Client Case Study 1 Integration via HTMl5 widget

- Initial adoption (% of clients using signals) after 3 months was at 4% compared to adoption after 2 years of 70-80%.

- The number of trades initiated when using signals was 20% higher.

- Engagement rates when signals were opened increased by 30%

- Sessions of activity when signals were opened increased by 50%

Client Case Study 2: Integration via email marketing platform

- Over a 6 month period, 1 email per day resulted in an average open rate of 56%

- 25% of users deposited fresh funds within 18 hours of the email being sent

- Over 15x ROI

Andrew Lane, CEO Acuity Trading;

“Technical analysis continues to be a popular tool for traders. AnalysisIQ is an extension to our recently launched products. It can be seamlessly integrated with our recently launched AssetIQ, Economic and Corporate Calendar products. By bringing together both traditional and alternative data sets in our unique visual style, brokers can create a more engaging research experience for their traders and nurture a more intuitive trading experience.”

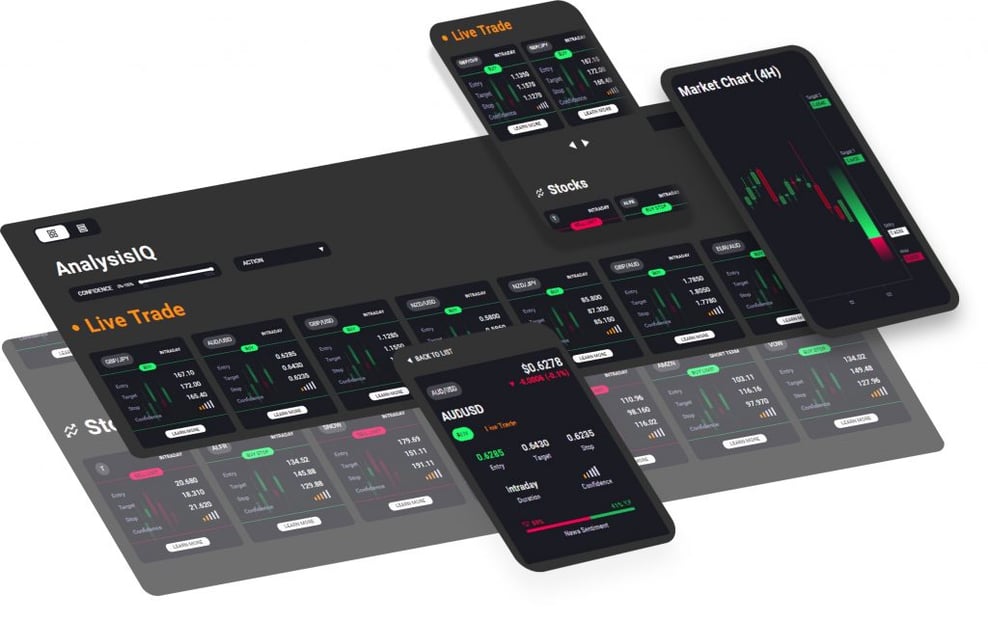

With every trade idea AnalysisIQ includes clear target levels, confidence ratings and continuous updates so traders can find them and time their trades. There is thorough transparency; each idea is accompanied by an explanation of the strategy behind it to enhance education. Further, every idea is continuously monitored and their performance reviewed. This performance data is then used in the proprietary confidence ratings of future trade ideas.

Available in multiple languages, brokers can share quality signals from AnalysisIQ through a range of delivery options across MT4/5, web, mobile, email, social media, instant messaging and API. Early adopters of AnalysisIQ are delivering trading ideas through platform integrations including but not limited to, SharpSpring, Blueshift, WhatsApp, Telegram, HubSpot, YouTube, SalesForce Pardot, Solitics, WeChat, Facebook and MetaQuotes.