India: Potential to Become a Growth Engine for the Global Economy

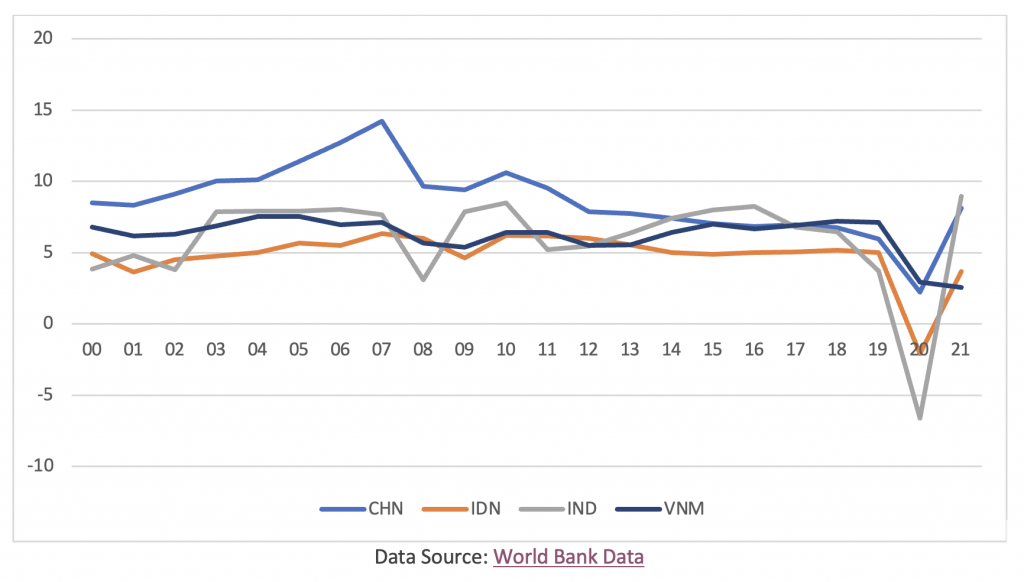

India, the third largest economy in Asia, seems to be on tract to become the world’s third largest economy by 2027, leapfrogging developed economies like Japan and Germany. The country is poised to record the fastest economic growth in 2022, among the major economies.

What did India do differently?

It went by the book, the one authored by Adam Smith (father of modern economics). The Wealth of Nations suggests a demand-side approach to warding off recessionary pressures, calling for governments to allocate funds for infrastructure development to spur economic activity, rather than triggering supply by handing out money to households, which fuels inflation in the longer run.

An effective vaccine rollout and continued investments in industrialisation have helped India weather the post-pandemic storm. The country’s equity market has matured and grown, even with recessionary winds blowing across the globe in 2022. The NSE Nifty 50 is up approximately 7% year to date, compared to a nearly 18% slump in global stocks.

What are the prospects?

Goldman Sachs expects India to achieve GDP growth of 5.9% in 2023. The country could benefit from growth in global offshoring, digitisation and energy transition. A slowdown in global economic growth could push India to become the back office to the world, with businesses in the US and Europe looking for more cost-effective solutions to protect their bottom line. Morgan Stanley projects the global spend on outsourcing to grow from the current $180 billion to more than $500 billion by 2030.

The government’s “Make in India” initiative, with tax cuts and pro-infrastructure policies, has been driving growth in India’s manufacturing sector in the post-pandemic era.

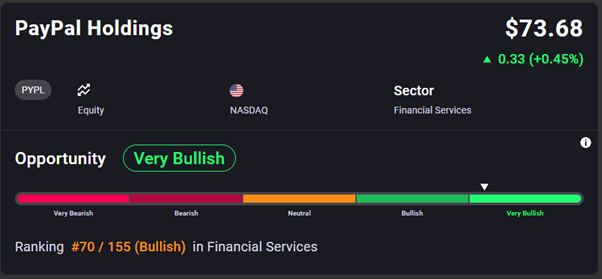

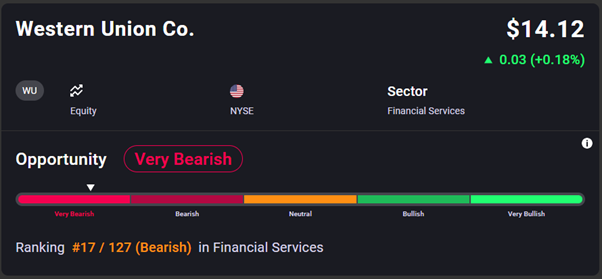

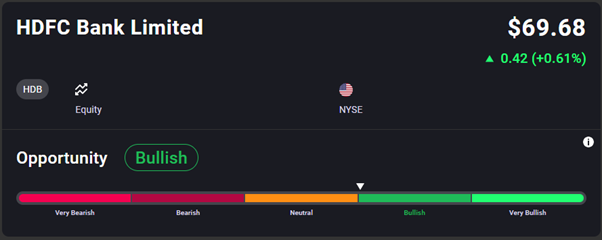

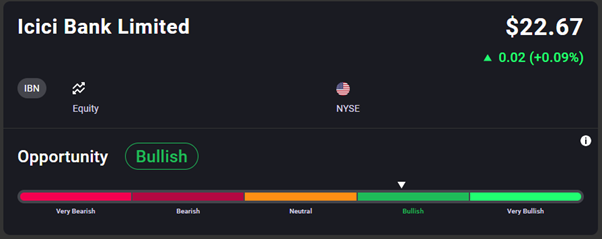

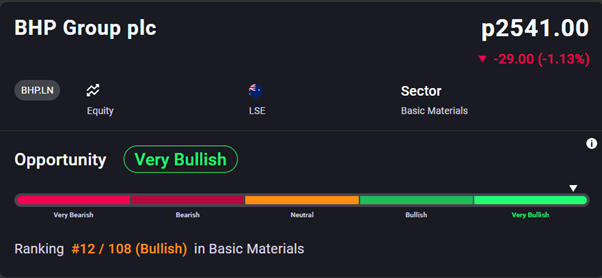

On the demand side, India has a household debt to GDP of just over 14%. The average consumer is one of the most underleveraged in the developing world. The growth of digitisation enabled micro and decentralised lending, and the growing acceptance of credit tools is expected to boost consumer spending in 2023. India’s growing appetite for digital payments is great news for companies like Visa, PayPal, and Western Union. The sentiment for such companies is overly bullish, as can be seen on Acuity’s AssetIQ widget.