The UK economy recorded no growth in the final quarter of 2022, only narrowly avoiding a recession, although it contracted by 0.5% in December. The Bank of England expects the economy to remain in distress for at least another five quarters. There are also continued worries around soaring energy prices and high inflation. The Consumer Prices Index accelerated by 8.8% in the 12 months to January 2023. This marked a downturn from the 9.2% announced for 12 months to December 2022, but the figure is still staggering.

While the UK economy is by no means out of the woods, British companies are raking in record profits. Between the whopping highs and lows, it’s difficult to decipher the current state of the economy and predict where it is headed.

While the UK economy is by no means out of the woods, British companies are raking in record profits. Between the whopping highs and lows, it’s difficult to decipher the current state of the economy and predict where it is headed.

British Companies Post Record Profits

Corporate profits in the UK climbed to a record high of £154.09 billion in the fourth quarter of 2022. This marks a steep jump from the £132.41 billion recorded in the previous quarter and the under £130 billion in the same quarter in 2021. In fact, 2022 was a phenomenal year for British companies. A report by UK’s largest private sector trade union shows that the profit margins of the biggest 350 companies listed on the London Stock Exchange averaged 10.7% in the first half of 2022, a huge jump from 5.7% in the first half of 2019.

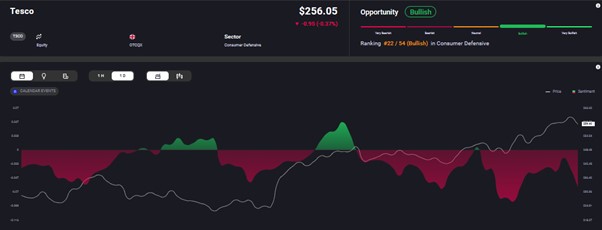

In mid-February, the FTSE 100 spiked to record highs after Centrica, Standard Chartered, RELX and other companies reported staggering earnings. The blue-chip index breached the 8,000 mark for the first time in its history and remained comfortably above that for two trading sessions. Sentiment for the FTSE 100 continues to be bullish, as can be seen on Acuity’s AssetIQ widget.

Unfortunately, the British corporate bonanza ends there. Experts predict a downturn in business activity in 2023, with British households continuing to face a cost of living crisis.

British Households in Distress

Why are household not benefiting from the record profits of businesses? There are a number of aspects to this paradox. Firstly, not all is well with corporate Britain, despite the latest profit growth figures. So far, the UK is the only G7 country or major economy that has not fully recovered its lost output during the pandemic. UK’s monthly production output contracted by 0.3% in January 2023 and remains 1.7% below the pre-pandemic levels.

Secondly, when we look at wage growth figures, the UK labour market seems healthy. In the final quarter of 2022, average pay growth was 7.3% for the private sector, representing the biggest spike in wages since the pandemic. However, real wages tell us a completely different story. Corrected for inflation, real wage growth rates have declined sharply. Real wages declined by 3.1% year-on-year in the fourth quarter of 2022 and are 2.5 percentage points below the pre-pandemic levels.

The lower wages have helped companies report record profits. However, this is unsustainable. Lower wages translate to lower purchasing power of households, which adversely impacts demand for products and services in an economy. This means businesses cannot hold up high profits for long while there’s a squeeze on real wages. That’s the reason retail sales volumes are 1.4% below the pre-coronavirus levels.

Where Does the UK Go from Here?

There is no easy answer. Increasing wages to match inflation will fuel inflation further. Albeit painful, that’s probably the only way out of this dilemma. Wage growth will spur consumption, which in turn will support businesses and prevent the UK from spiralling into a recession.

The picture is not all doom and gloom. Even amid these challenges, big oil and gas companies, like BP and Shell, could continue booking large profits. Businesses that claim a share of the discretionary household spending, like Tesco and AstraZeneca, may also thrive. Companies that are export focused, like BAE Systems and Rio Tinto, could continue to protect their bottom lines as well. Since the FTSE 100 companies generate 75% of their revenues outside the UK, prospects for the index remain bright.

Also, the Bank of England’s interest rate hikes have managed to contain inflation and gas prices are declining, both of which should ease the burden on real wages and support consumption. This, however, could still take a few months to play out.