Did the Fed’s pandemic-driven monetary policy work a little too well? No. The real reason was the trillions of dollars in relief that the government decided to dole out during the pandemic. Excess money supply, with no value to back it, is the root of soaring inflation. At the same time, with low interest rates driving business activity, unemployment in the US fell to near record lows. More people with jobs means they have higher purchasing power, which boost demand and drives prices higher. Inflation began accelerating, reaching a four-decade high of 9.1% in July. The Fed had no choice but to step in and reverse its money policy.

Brutal Year for the US Stock Market

To combat soaring inflation, the US Fed began its rate hike spree in March 2022. The federal funds rate moved from near zero to 4.75%-5% in the span of just a year. US companies found themselves between a rock and a hard place. The combo pack of persistently high inflation and Fed rate hikes led to rising input prices and wages, while demand was severely hit.

These headwinds translated to significant repricing on the stock market in 2022, the worst we’ve seen in the 2008 financial crisis. The S&P 500, a barometer of the health of the US equity market, sank 19.4%, while the tech-heavy Nasdaq tanked 33.1% and the Dow Jones tumbled 8.8%.

US Stocks Stage a Comeback

US stocks climbed during the first quarter of 2023, albeit amid considerable volatility. The equity market exhibited great resilience, shrugging off the banking crisis to continue its uptrend. Investors added popular names to their portfolios, as a stormy 2022 had rendered many stocks undervalued. Sentiment was also supported by expectations of the Fed’s rate hikes coming to an end.

The S&P 500 ended the first quarter 7% higher. The Nasdaq 100 rose 16.8% and the Dow Jones added 0.4%. Improved risk sentiment permeated other markets as well, including cryptocurrencies, which spiked almost 50%.

The Road Ahead

Investors now look to the Fed’s next moves, after nine rate hike announcements since March 2022. The US central bank, scheduled to meet on May 2 and 3, seems close to pausing its monetary policy tightening. The Fed will likely deliver another 25bps increase in May, and then pause the hikes. Although it’s not yet time to cheer the Fed’s victory against inflation, we wouldn’t be surprised to see policymakers begin cutting interest rates by the end of the year.

Impact on the US Stock Market

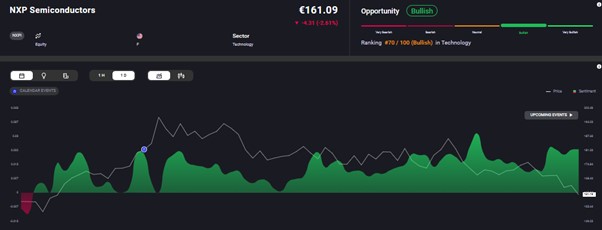

A pause in rate hikes and prospects of subsequent cuts could trigger a stock market rally. There are some stocks that may outperform the market. Take the automobile sector, for instance, for which rate hikes spelt a double whammy. Automobile companies typically have large amounts of debt, and servicing this became very expensive. On the one hand, the spike in interest rates on new vehicle loans hurt demand. Automobile stock could outperform when the Fed stops hiking rates.

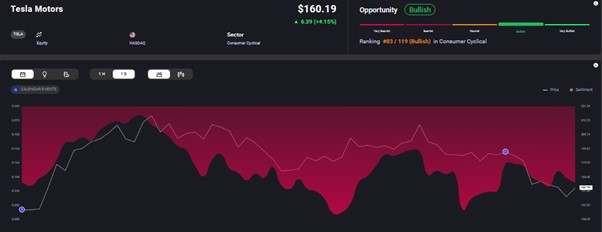

Despite inflation, Tesla has slashed prices for some of vehicles for the sixth time this year, as competition heats up among EV makers. The Cybertruck is finally ready to enter production this summer. Tesla also has new factories to ramp production, given its goal of 1.8 million vehicles by yearend. Tesla’s stock, which is currently around $160, could climb to $250 before we bid adieu to 2023. Market sentiment for the EV marker is overly positive, as can be seen in Acuity’s AssetIQ widget.