A Look Back at the Recent Cuts

Recessionary fears dampening global oil demand has forced the OPEC+ nations to announce several production cuts over the past year. In October 2022, the cartel announced a 2 billion bpd reduction. Yes, oil did respond. But the gains were temporary to say the least. Oil prices maintained a downturn to reach a 15-month low in mid-March 2023.

The OPEC+ members collectively cut production by 1.6 million bpd in April and succeeded in lifting oil prices. However, subdued global demand corrected the $9 per barrel increase in less than a week.

Recent history suggests a very low probability of Saudi Arabia’s latest move helping to stabilise oil prices. There are, however, other factors to consider.

Assessing the Strength of the De Facto Leader

Saudi Arabia has long since been the de facto leader of the OPEC. The latest cuts planned will reduce global supply meaningfully, but maybe not meaningfully enough. Despite Saudi Arabia being the world’s largest oil producer, it contributes roughly 10 million barrels a day. Cutting this by 10% may prove too little to move the needle.

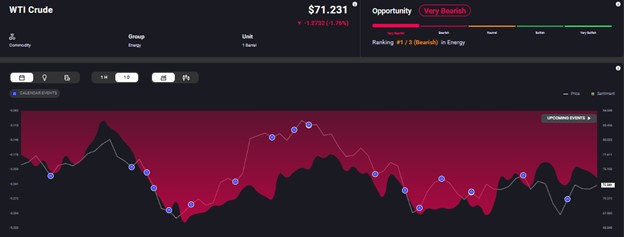

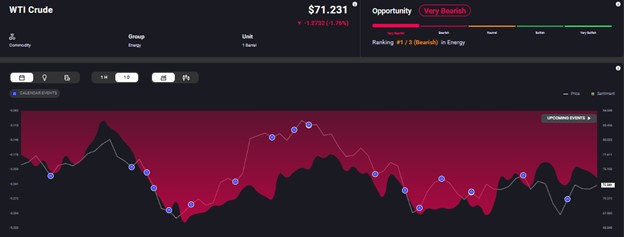

Also, the OPEC+ has reiterated its oil production target of 40.463 million barrels per day for 2024. So, the global supply remained unchanged in the longer term. Against this backdrop, the market sentiment for both WTI crude and Brent crude remains bearish, as can be seen in Acuity’s AssetIQ Widget.

What About the True Leader?

We may put sanctions on Russia and disagree its political stance, but it is still the world’s largest exporter of oil to the global markets. The country agreed to cut production by 500,000 bpd in March. However, Russia is focusing on the Asian markets, given that it has lost favour with the Western world and is strategically positioned to cater to Asia’s growing energy demand.

The EU and G7 together put a $60 per barrel cap on Russian imports, forcing the oil major to divert a larger share of its output to the Asian markets, where the demand is projected to grow through 2023 and 2024.

Also, Russia’s relationship with the OPEC has been rocky. Since the formation of the cartel, Moscow has produced above target on several occasions. OPEC’s production cuts without compliance from Russia put other members at a disadvantage.

Prospects of a Rally

As of now, the cumulative oil production cuts by OPEC+ stands at 4.66 million bpd, or 4.5% of the global demand. Oil prices are at 66% of what they were at the time of the Ukraine invasion in 2022. Despite multiple cuts, oil prices have ranged between $70 and $83 per barrel since November.

With over 60% of global oil exports, OPEC+ can potentially disrupt global oil supply. The Saudi lollipop alone may not sweeten oil prices enough. So far, Saudi Arabia’s latest move seems nothing short of a desperate and failing attempt to support oil prices.

The Fed’s interest rate decisions, which trigger US dollar movements, will remain key in determining where oil prices are headed. With the US central bank expected to lower its fed funds rate as the year progresses, oil demand may receive some support. Large drawdowns of US stockpiles could add to the fillip.

Reports of the Eurozone entering recession, with its economy contracting for two consecutive quarters, will keep demand concerns on the front burner and crude prices in check.

Short term volatility could continue offering attractive trading opportunities. But a more permanent uptrend is unlikely as long as demand remains subdued across the globe due to the uncertain macro environment. Don’t be surprised to see Brent crude prices ending 2023 below $80 per barrel. WTI crude prices may struggle to breach $78 per barrel.

Prospects of a rally in oil prices is unlikely this year, unless there’s meaningful and widespread economic recovery. All eyes are still on China and India, the world’s #1 and #3 crude oil importers. China is gearing up to announce another fiscal stimulus package to spur growth, while infrastructure development continues to be on the Indian government’s radar for economic expansion.