Will ExxonMobil Ever Come Clean?

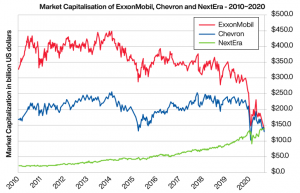

ExxonMobil could have overcome these setbacks with some shrewd moves in the right direction. While other oil majors began exploring electric and renewable energy sources (mainly wind and solar), ExxonMobil refused to navigate the shift from fossil fuels to clean fuels.

Even as early as 2008, Neva Rockefeller Goodwin said at a shareholder meeting, “ExxonMobil is profiting in the short term from investments and decisions made many years ago, and by focusing on a narrow path that ignores the rapidly shifting energy landscape around the world, including developing nations.”

Should ExxonMobil make the transition to clean energy? To begin with, oil is going to get increasingly difficult to discover and drill. There’s already a considerable slowdown in fossil fuel extraction in countries like Algeria, Argentina, Guinea, Mexico, Venezuela, and the UK. As fossil fuels deplete, extraction will become increasingly expensive, while the quality of crude will continue to deteriorate.

The world will eventually need to make the shift to renewable energy. With advancements in technology, the generation and storage of renewable energy will become more economical and efficient.

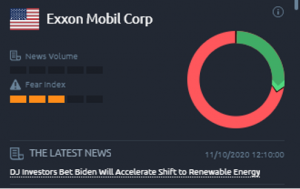

Against this backdrop, investor sentiment for ExxonMobil turned vastly negative, as can be seen on the Acuity Trading Dashboard. Sentiment was also hit by Biden’s win in the US Presidential election, given his support of clean and renewable energy as a way of reducing global warming. After all, Climate Change was a key agenda for the Democrats during the election campaign. Acuity’s US Elections widget indicates its high Share of Voice (how frequently these topics were covered by the Democrats during the election campaign). Climate change even beat talks around coronavirus and the economy.