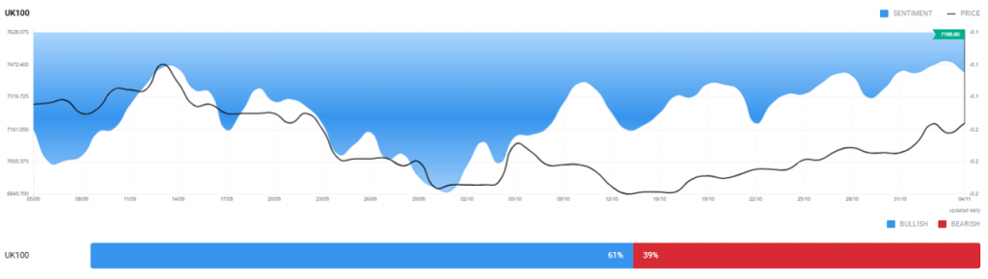

The FTSE 250 declined by 0.59% to close at 18,109.61, while the FTSE 100 gained 0.62% to 7,188.63. This is because the FTSE 250 includes more UK-focused companies, while the blue-chip index includes multinationals that have exposure to other economies.

Banking and insurance companies would benefit from the BoE’s rate hike. Also, commodity-linked stocks will remain in focus as prices of oil and agricultural produce increase.

Overall, these are interesting times for UK equity investors. Yes, there is uncertainty and many a sign of an economic slowdown. But markets seem to have overreacted and panic selling has left stocks available dirt cheap. This is a great time for institutional and wealthy investors (think Warren Buffett) to buy shares of quality companies at bargain prices. There are some offering massive yields, like Rio Tinto, OSB and Taylor Wimpey. Some dividend and defensive stocks have become exceptionally attractive, such as Urban Logistics, London Metric Property, Imperial Brands, ITV, Diversified Energy Company, and DS Smith. Institutional interest could lend upside to such equities as well as stock indices.

The FTSE 100 has so far exhibited more resilience. It recorded significant gains in October and continued to rise after the BoE’s November rate hike. The index could remain elevated, since it includes more defensive shares, such as those of consumer staples, utilities and healthcare companies. Any further weakness in the pound will also help, as the index includes dollar-earners like Unilever and AstraZeneca.