“An unusual journey” is how Premier Li Keqiang characterised China’s economic operations in 2022. Many analysts echo these thoughts, as the world’s second-largest economy struggles to return to its pre-pandemic state. China got off to a roaring start in 2022, posting GDP growth of 4.8%, exceeding market expectations of 4.4%. However, from March 2022, Beijing began a new battle with its largest economic drag in recent years – covid-19. President Xi Jinping’s response to virus outbreaks has been mass lockdowns, surveillance and testing, representing significant headwinds to economic activity. A shutdown in Shanghai, for example, means reduced activity in the world’s busiest seaport.

Here’s a look at why China may still be able to pull it off.

Proof of the Pudding

China’s route out of the covid-led recession was by grabbing any resurgence in global demand. While the economy posted its lowest GDP growth in decades in 2020 (2.3%), it was the only major economy to generate any growth at all.

Yes, trade has faced strong headwinds since mid-2021. Every news article mentions “supply chain shortages”. The Russia-Ukraine situation didn’t help the cause. But what has really impacted China’s economy is the Fed and BoE’s hawkish stance, resulting in massive rate hikes that lead to lower demand for Chinese exports. While these factors suggest China’s weakening position as an export powerhouse, the data paints a rosier picture. China’s trade surplus soared to a record $98 billion by the end of Q2, partly spurred by the reopening of Shangai. China’s trade with its BRICS (Brazil, Russia, India, China and Singapore) trading partners grew 14.4% in the first half of 2022.

Another promising datapoint is that shipping spot rates between China and its largest trading partner, the US, remains low even with the growth in trade. Stable shipping rates indicate that global supply chains are not as overloaded as they were in 2021. China’s exports may also surge if President Biden is able to curb US inflation (9.1% in June) and lifts trade tariffs on imports from China.

More Support from Policymakers

While the world worries about China’s growth slowdown, there is some reason to be optimistic. Poor GDP figures increases the impetus for policymakers to spur growth. The Chinese government is betting on a stronger second half of the year, with lower infections. The IMF forecasts 4.4% growth for the year, which reflects accelerating growth over the final two quarters of the year. This estimate is based on Beijing’s policy stance, adopted in the wake of a decline in output in the second quarter.

The People’s Bank of China Governor Yi Gang had emphasised that monetary stimulus is unlikely to take the form of rate cuts. Instead, the PBOC is considering changing credit conditions. This includes a reduction of reserve requirements for banks. In April, a drop of 25-50bp is estimated to release about $80 billion in long-term market liquidity, as per the PBOC.

Higher Fiscal Spending

Fiscal stimulus is expected to be the chosen route for the delivery of economic recovery. President Xi’s tried and trusted formula of infrastructure-based public spending to boost growth is already in the works. As part of a 33-part detailed plan of administrative measures, Beijing has highlighted investment in transportation infrastructure, with a call to accelerate investments in road laying and maintenance and to support the issue of $45bn in railway construction bonds.

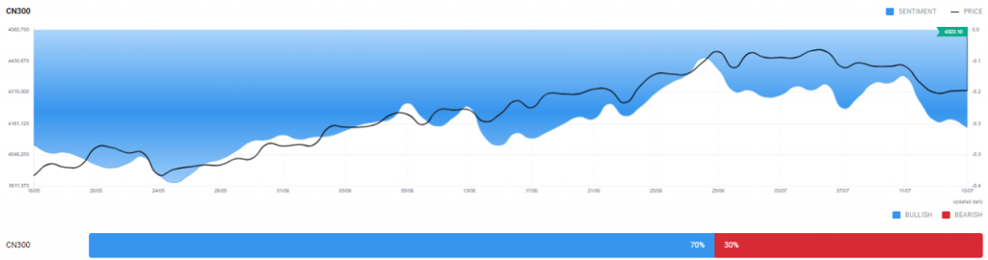

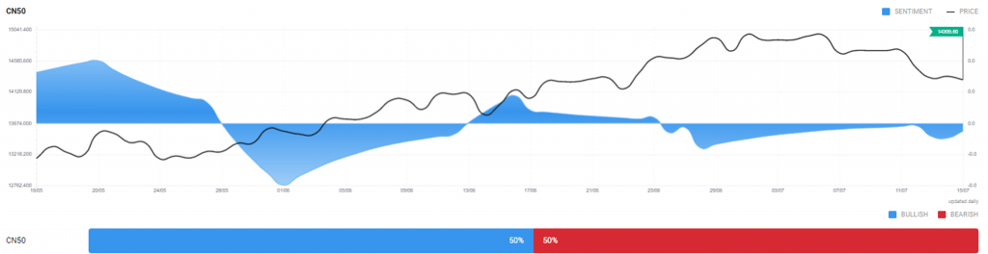

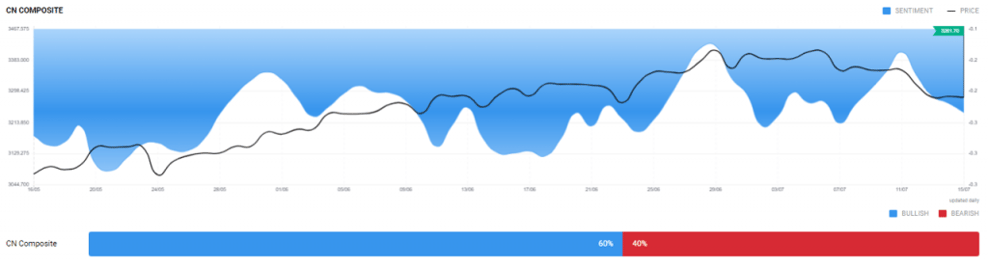

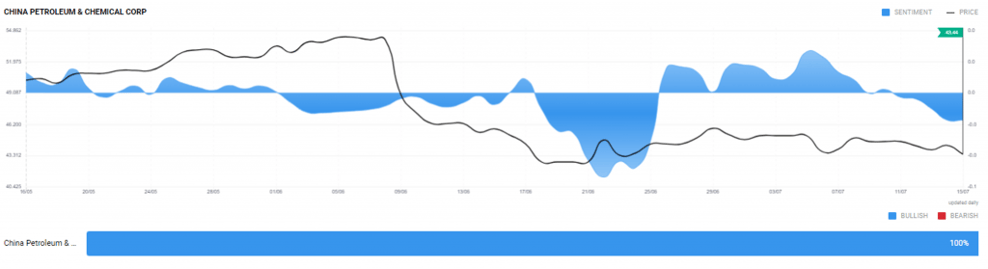

The infrastructure sector is likely to be the focus of fiscal stimuli. This is the reason investors are excited about Chinese infrastructure stock. Investors are also gaining exposure to the broader economic effect of stimuli through equity indices. Even as investor risk appetite globally has been hit, the sentiment for Chinese indices remains largely positive, as can be seen on Acuity’s Sentiment Widget.