While the US and EU continue to struggle with inflation, the second-largest economy in the world has been grappling with deflation since August 2023.For most of the year, China has reported worse-than-expected CPI data. And while the consumer price index turned positive in February 2024, for the first time in 6 months, the gains were driven largely by the spending boom during the Lunar New Year holiday. So, it is still too early to say that deflation might be coming under control.

The State of the Chinese Economy

The housing market slump and weak domestic demand have been weighing on China’s economy. The continuing high debt levels and rise in foreign investment outflows have only added to the woes. China has been battling the economic slowdown through its excess production capacity, driving exports by lowering prices of goods. While this has helped nations that import from China, lowering their inflation, its impact on the Chinese economy has been muted.

So far, inflation has remained well below the PBoC’s 3% target. Meanwhile, policy priorities for the ruling National People’s Congress (NPC) in 2024 are medium-term themes, such as building “new productive forces” and driving high-quality development through education and science, followed by promoting domestic demand. THE NPC also intends to implement policies to push foreign investment and the development of the private sector.

The problem is that deflation creates a vicious cycle that impacts the economy. Companies and individuals delay investments and purchases, waiting for prices to fall further. Lower spending then leads to businesses cutting back and unemployment rising. Given that China dominates multiple sectors, deflation could lead to a ripple effect of pricing pressures on China-led industries, including EVs, steel, solar products, and batteries.

China’s producer price index fell into negative territory in 2023, a trend that is likely to persist in 2024. For February, the PPI stood at 97.30, down from January’s 97.50 and 98.60 a year ago. This represents a 0.21% decline from January and -1.32% from a year ago.

What Does All This Mean for Investors?

Investors need to closely monitor China’s economic data to stay prepared for market volatility. Here’s why.

China is the third-largest trading partner of the world's largest economy, accounting for almost 11% of the total US trade. But the impact of deflation in China goes far beyond the risks for US investors.

The state of the Chinese economy also impacts the global financial markets because the nation’s imports account for 70% of the world’s traded iron ore, 60% of soybeans and copper, and 72% of aluminum. Plus, it imports over 25% of the globally traded crude oil and more than 50% of the coal produced globally.

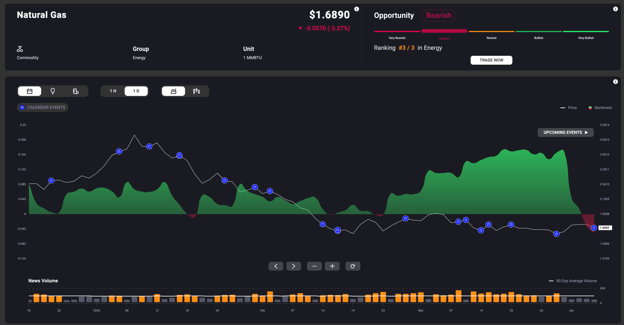

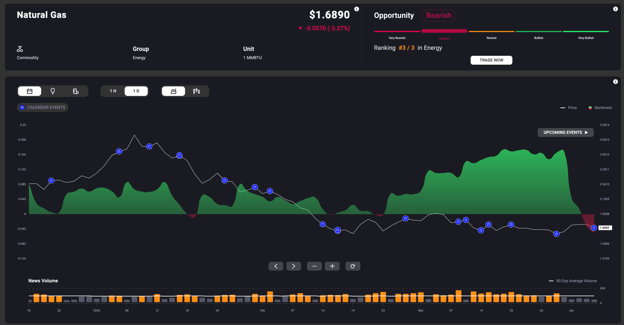

China is also the third-largest importer of natural gas in the world. A look at Acuity’s AnalysisIQ widget shows that there is overwhelming bearish sentiment on this commodity at present.

Economic weakness and deflation in China also present risks for investors exposed to emerging market ETFs or Chinese stocks. Acuity’s AssetIQ confirms negative sentiment towards the China 50 (CN50) stock index. It has been on a downtrend for the first three months of 2024.

Investors exposed to US treasury bonds also need to be on alert. Of the $7.6 trillion US treasury bonds held by foreign countries, China accounted for $868.9 billion as of October 2023, down from the $1.3 trillion held a decade ago. China is still the second largest foreign holder of these bonds, so if it continues selling off its stake, it will negatively impact US Treasurys.

The Chinese yuan has also been declining, reaching a 4-month low against the USD in mid-March 2024, leading China’s state-owned banks to step in and buy CNY in exchange for dollars to bolster it on April 2, 2024. A look at the USD/CNY on Acuity’s AssetIQ shows that the forex pair has continued on its bearish path.

Another potential impact of continued weakening and deflation in the Chinese economy could mean a conflict with Taiwan. Historically, governments have resorted to military conflict to not just create a distraction during uncertain times, but also provide economic stimulus. Tensions, which are ever-present between China and Taiwan, have been on the rise. If it turns into a full-fledged conflict, it could impact the global markets, since Taiwan manufactures 90% of the chips used in technologies such as artificial intelligence and cloud computing. Taiwan also accounts for 70% of the semiconductors produced globally.

Given the impact of the technology sector on the performance of stock indices, especially the S&P 500 and Nasdaq, any disruption in Taiwan’s chip production will negatively impact the global technology sector.

Brokers need to support their traders to stay abreast of developments in the Chinese economy with an economic calendar. Also, facilitating robust research on the performance of markets that China has the most impact on, such as commodities, forex, and stocks, can help traders make the most of market opportunities.

Economic Outlook,

China,

Asia