Do CBDCs Herald a Long Winter for Cryptos?

The crypto-winter is an epithet used to describe the crypto-market downturn of 2017-18, during which crypto bellwether bitcoin (BTC) fell over 82%. Will the launch of CBDCs wreak similar havoc in the market?

Stablecoins offer a cryptocurrency solution to high-cost payments and are likely the most vulnerable to CBDC introduction. The value of stablecoins are pegged to a reserve asset, such as the dollar or gold, and can be transferred at low costs between wallets. Bank of America analysts expect the use of private stablecoins to surge in the coming years, driven by cross border payments. They have also been controversial, with analysts questioning whether operators held sufficient asset reserves to keep the value pegged. Governments share these concerns. The Biden administration endorsed the potential of stablecoins as a transfer mechanism, but only in a regulated environment and when issued by insured banks. Private stablecoins could lose the fight in the long term, with the better backed CBDCs being stabler and a potentially cheaper mode of transfer.

At the core of the crypto community is a fundamental belief in decentralisation and low censorship. As a central bank liability, CBDC transfers will be trackable, with the KYC requirements of the accounts making it easy for state actors to identify senders and recipients of. This monitoring helps alleviate the risk of CBDCs being used in a crime or stolen as cryptos have been. However, malicious state actors could potentially prevent CBDCs from being transferred to businesses and individuals they do not view favourably. Cryptos can still find value in ensuring the anonymity and safety of its participants.

In addition, Decentralized Financing (DeFi) is a quickly growing facet of the crypto world. Built on smart contracts on networks like Ethereum, DeFi eliminates the need for financial intermediaries in functions such as investing and lending. Instead, they are conducted by completely transparent algorithms. CBDCs do not seek to compete with the DeFi space. Instead, in a CBDC regime, financial institutions are still required to facilitate investment and decision making.

Moreover, bitcoin is widely seen as a hedge against inflation, akin to gold. This utility will not be upended by a fiat pegged CBDC with the same inflation risks.

There is also a significant question regarding how far CBDC adoption would go. No doubt, CBDCs are a superior product to bank accounts and cash. It offers central banks access to a robust and monitorable tool to combat credit and asset bubbles, stave off bank runs, and oversee the quality of bank lending. However, that degree of control will mean it is simply a digital version of the fiat currency. CBDC adoption may not curb the demand for cryptocurrencies.

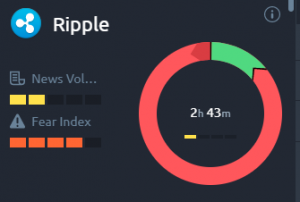

Although the leading cryptos seem to have lost favour so far this year, after reaching record highs in 2021, there’s no debating their wide adoption. This has been driven by a rapid increase in global liquidity (with governments disbursing funds amid the pandemic), easing barriers to crypto purchases, and crypto adoption by institutional investors. There seems to be further downside ahead, as can be seen on the Acuity Trading Dashboard.