These numbers are not unbelievable. In the US alone, green industries already generate around $1.2 trillion in annual sales and employ around 9.5 million full-time employees.

Green Supply Chain

China has been way ahead in its green initiatives, becoming the world’s largest supplier of wind and solar technology as early as in the 2010s, and dominates the supply chain. Beijing controls a large portion of the world’s supply of materials required to build green technology, including lithium, cobalt, and rare-earths. The country hosts 75% of all battery cell manufacturing capacity and 90% of all anode and electrolyte production. While green is a growing trend, China has collected much of the benefits so far.

The pandemic brought the world’s dependence on supply chains that run through China into sharp focus. In addition to highlighting corporate and sovereign distrust of Beijing’s readiness to interfere in free market processes, the supply chain disruptions also created a vicious cycle of inflation that threatens to persist long after the pandemic. The Biden administration is nervous and focusing on more “friendly” supply chains, to prevent this from being used as a political tool.

Carrot and Stick

As part of the Inflation Reduction Act (IRA), passed by the US Congress in 2022, lawmakers identified green industries as crucial to alleviating current and future inflationary pressures. Earlier policymakers tended to lean towards punishing emitters. In contrast, the IRA offers a carrot rather than a stick, with $370 billion allocated for subsidies and tax breaks to boost green industries and lower US emissions. While the execution of the act is still under process, there are some early signals of whether these tax cuts will bring much success.

The EV Industry

Electric vehicles can be considered the flagship of an economy’s transition to lower emissions. EV sales could then become a measure of the IRA’s success. The IRA includes tax credits for manufacturers to spur domestic EV component manufacturing and tax credits for consumers who buy EVs with battery raw materials that have been extracted from the US or countries with which it has Free Trade Agreements.

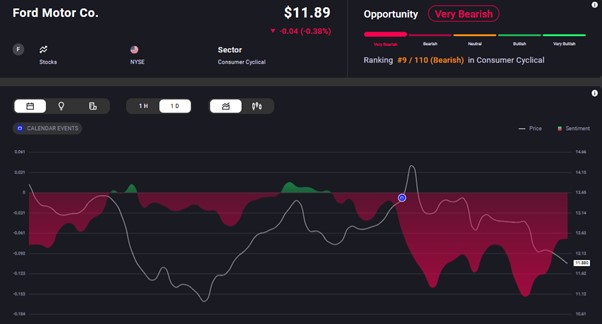

Moving battery raw material to North America (aka away from China) would spell a major victory for the Biden administration. Companies announced over $73 billion in US battery plants in 2022, which is 3X of the planned investments recorded in 2021. While focusing subsidies on production in the US and FTA partners has drawn the ire of many foreign-based EV makers, some like Volkswagen look forward to the lower costs of a domestic supply chain. This is reflected in the overly positive sentiment for Volkswagen, as can be seen on Acuity’s AssetIQ widget.