In June 2016, the UK voted in favour of exiting the EU, by a slim margin of 51.9%. The news shook the global financial markets. British and Wall Street stocks plummeted by more than 3% and almost 9% was shaved off from European shares. The British pound tumbled to its lowest level since 1985, far below the levels recorded during the worst of the 2008 financial crisis!

More than 4 years and several failed negotiations later, there is still substantial uncertainty surrounding Brexit. The EU-UK divorce was long and painful, with blistering attacks from officials and policymakers from both sides. After Britain’s exit, the terms of the divorce are still being debated.

Between a Rock and a Hard Place

The covid-19 outbreak only added to the angst, further infecting the geopolitical atmosphere. With various regions in Europe experiencing unprecedented lockdowns through the summer and political brinkmanship around the Brexit negotiations, the pound took a serious beating. In the first quarter of 2020, the GBP shed more than 10% of its value. That wasn’t even the worst of it! In April, the pound crashed more than 20%.

Fading hopes of a trade deal with the EU kept the pound under pressure through the next four months. In September, British Prime Minister Boris Johnson set the deadline of October 15 for a trade agreement with the EU. As we approach the deadline, there is only more chaos, triggered by the UK government’s move to amend parts of its EU withdrawal agreement inked last year and the IMB (Internal Market Bill) controversy.

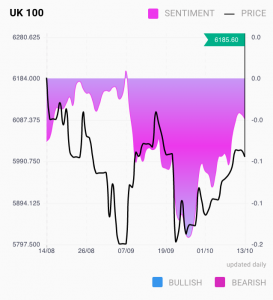

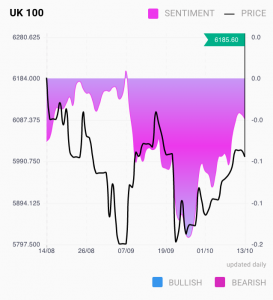

Concerns around the UK’s prospects are reflected by Acuity’s News Sentiment Chart for the FTSE 100, where sentiment has been in negative territory for the past month.

Where Does the Pound Go from Here?

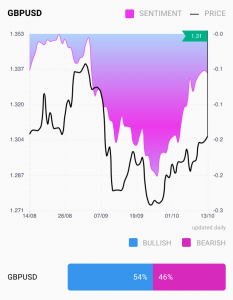

The correction in the pound doesn’t seem to excite investors looking for undervalued assets. With increasing probability of a no-deal Brexit, the British currency could remain weak amid heightened volatility leading up to the end of the transition period on December 31. We’re unlikely to see the pound recover until the new year, and even then only modestly and gradually. There is a higher probability of the sterling shedding more value against its major rivals than of it making a meaningful and lasting recovery.

It’s not just Brexit and covid-19 that threatens the pound. These situations have increased the risk of the Bank of England lowering its benchmark interest rate, which is already at an all-time low of 0.1%. Referring to the pound’s fate in the current scenario, senior strategist at Rabobank Jane Foley said, “(The) market is reluctant to dismiss the possibility that the BoE could at some point be forced into using negative interest rates.”

What’s so worrisome about negative interest rates? After all, countries like Switzerland, Denmark and Sweden have negative interest rates. The difference is that none of these countries have a current account deficit. Not only is the UK’s current account balance in the red, the deficit is a whopping 3.8% of the country’s GDP in the first quarter.

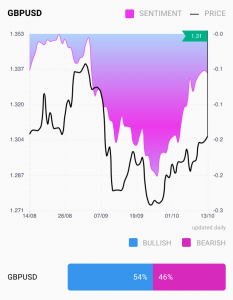

Concerns around the UK’s prospects are reflected in the sentiment for the GBP/USD pair in Acuity’s Sentiment widget.

Giving the Devil His Due

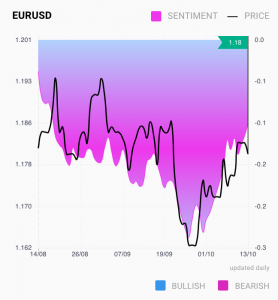

The pound’s weakness is not the only thing to blame. Some of the GBP/EUR decline can be attributed to the euro gaining strength. With the US Federal Reserve aggressively cutting interest rates earlier this year, the euro became the go-to currency. The single currency was also supported by the EU’s announcement of a €750 billion coronavirus rescue fund, which worked to bring the region’s countries closer both politically and in fiscal terms.

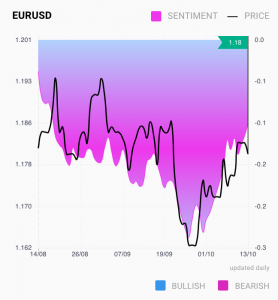

The euro’s status could remain strong with the US Presidential elections approaching. The situation is such that the US dollar is headed for weakness irrespective of who enters the White House later this year. The improving sentiment for the euro can already be seen in the Acuity Trading Dashboard.

Market analysis indicates hedge funds are expecting the euro to rise in December. Meanwhile, market chatter around the British pound is currently negative and could remain that way in the near future.

The improving sentiment for the euro can already be seen in the Acuity Trading Dashboard.

UK,

Brexit,

Currencies,

FX