Declining prices is a big concern for the OPEC+ group (Organization of Petroleum Exporting Countries and its allies), which accounts for around 37% of the world’s oil production and 60% of the commodity traded internationally. The cartel is led by Saudi Arabia and Russia, two countries that have a frayed relationships with Western democracies. Despite the energy crisis in Europe and pleas by the US, the OPEC+ group announced production cuts of 2 million barrels per day (bpd) to support oil prices, after weeks on a downtrend. Here’s a look at how these cuts may impact the global financial markets.

How to Play the OPEC+ Production Cuts

The Commodity Market

Risk sentiment in the global financial markets has been hurt by the hawkish stance being maintained by central banks around the world. In this scenario, oil may prove to be an oasis for long position returns.

Oil forecasts for the last quarter of 2022 are largely bullish. Both rate hikes by central banks and inflation support oil prices. Despite concerns around rate hikes being a drag on economic growth, curbing demand for fuel, analysts are upbeat. Goldman Sachs has raised its Brent crude price forecast along the spot curve, by $5 to $104 per barrel for 2022 and by $2 to $110 per barrel for 2023. Analysts speculate that the OPEC+ may be targeting a price of $90 per barrel for Brent crude.

Analysts at the US EIA (Energy Information Administration) have set their projections at $93 per barrel for 2022 and $95 per barrel for 2023, citing a global economic slowdown and increased production by the US. On the other hand, US shale is still plagued by supply constraints and higher input costs, and producers may prefer to maintain capital discipline over drastically increasing supply.

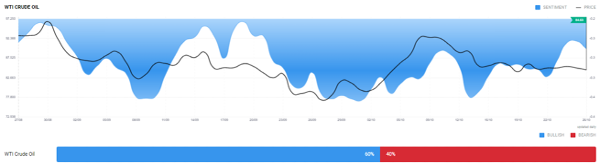

The sentiment for crude is largely positive, as can be seen on Acuity’s Sentiment widget.