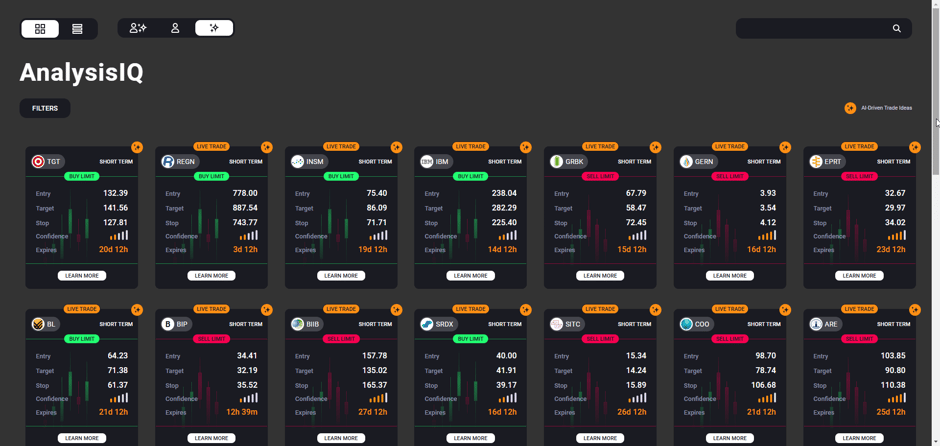

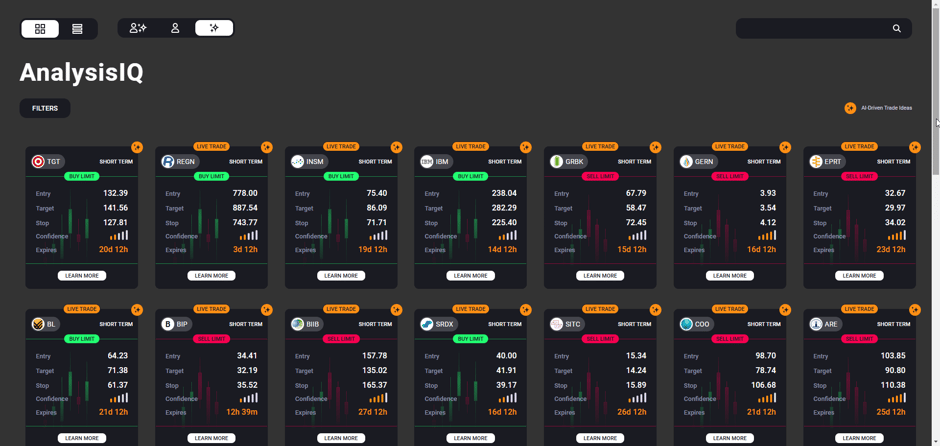

Acuity Trading is proud to announce the launch of its fully automated AI-powered trading signals, their latest innovation powered by Acuity’s proprietary cutting-edge AI technology. As an extension of Acuity’s popular AnalysisIQ product offering, this new feature gives clients the option to access both expert human-led, multi-asset signals and AI-driven automated signals, which currently focus on FX and cryptocurrency markets.

Developed by Acuity Analytics, the launch of Acuity’s automated signals marks a new era of automated trading insights and technical analysis by blending traditional market strategies with advanced Natural Language Processing (NLP) and sentiment analysis.

Revolutionising Technical Analysis with AI

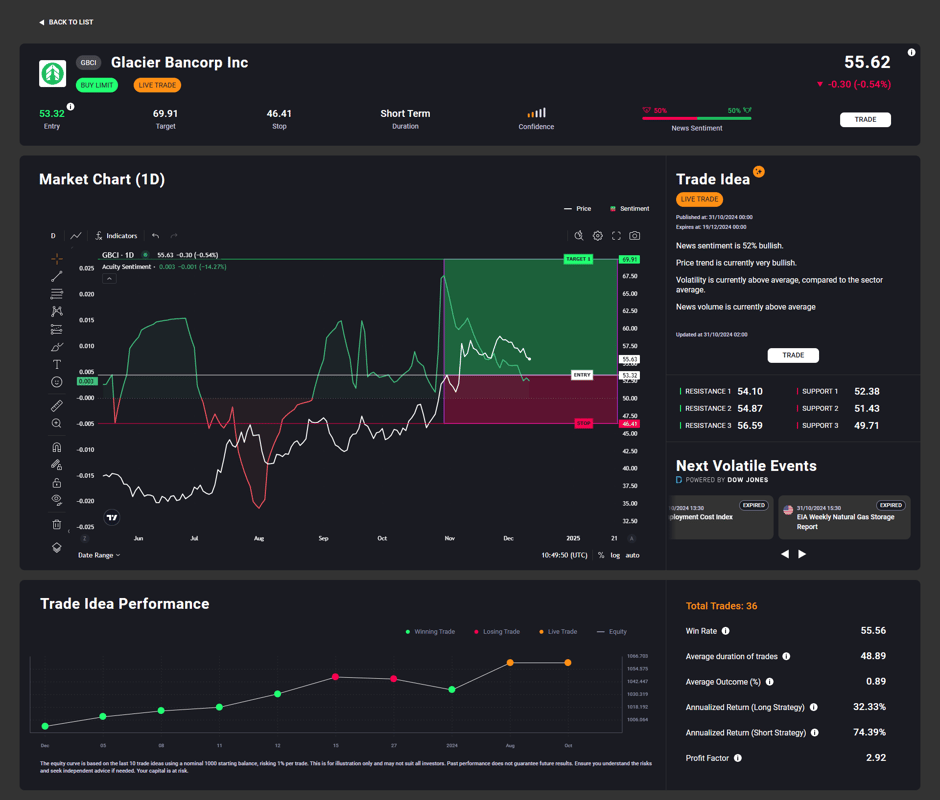

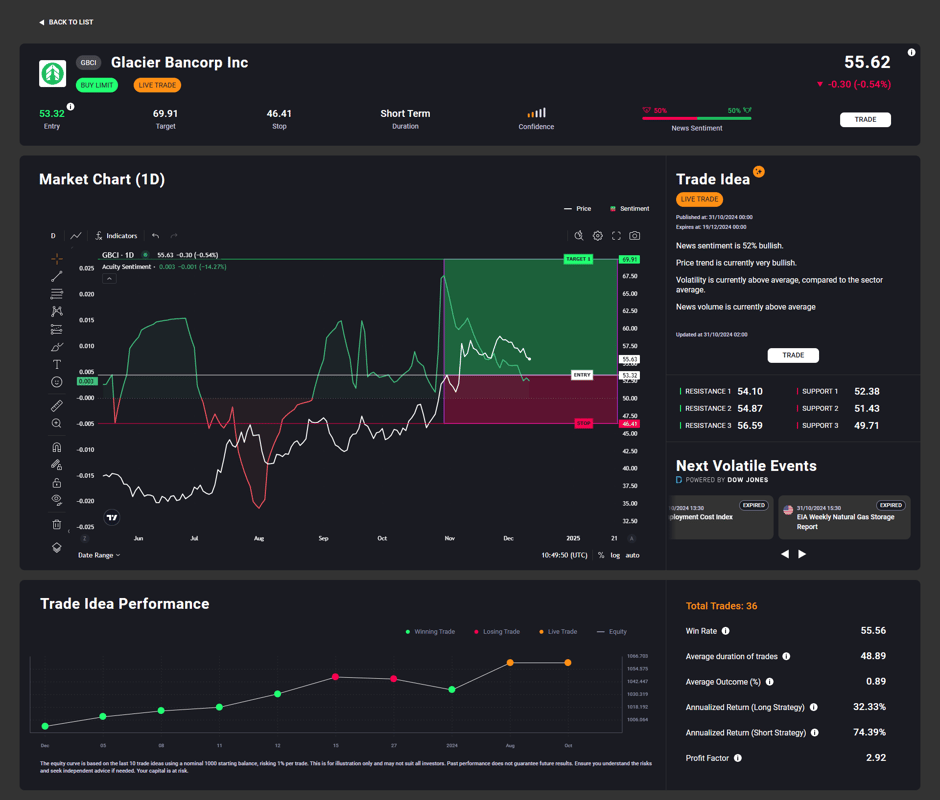

Technical Analysis (TA) has long been a cornerstone of trading, relying on historical market data to forecast future price movements. Acuity Trading has taken this foundational approach and elevated it by integrating AI-driven sentiment analysis from news sources and market volatility data. This sophisticated combination encompasses a more comprehensive, multi-dimensional research approach, providing traders with a critical edge in the dynamic financial markets.

Ariel Duarte-López, PhD, Head of Data Science at Acuity:

“Acuity automated signals represent a significant advancement to our already popular technical analysis offering. By leveraging AI and data science, we’re able to generate trading signals that not only reflect historical data but also capture real-time market sentiment and volatility.”

Client Flexibility with AnalysisIQ

The product extension is fully integrated into the existing AnalysisIQ product, maintaining the familiar brand and features clients trust. This flexibility ensures that traders can customise their approach based on their preferred trading strategies and asset classes.

Comprehensive Asset Coverage and Future Expansion

Acuity currently offers trading signals for 2,122 assets, covering major indices such as the SP500, Russell 2000, EUROStoxx, FTSE100, NASDAQ100, and a wide array of cryptocurrencies. This extensive coverage is strategically designed to target assets with high liquidity and popularity, ensuring that traders have access to the most relevant and actionable signals.

As part of Acuity’s commitment to continuous improvement, the next phase of development will expand coverage to include additional global equities, commodities, and foreign exchange (FX), further enhancing clients' access to diverse trading opportunities.

Optimised Trading Strategies

Each trading strategy within Acuity’s AnalysisIQ is meticulously optimised to suit different parameters, including decision-making timeframes and risk tolerance levels. This optimisation process, conducted separately for long-only and short-only strategies, has consistently demonstrated superior results during rigorous backtesting.

Ariel Duarte-López, PhD, Head of Data Science at Acuity:

“The precision of our signal generation pipeline is a testament to the thorough backtesting and optimisation we’ve performed. While our historical performance has been strong, it’s important to emphasise that success in trading is not guaranteed, and we always recommend a cautious approach.”

Performance and Risk Management

Acuity’s trade ideas have been validated against traditional buy-and-hold strategies, with results showing significant outperformance. Despite a win rate below 50%, the AI-powered trades have proven profitable due to careful risk management and effective stop-loss measures.

“Even with a lower win rate, our strategy’s profitability is driven by the higher revenue from successful trades compared to losses from unsuccessful ones,” adds Ariel Duarte-López, PhD. “This is a crucial aspect of our risk management approach, ensuring that our clients are supported in making informed trading decisions.”

Press Release