How Alternative Data Helps Brokers

Today, any information that can influence market behaviour or stock price is instantly shared with market participants globally and analysed by analysts and investors. Needless to say, timely access to information that provides a competitive edge, whether it is to gain an edge over peers or against benchmarks, is much in-demand.

Traditionally, this information has been limited to economic releases by various nations, company reports and financial statements, and central bank announcements. The data is released on a monthly, quarterly or annual basis and tends to have the characteristic of a lagging indicator.

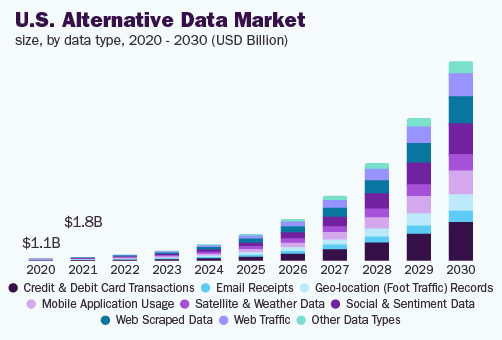

On the other hand, alternative data offers an almost real-time view of economic activity, consumer sentiment and much more, beyond the scope of the officially reported data mentioned above.

While there are multiple use cases for such data for market participants, brokers, in particular, can attract and retain clients by using this data for:

Tracking Inflation and Its Market Impact

Millions of products can be tracked online via web scraping to analyse inflation levels. Inflation not only influences asset prices but also central bank monetary policies. It also impacts forex rates. Therefore, the ability to track inflation can offer traders a crucial decision-making tool for entry and exit positions, as well as risk management.

Stock Market Forecasts

Key company data can be culled from alternative information sources, such as foot traffic at its stores, inventory numbers, supplier payments track record, discussions forums and social media chatter. This can offer insights beyond the usual earnings call transcripts and analyst predictions. It could even help identify the current and predict the future financial health of a company.

Commodity Market Forecasts

Satellites are already being used to track the movement of cargo across the oceans, road and rail. Tracking the shipping of crude oil, natural gas, iron order, gold, coffee, wheat, corn, and more can help identify supply disruptions, apart from gaps in demand and supply. This could help predict future commodity prices and market sentiment and behaviour.

ESG Investment Decisions

Forums, blogs, social media and regular news are effective sources to track how companies are fulfilling their ESG responsibilities. AI can help discover events and initiatives by companies associated with social and environmental responsibilities, such as awareness drives, level of diversity in the managment team, etc. Machine learning can also be used to scour the World Wide Web for ESG terminology to keep track of companies fulfilling their responsibilities. ML can also help identify investor sentiment regarding these companies to support trading decisions.

Risk Management

Brokers can offer traders means to enhance their fundamental analysis through alternative data, including analysis of changing market sentiment and behaviour, high-frequency news flows and large quantities of economic data. This can then be used for forex and stock market predictions and fine tuning of strategies to mitigate potential risks.