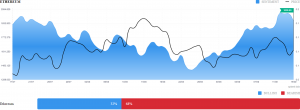

Although Ethereum transactions involve much less energy than Bitcoin mining, it is estimated to consume more than 112 terawatt hours a year, comparable to the energy consumption of the Netherlands. While a large portion of energy for mining comes from renewable sources, the Ethereum network leaves behind a carbon footprint comparable to that of Singapore.

In a PoS network, there is no complex math to solve and, therefore, much lower computing power and energy needed. Instead to validate a block and earn rewards, validators need to ‘stake’ a minimum amount of cryptocurrency, effectively locking it away to be eligible for block verification. The networks then choose a validator at random to verify a block and collect the rewards.

What Does the Big Merge Involve?

With the Beacon Chain’s launch in December 2020, Ethereum began its own foray into the world of PoS validation that its competitors boasted of. The metaphoric spaceship’s new shiny engine has endured two years of testing and is ready to replace the older, less efficient one mid-flight. Essentially the Beacon Chain PoS network is being merged with the smart contracts and ledger of Ethereum’s main-net to create what is being dubbed as Ethereum 2.0.

Implications for the Crypto Markets

The largest impact of the switch to PoW is the energy savings that would be achieved. Ether developers estimate the merge will reduce Ethereum’s energy consumption by more than 99%. Such estimates have drawn plaudits from the likes of the White House and may significantly improve market sentiment for Ethereum, especially in a world that is increasingly environment conscious. Moreover, concerns around an energy crisis, especially in Europe, have recently reigned in market sentiment.

The post merge Ethereum is also more secure. To become a validator initially, a person or pool must stake 32 ETH, which is currently more than $51,000. There are expectations of nearly 80% of ETH being eventually staked (worth around $170 billion), making it a monumental endeavour to control the network.

Following the merge, Ethereum is also planning to undertake “Sharding”, the splitting of the network eventually among 64 different chains. This would serve to split the workload, creating a faster network.

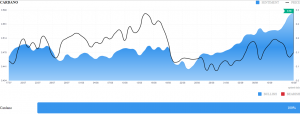

The Big Merge could make Ethereum far more attractive for investors. Investors who had supported the Ethereum killer projects for the energy efficiency they offered can now look at the more established and larger Ethereum network to conduct their commerce.

Similarly, institutional investors with designs of investing in DeFi projects but with ESG considerations can make ETH more popular.

Following the Big Merge, yields on staking are expected to rise by nearly 15%. This feature also offers the benefit of a bond-like aspect, that can serve to attract fixed income investors.

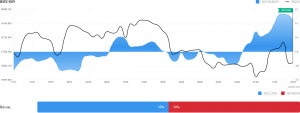

The Shift of Machines

The end of traditional mining for Ethereum would result in unemployed rigs, which will need to look for mining opportunities elsewhere. Mining for ETH requires GPU-based computing power, which is not feasible for Bitcoin. GPU miners may drift to other GPU-based projects, like Livepeer and RenderNetwork. These networks could see a surge in computing supply, reducing fees. In addition, other GPU-based mining coins like Monero could see a flood of new miners, exerting pressure on their prices.