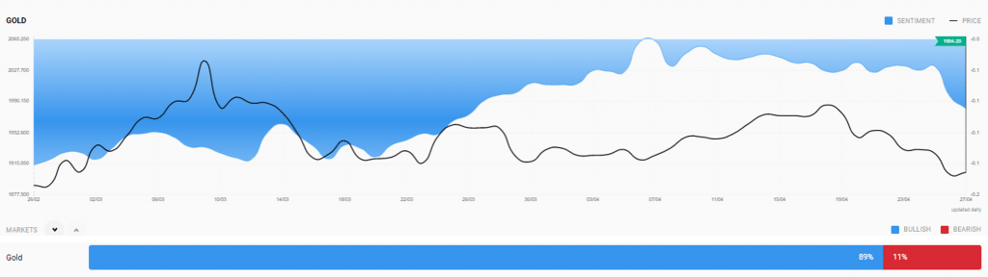

Why Gold May Not Breach $2,000 Anytime Soon

Inflation

With worsening supply chain constraints and economic activity recovering only moderately, the focus of the major central banks (Fed, ECB, BoE) has shifted to inflation. Let’s take the US as an example. After maintaining a dovish tone for the better part of two years, the Federal Reserve has turned strongly hawkish. The May meeting could see policymakers hike the benchmark interest rate by as much as 0.5% and approve plans to shrink their oversized asset portfolio.

The market’s heightening expectations of Fed rate hikes has pushed the 10-year US treasury rate from 1.56% in January to the current 2.76%. Rising yields increases the opportunity cost of holding non-interest yielding assets, like gold. Such sentiments could continue to dampen gold prices. Despite the IMF lowering its projections for global economic growth and the resurgence of infections in China, analysts maintain their yield estimates around 3%. The 3% nominal yield level for the 10-year US treasury has historically formed a resistance level, most recently seen in 2018.

The Fed now aims to snip these heightened inflation expectations in the bud and to frontend their rate hikes. This limits the potential of any gold rally in the near term. However, it’s important to bear in mind that the Fed can’t raise rates too fast, as this has serious consequences for the labour market. The weakening in gold will likely be proportionate to how quickly the Fed tightens its monetary policy.

Slowdown in Economic Growth

After a year of pandemic-led restrictions, investors were looking forward to a strong economic recovery. Markets took various challenges, like the semiconductor shortage, supply chain issues and labour market disruptions, in their stride. However, they couldn’t ignore the prolonged Russia-Ukraine war.

Experts have lowered their estimates for global economic growth. US GDP growth is projected to decelerate to 3% in 2022. This means central banks will need to spread out their interest rate hikes through the year, while simultaneously addressing supply-side pressures. This spells continued weakness in gold.

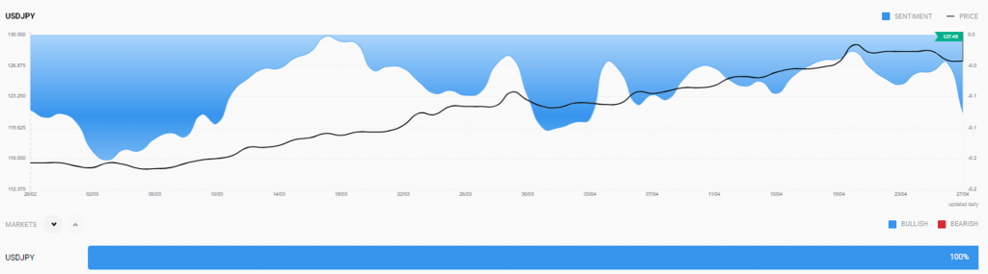

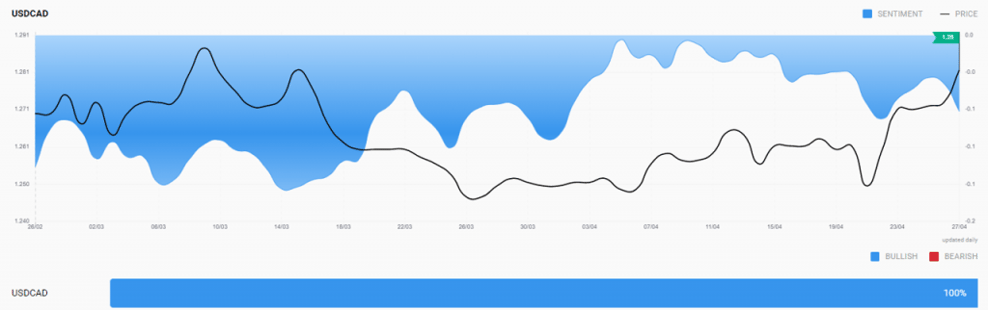

The Dual Impact of the Greenback

Gold is not the only safe-haven option. The US dollar is a very popular safe-haven asset for traders and investors alike. With the Fed expected to hike interest rates, market participants may gravitate to the US dollar in the face of geopolitical turmoil or economic concerns.

On the other hand, gold prices are expressed in US dollars in the global markets (XAU/USD). This means any spike in the greenback makes gold more expensive for investors and traders from other countries.