News sentiment analysis is fast becoming one of the foremost data driven methods to employ the effects of market psychology in trading. This is not to be confused with market sentiment, where traders’ position data is most commonly used to analyse the overall market momentum.

News sentiment is the underlying feelings in the market, conveyed in the news. This can be both overt and subtle. By analysing this on a global scale, 24/7, we can better understand the collective mood of the market. By knowing what the mood of the market is, we can better anticipate the future behaviour of the market. When traders have high risk appetite, the market reacts strongly to upbeat news headlines and economic reports, while ignoring downside data. During a low risk environment, there is a strong negative reaction towards downbeat data, while traders ignore the upbeat reports.

While news sentiment data is a very recent addition to the trader toolkit, hedge funds and institutional traders have been using it very successfully since 2000. Now, thanks to advancements in scalable technologies and visualisation capabilities, the benefits of news analytics can be offered for retail trading as well.

Turning News Volume into an Advantage

The digital era and advent of social media have brought about an explosion of news content. At the same time, it has become increasingly difficult for traders to stay abreast of what’s happening in the market to any effective level. Globalisation and the 24/7 nature of news flow makes it a difficult process, despite the best internet speeds, device capabilities and a rise in various aggregation type services. Human cognitive power just isn’t sufficient.

News is basically an unstructured data set, which makes it traditionally difficult to analyse in large volumes. While it is easy to make comparisons and interpretations with two or three articles, what happens when contradicting theories come forward through numerous sources? What happens when a new story breaks and thousands of opinions are voiced over the internet in a small amount of time?

Traders who try to access various reports and news articles and attempt to process what they all “mean” for their trading objectives will always risk missing something important. News is constant, its impact always changing. Does the current news reflect positively or negatively on their chosen assets? Why do market commentaries in different articles vary? How can I arrive at an investment decision? To undertake this cognitive process with millions of streaming articles is impossible. In this respect, news volume can be a hindrance for traders.

Only with the help of AI/NLP technology can we turn news volume into a trader’s asset. News analytics, the process of extracting sentiment data from the news, helps reduce infobesity (information overload) for traders. Instead, it helps make content central to a trader’s research, harvesting it in ways that allows traders to make the best use of the information at the right time.

By using NLP, the Acuity Sentiment Analysis tool turns millions of news articles with unstructured data (text) into a structured data sets (numerical). By digitising the news in this way, it can now be analysed in the same way as any other numerical data, such as price data. And because of the richness of the data, traders can now find unique trading opportunities that might not be visible to everyone, helping them avoid herd mentality.

This is because news sentiment data is now powering a new kind of trading style. No longer is it only used by hedge funds to enable algorithmic trading strategies. Without the need for quantum analysts, new tools from the likes of Acuity support visual trading styles. Data is displayed through intuitive designs, which can be interpreted quickly and easily by retail traders regardless of their experience.

Importance of Investor Sentiment in Online Trading

Empirical evidence says that news sentiment is one of the most reliable market signals of price trends. News analytics has the ability to make connections between many disparate entities, such as financial instruments, companies, governments, individuals as well as patterns of behaviour. All of which impact the global financial markets and are otherwise difficult to spot with manual methods. It is these connections and patterns of behaviour that offer a wealth of alternative insights that traders can use to help make decisions.

Traders are now basically able to decipher the pulse of the market through a big data set composed of news.

Sentiment Analysis as an Alternative and Leading Indicator

News sentiment data is an incredibly rich data set due to the volume and variety of the news sources from which the sentiment data is extracted. This, coupled with the various news analytics techniques that can be employed, means that news sentiment data opens up a wealth of alternative opportunities for traders, moving away from the more obvious, popular trades and avoid following the herd.

As well as new opportunities, one of the very appealing characteristics of news sentiment is its leading indicator properties. Unlike price data (which is historical in nature), news sentiment is considered a forward-looking data set. By understanding the current feelings in the market, the easier it is to understand how the market is likely to react in the short term. It is this predictive quality of news sentiment data that is revolutionising the trading experience.

How the Acuity Sentiment Analysis Tool Helps

Visual Cues about Market Sentiment

News analytics creates vast and varied data points. Traders can quickly understand how the global investment community is feeling about any tradable instrument any point in time, helping traders to time their trades and find opportunities.

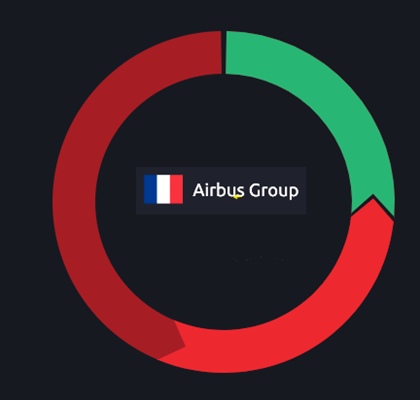

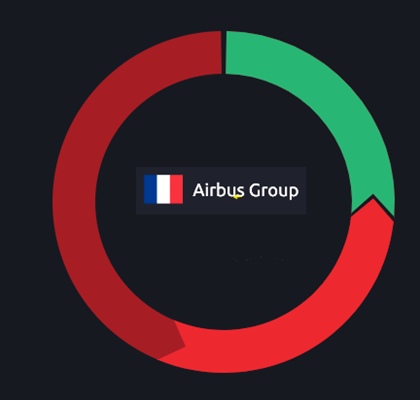

In this example, Airbus has moved from a slightly bearish (darker red arrow) position to a very bearish position (lighter red arrow) with the trend continuing in that direction (arrow pointing in the same direction). This suggests a big change in sentiment since the last reading (1 day ago).

Traders can gain insights into market sentiment regarding a range of asset classes. This includes aggregated opinions, mood, views, feelings, data and future outlook that all make up the risk sentiment of the market at any point of time.

Conversely, in this example, we have an extremely bullish signal for GBP/USD over the past 24 hours, with the sentiment having moved from a “neutral” position at the last reading.

Better Trading Decisions and Ideas

Sentiment Analysis tools are not related to market price movements. This helps traders to gain an alternative view of the market. Powerful visual cues help traders understand the market in a better way and stimulate trade ideas. By combining these insights with technical analysis tools, traders are better equipped to plan positions in an asset.

If we look into the EUR/USD currency pair example below, we can estimate that the current rally will soon fizzle out, based on the head and shoulders pattern that has emerged (see image below). The Euro has been on an upswing due to weakness in the US Dollar since June 2020, but the Dollar might soon gain momentum again, being a safe-haven asset and due to the second round of US fiscal stimulus.