This article offers some insight into the mechanisms of news production and how news analytics technology is being advanced to help traders exploit the rich and powerful insights that news offers on the global financial markets.

The old and the new

If we step back in time to before the internet, finding information often required a trip to your local library. Remember stepping in to those grand, often imposing buildings to find corridor after corridor, shelf after shelf of books looming towards you. You know what you want to read about but you’re just not sure where to start. Cue a bespectacled librarian to whom you explain what you are looking for and they miraculously take you to the exact spot that you need.

Ok, so admittedly, the librarian is very much a stereotype, but ‘infobesity’ has amplified in today’s information age and professional news readers have had to find their own, modern day version of the librarian. But knowing where to look is only half of the battle today. With so much competition, warranted or not, being able to analyse the news and extract uncompromising value from it are the key drivers in today’s advancing news analytics capabilities.

So how has news analytics technology evolved and what capabilities can be exploited? How do they bolster traders’ activities and why should a professional, augmented news feed still be at the top of a trader’s tool box?

The Value of Signage

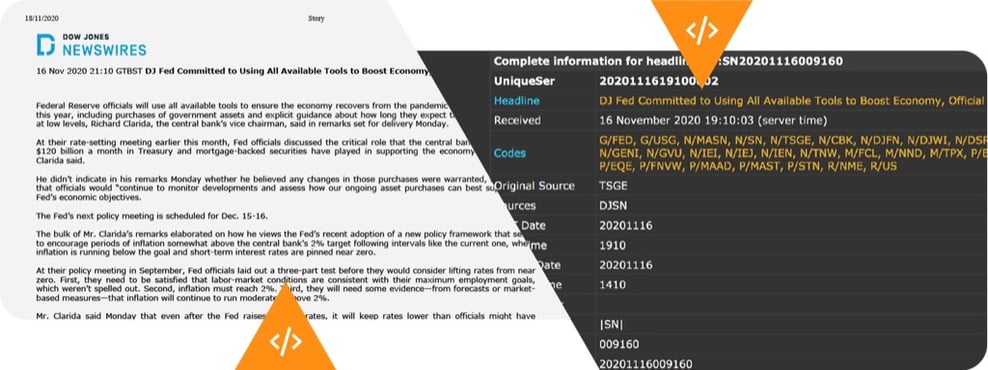

Just as a traditional library uses physical signage in their building, on their shelves and on the spines of their books, a professional news feed also uses a navigational system of codes, known as ‘metadata’.

During the editorial process these codes are assigned to every story, either by an editor or automatically by a machine or some combination. The codes identify the types of news content being published and the entities that are being written about. For example, an article on a company could have codes for the industry, sector, asset type, entity name and location. Equally important, each story also includes codes which identify the type of content the article is, such as breaking headlines or commentary and analysis, for reasons which we will come on to shortly.

Dow Jones deploys a rich, structured set of codes across their newswires. Not only does this help their readers to find the content they want, but it also helps Dow Jones to segment and prioritise content, so that their readers cut out the noise and focus their attention where it matters at that moment.

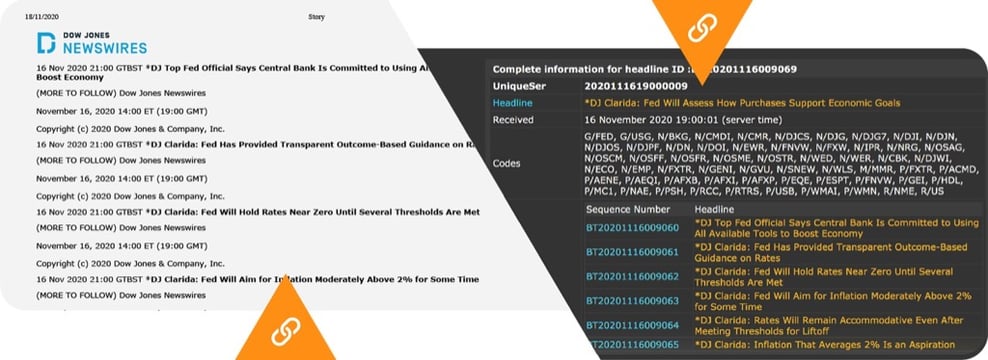

For example, important news stories are coded as ‘significant’ to draw attention to newsworthy articles within trader workflow. Or in the event of a breaking news story where all the details are yet to be established and multiple headlines are pushed out in quick succession, a sophisticated method of linking each headline, known as ‘chaining’, is used. This chaining of codes help publishers and readers to understand the sequencing of events as the story unfolds and to help distinguish stories from potentially multiple reporting streams.

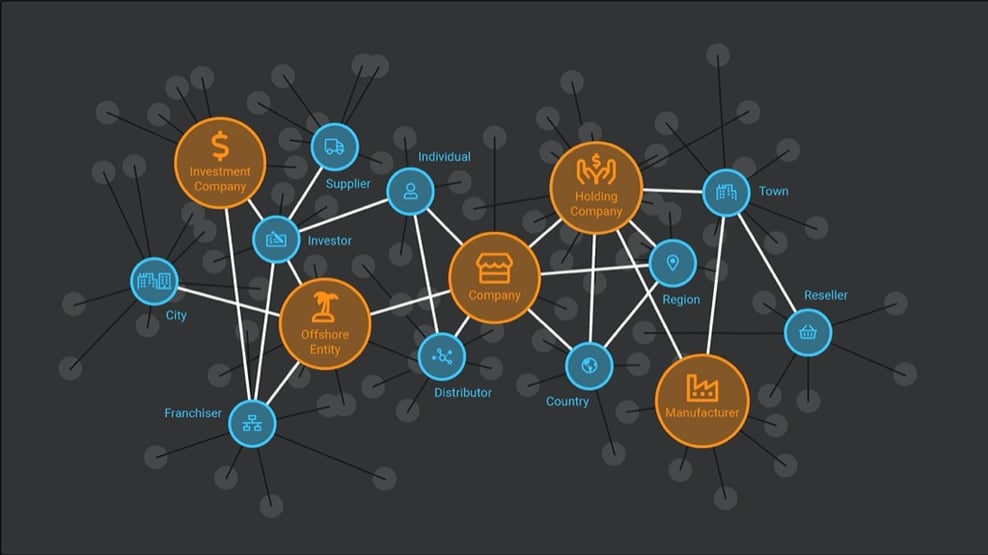

With the help of natural language processing (NLP) technology, the application of codes can offer even greater benefits. For example, when a new theme such as ESG (Environment Social Governance) emerges, historical articles can be ‘back coded’ to give readers insights that add value today.

Or, in another example, NLP can be used to apply codes to stories that are not immediately obvious to the editor at the time of writing. For example, a fire in a mobile phone factory is identified as being involved in an ESG scandal.