It doesn’t take a genius to predict a rise in commodity prices with a recovery in the global economy. But the magnitude of the rally so far is something most investors couldn’t have foreseen.

Commodity prices became buoyant as global demand began to kick in after the March 2020 crash. The Bloomberg Commodity Index has rallied more than 55% since its lows on April 20 last year. A recovery in Chinese demand helped tug the market out of its pandemic-induced slump, and commodities benefited from returning economic growth globally. In fact, copper and iron ore hit record prices in May 2021.

What markets are concerned about now is whether commodities have become too hot. This is quite evident from the increasing negative sentiment for commodities from coffee and coffee to nickel and wheat, as can be seen in the Acuity Trading Dashboard.

So, is it time to go short and take profit? How sustainable is this broad market rally? Let’s dig a little deeper to understand.

Metals

A Peek into the Past

The last time demand came online this quickly was when China began industrialising in the 2000s. Commodity supply struggled to cope, as China set up new industries and cities. Here’s an idea of the commodity supercycle. Economic bellwether copper spiked from $2,000 in the 1990s to above $10,000. The subsequent cooldown as the Chinese economy matured in the 2010s led commodity markets into a decade-long slump from which they are only emerging. Despite the recent rise in commodity prices, what investors should bear in mind is that mining has considerably slowed. This means that recovering demand as the global economy grows will be met with supply shortages, which could push prices higher.

Stayin in the Green

The world’s economic superpowers remain committed to transitioning to greener economies. China is focused on its strategy of reaching net-zero carbon emissions in 40 years, while the Biden Administration’s proposed infrastructure plan and the Next Generation EU fund are heavily directed to reward investment in environmentally friendly ventures. Many are taking the opportunity of the economic contraction to shape the ongoing expansion to meet their green goals. Metals like copper, nickel and our 2021 favourite silver are heavily used in green industries, and their rallies will likely find more legs as the demand for green technologies ramp up.

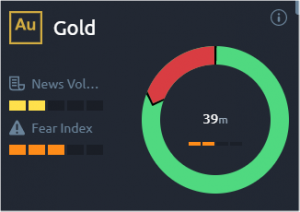

Everything that Glitters

As a precious metal with little industrial application, Gold is widely used as an inflation hedge. With central banks globally remaining hesitant to hike rates too soon in the reflationary process, inflation remains a threat that investors are actively hedging their portfolio against. The yellow metal has been tumultuous in 2021, after a successful 2020. Central banks may not be able to convince markets that the current inflation levels represent transitionary reflation, and gold may continue to find support.

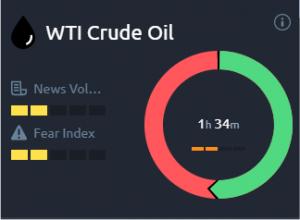

Energy and Oil

The World Bank expects energy prices to average a third higher in 2021 than in 2020. Cross industrial recovery in the economic giants has more than offset weary demand in Asian countries that are still struggling with pandemic restrictions. In the second week of June, US crude inventories fell for their fourth straight week to the lowest since February, indicating that this resurgent demand is not letting up. Iranian oil reserves remain off the global market while their Nuclear Deal negotiations continue, providing crucial price support. Crude oil has rallied over 40% year to date.

A further rally is heavily dependent on OPEC’s current supply restrictions. The group has announced monthly deliberations to reduce market volatility and quickly take profit from bull runs throughout the year by releasing supply. This could be a source of downward pressure on oil prices. On the other, even the most advanced economies have not fully opened air travel. The resumption of international travel will lend upside.

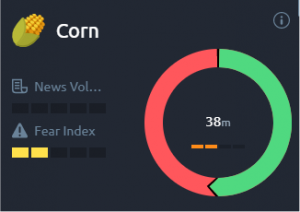

Agriculture

Food prices jumped 40% in May, buoyed by China’s appetite for corn and demand for soya bean oil for biofuels. An ongoing severe drought in Brazil, a major exporter of corn and soy, could help support prices for much of the year. The weather could also threaten supply from major food exporter Argentina. Agricultural commodities have much more room to rally with these supply threats.

Policy Matters

While inflation is a tailwind for commodities, it increases the possibility of monetary tightening if it persists. Inflation in the US has already exceeded the Fed’s 2% target. In fact, from March to May, prices rose by 5%. This keeps markets on tenterhooks about the looming monetary policy tightening by the central bank. Tightening could reduce both inflation hedging and organic demand for commodities.

Inflation is also a concern in China, the largest purchaser of commodities. Beijing has been trying to stave off price increases but has achieved only moderate success.

Conclusion

Commodities still have steam from demand and supply factors that could see broad market rallies through 2021. While prices for polluting commodities like iron ore and oil may face some headwind, others have a considerable tailwind from expanding demand and restricted supply. We wouldn’t be surprised if these “green” commodities deliver another supercycle.

US,

China,

Commodities,

Green Energy

.png?width=274&height=190&name=Picture_3%20(2).png)

.png?width=280&height=194&name=Picture_2%20(1).png)

.png?width=276&height=194&name=Picture_1(1).png)