It was a bitterly cold winter for Bitcoin in 2022, which shaved off almost 65% of the coin’s value. There were several reasons for this, including an unstable global economy, the once popular Terra Luna crashing and losing more than 99% of its value, and the collapse of the crypto exchange FTX. Bitcoin exited 2022 below $16,550.

The storm clouds lifted as the year turned. Renewed investor confidence in the crypto universe supported Bitcoin’s upward trajectory. The world’s largest cryptocurrency moved confidently higher, to breach the $30,000 mark in April. However, Bitcoin seemed to begin losing steam in May. Will it pick up and continue its uptrend this year or will it fizzle out by yearend? Here’s a look at why the Bitcoin rally may have just begun.

Been There, Done That

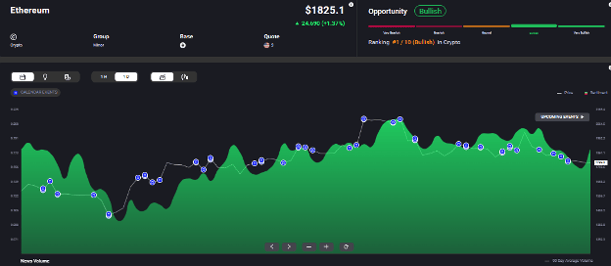

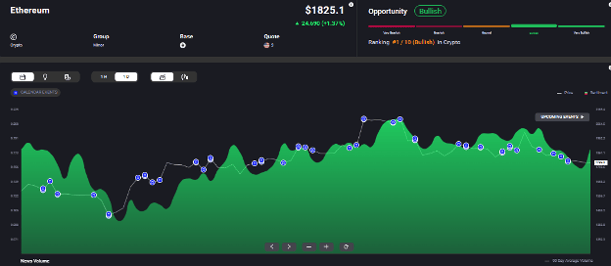

Although Bitcoin is up around 64% year to date, let’s not forget it is still less than half of its all-time high. While reports of Bitcoin’s rise has grabbed headlines so far in 2023, there’s a long runway left for it to reach anywhere close to the peak of almost $69,000 that it achieved in 2021. Market sentiment for Bitcoin is overly positive, as can be seen in Acuity’s AssetIQ widget.

The storm clouds lifted as the year turned. Renewed investor confidence in the crypto universe supported Bitcoin’s upward trajectory. The world’s largest cryptocurrency moved confidently higher, to breach the $30,000 mark in April. However, Bitcoin seemed to begin losing steam in May. Will it pick up and continue its uptrend this year or will it fizzle out by yearend? Here’s a look at why the Bitcoin rally may have just begun.

Been There, Done That

Although Bitcoin is up around 64% year to date, let’s not forget it is still less than half of its all-time high. While reports of Bitcoin’s rise has grabbed headlines so far in 2023, there’s a long runway left for it to reach anywhere close to the peak of almost $69,000 that it achieved in 2021. Market sentiment for Bitcoin is overly positive, as can be seen in Acuity’s AssetIQ widget.

History of Halving

Bitcoin production halves every four years, and the next halving is scheduled for 2024. Historically, halving is followed by a rally as it impacts supply. Whales and institutional investors have already started accumulating Bitcoin ahead of next year’s halving event. This could continue to lend support to the crypto.

Banking Crisis Tailwinds

Banking failures have been a major cause for concern among investors. The collapse of banks like Silicon Valley Bank, Silvergate Capital and Signature Bank within just 10 days as well as leading Swiss bank Credit Suisse being acquired by UBS for £1 sent shivers down the spine of even the most risk tolerant investors. News of depositors pulling out funds from these banks shook investor confidence in fiat currencies and worked in favour of cryptos, pushing Bitcoin 40% higher.

On May 1, regulators took control of First Republic Bank, resulting in the failure of the third US bank since March. Although the US government is determined to take extraordinary measures to put a pause to the banking crisis, there are more than 100 banks at risk of meeting the same fate. More such news could continue to act as a catalyst for cryptos. Market sentiment for other major cryptos, like Ethereum, Cardano, and Litecoin, is also positive against this backdrop.

Stablecoins Get Knocked Off Their Peg

DeFi (decentralised finance) had recorded outsized growth of almost 1,000% in 2020. The segment’s market size grew by another 335% to around $85 billion in 2021, with Terra’s market cap spiking by a whopping 4,700%. However, the crypto winter served a massive blow to DeFi in the following year.

As DeFi collapsed, so did the faith in stablecoins. Soon investors began shifting their funds from stablecoins to the more popular cryptos, like Bitcoin. We see this trend continuing this year.

Fading Correlation Between Bitcoin and Stocks

The crypto universe had previously exhibited some correlation with the stock markets. This wasn’t surprising because both were perceived as risky assets, were supported by improvements in risk appetite and competed for a place in investor portfolios.

However, in the first quarter of 2022, the correlation started to weaken. Bitcoin is already attracting more interest from institutional investors as a true hedge against a global economic crisis. Retail investors are likely to stop choosing between stocks and cryptos. Instead, they could continue using one to hedge the other.

An Eye on Government Regulations

The first bitcoin futures-based exchange-traded fund (ETF) started trading on the NYSE in October 2021. The US SEC’s (Securities and Exchange Commission) approval of spot Bitcoin ETFs could lend support to the crypto king.

In April 2022, the Indian government announced a 30% tax on income from cryptocurrencies. This added momentum to the crypto market’s downward spiral. However, this was short-lived. Indian investors not only digested the news fast, but also saw it as a positive as the high taxation meant the Indian government was no longer considering an outright ban on cryptos. The number of crypto owners in India rose from around 97 million in 2022 to around 115 million by January 2023. The country has a large and young population, with 65% below the age of 35 years. India’s fascination with the crypto space is unlikely to fade anytime soon.

The US Fed Slamming the Brakes on Interest Rate Hikes

It’s finally happened. After more than a year of aggressive rate hikes, the Federal Reserve seems ready to take a breather. In fact, there are higher chances of the US central bank starting to cut interest rates by yearend. This exerts pressure on the US dollar.

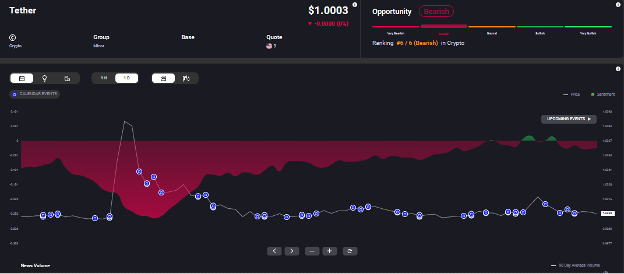

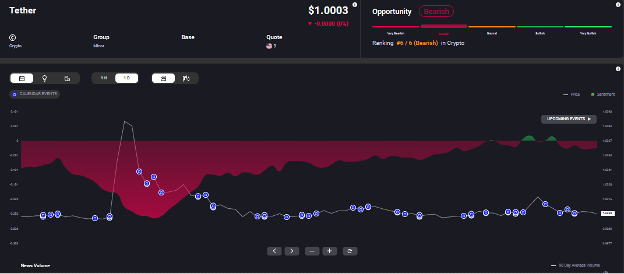

Weakness in the US dollar benefits Bitcoin in two ways. Firstly, investors pulling out of the greenback means Bitcoin and other assets may get a higher share of investors’ funds. Secondly, traders from some countries trade Bitcoin against Tether (USDT) instead of their local currencies. Since this coin is pegged to the US dollar, Bitcoin will become cheaper for holders of other currencies.

Bitcoin to the Moon

There are several influencers and experts predicting Bitcoin’s rise to $100,000 this year. This may prove too farfetched. What is more likely is that bulls are likely to remain in control this year and the world’s largest cryptocurrency could breach $40,000 at least a few times in the second half of 2023.